Highlights

- Xero informed the market today (10 November) that Steve Vamos, after serving for almost five years as the company’s CEO, is retiring from the role.

- Xero has appointed Sukhinder Singh Cassidy as the new CEO.

- In its H1 FY23 market report, Xero reported a 30% rise in its operating revenue.

Software and services giant Xero Limited (ASX:XRO), on Thursday (10 November 2022), announced via an ASX release that Sukhinder Singh Cassidy will be joining the company as the new CEO from 1 February 2023. Sukhinder will succeed Steve Vamos, who has been with Xero for the last five years.

As per Xero’s release, Sukhinder is a skilled digital leader and has been associated with big companies like Google, Amazon, Yodlee, Joyus, eBay, and StubHub.

Meanwhile, Xero shares closed Thursday’s trading session at AU$64.740 apiece, down 10.851%, with a market capitalisation of AU$10.90 billion on the ASX.

On Thursday, Xero also shared a its FY23 first half market update Here are the key takeaways:

- The company’s operating revenue increased by 30% to NZ$658.5 million.

- Total subscribers rose by 16% to 3.5 million.

- Annualised monthly recurring revenue jumped by 31% to NZ$1.5 billion.

- Xero’s total subscriber lifetime value increased by NZ$3.1 billion, or 30%, to reach NZ$13 billion.

- The EBITDA was NZ$108.6 million, up 11%.

- Xero’s free cash flow was NZ$15.6 million compared with NZ$6.4 million in the prior corresponding period.

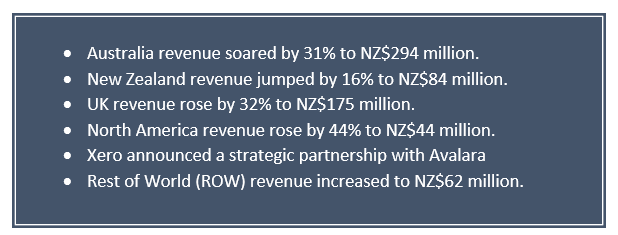

Market highlights:

Outlook shared by Xero

As per Xero, the total operating expenses as a percentage of operating revenue for FY23 are expected to be towards the lower end of a range of 80%–85%.

Share price performance of Xero

The shares of this New Zealand-based technology firm have shed 11.70% in the last five trading days. In the past month, the shares have lost 11.13%, and in the last six months, Xero shares have went down 25.56%. In the past year, the company’s shares have tumbled 53.13% in value. On a year-to-date basis, the stock has plunged by 55.72% on the ASX (as of 4:10 PM AEDT, 10 November 2022).