Highlights

- Bitcoin income fell by US$1.8 billion during the period compared to the same period last year.

- Transaction-based revenue grew by US$273.2 million during the quarter.

- Block’s shares were trading at AU$141.72 each, down 2.62% on ASX at 12.03 PM AEST.

Technology company Block Inc (ASX:SQ2) shared its financial results for the first quarter of 2022, ending on 31 March 2022, on Friday (6 May 2022).

Block’s shares were trading at AU$141.72 each, down 2.62% on ASX at 12.03 PM AEST.

What happened in 1Q22?

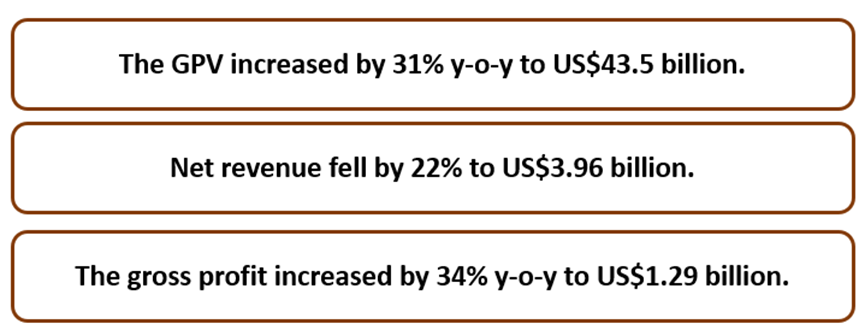

When comparing the three months ended 31 March 2021 to the three months ended March 31, 2022, total net revenue declined by US$1.1 billion, or 22%. The company said that the bitcoin income fell by US$1.8 billion during the period compared to the same period last year. In the three months ended 31 March 2022, total net revenue increased by US$683.7 million, or 44%, when compared to the same period last year.

Image Source: © 2022 Kalkine Media ®

Data Source- Company announcement dated 06 May 2022

The company’s transaction-based revenue grew by US$273.2 million, or 28% when comparing the three months ended 31 March 2022 with the previous corresponding period (pcp). This rise corresponded to a 31% increase in GPV for the three months ended 31 March 2022. The following factors contributed to the increase in transaction-based revenue:

- Growth via online channels, such as Square Online, Invoices, Virtual Terminal, and eCommerce API, as well as growth in our overseas markets, has resulted in continued improvements in both card-present and card-not-present volumes.

- Cash App Business GPV is increasing, which includes cash for Business and peer-to-peer payments sent from a credit card.

Also Read: Block Inc. (ASX:SQ2) shares rally as ASX tech sector picks up

Block further informed that subscription and services-based revenue increased by US$401.9 million, or 72% during the quarter. The revenue generated by the BNPL platform following the acquisition of Afterpay in the first quarter of 2022, which provided US$129.8 million in subscription and services-based revenue in February and March 2022, was the primary driver of this rise. The results of Cash App and Square also contributed to the increase.

Source: © Rawpixelimages | Megapixl.com

On the other side, when comparing the three months ended 31 March 2021 to the three months ended 31 March 2022, hardware revenue grew by US$8.5 million, or 30%. This growth was mostly due to an increase in hardware sales across many of the company’s product lines, including Square Register, Square Terminal, and Square Reader.

Meanwhile, during the quarter, Bitcoin revenue fell by US$1.8 billion, or 51%, compared to the three months ending 31 March 2021. This drop was mostly due to the price of bitcoin remaining relatively stable during the quarter, which lowered client demand and trading activity compared to the quarter ending 31 March 2021.

Although bitcoin income accounted for 44% of total net revenue in the three months ended 31 March 2022, gross profit from bitcoin transactions only accounted for 3% of the overall gross profit (compared to 8% of total gross profit in the three months ended 31 March 2021).

Block had a net loss of US$204 million. On the other hand, it posted earnings per share of 18 cents on an adjusted basis.

Also Read: CPU,WTC, SQ2: How are these ASX tech stocks performing today?