Highlights

- Rio Tinto has stated that it is still looking forward to getting support for its acquisition offer for 49% interest in Turquoise Hill Resources.

- Rio has been negotiating with Turquoise for a long time.

- The bid price stands at CA$43 per share.

Australian miner Rio Tinto (ASX:RIO), on Friday (18 November), shared that it has studied the worries of minority shareholders of Turquoise Hill Resources Ltd concerning certain disagreements. Rio shared that a few shareholders were concerned about the deals Rio has struck with Pentwater Capital Management and SailingStone Capital Partners.

Meanwhile, the miner's shares were spotted trading 0.226% lower at AU$105.910 per share at 11:57 AM AEDT on the ASX on Friday.

Rio, in its release, stated that minority shareholders of Turquoise Hill had concerns regarding Rio’s agreements with Pentwater Capital Management LP and SailingStone Capital Partners LLC. Rio announced these deals on 1 November 2022. Rio Tinto added further that it tried to negotiate with Turquoise Hill on comparable provisions for minority shareholders. However, the talks have not materialised, and Rio has terminated those agreements.

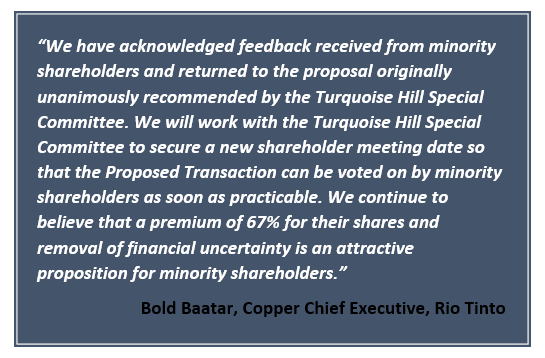

Rio informed that it now looks forward to acquiring 49% of shares of Turquoise Hill that Rio does not already own. The acquisition price stands at CA$43.00 per share in cash.

Rio declared further that all the minority shareholders of Turquoise will now be eligible for accessing dissent rights and statutory process via the Yukon Courts for Rio’s takeover offer.

Towards the end of the announcement, Rio stated that the takeover proposal of CA$43.00 per share is the best Rio could offer. This is a 67% premium to Turquoise Hill’s closing price of CA$25.68 per share on 11 March 2022, a day previous to Rio’s initial acquisition proposal. It should be noted that Rio presently owns 102,196,643 shares of Turquoise, almost 51%.