Highlights

- Rio Tinto shared its half-year results for the financial year 2022 today (July 27).

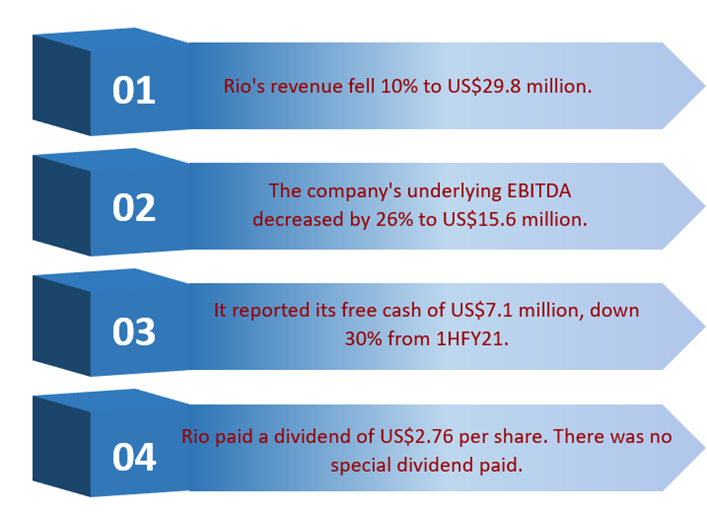

- The mining company’s revenue fell 10% to US$29.8 million in H1 2022.

- Rio paid a dividend of US$2.76 per share.

After the market close today (27 July 2022), Mining giant Rio Tinto Limited (ASX:RIO), which extracts copper, gold, iron ore, coal, aluminium, borates, titanium dioxide and other minerals and metals, shared its half-year results for the financial year 2022 today (July 27). Rio released the results after the market close today and it would not be wrong to say that all eyes will be on Rio’s share price tomorrow (28 July 2022).

Rio's shares closed 2% lower today to end the day’s trading at AU$96.98 each on ASX. This underperformed ASX 200 Materials Index, which closed 1.21% lower at 15,074.00 points today.

Key highlights of Rio’s H1 2022 results

Image Source: © 2022 Kalkine Media ®

Data Source- Company announcement dated 27 July 2022

Does Rio’s H1 2022 results meet market expectations?

The H1 2022 results seem to have fallen a little short of expectations, which is not good news for Rio Tinto's stock price.

In a recent note, for instance, Goldman Sachs' analysts stated that they anticipated revenue of US$29,655 million and an underlying EBITDA of US$15,671 million.

In contrast to the average forecast of US$3.97 per share, Goldman had pencilled total dividends of US$3.68 per share. Special dividends of 50 and 67 cents each were included in both projections.

Image Source: © 2022 Kalkine Media ®

Data Source- Company announcement dated 27 July 2022

Rio’s deal with Ford Motor Company

Last week (21 July 2022), Rio Tinto and Ford Motor Company agreed to work together to create supply chains for battery and low-carbon materials that will be used in Ford vehicles that are more secure and sustainable. The agreement is not legally enforceable.

By providing materials like lithium, low-carbon aluminium, and copper to Ford, one of the biggest automobile manufacturers in the world, the multi-materials alliance will aid in the transition to a net-zero future. Rio Tinto, a major international mining and metals giant, will be able to get closer to fulfilling its promise to collaborate with clients to decarbonise value chains.

Ford will look into becoming the founding client for Rio Tinto's lithium project in Argentina's Rincon. In addition to working with Ford to develop a sizable lithium off-take deal to boost its production of electric vehicles, Rio Tinto is now moving forward with its intricate planning to put Rincon into production.

In addition, Rio Tinto's presence in North America will help Ford and Rio Tinto create safe domestic supply chains for other important commodities for the energy transition, such as copper produced with a low carbon footprint.

Rio's Q2 2022 production results

On 15 July 2022, Rio shared its production results for the second quarter of 2022.

Rio reported Pilbara iron ore shipments of 79.9 MT in the second quarter, an increase of 12% from the first quarter and 5% from the same period in FY21. Production of bauxite mined copper and Pilbara iron ore increased in comparison to Q2 FY21 by 3%, 9%, and 4%, respectively.