Highlights

- The 2022-23 budget of Australia invested AU$522 million in the aged care reforms

- Swift Networks implemented an agreement with Hubify Limited worth AU$1.5 million

- In 2021, SNZ reported a 136% increment in net profit after tax

- In May, HSC received approval from the Therapeutic Goods Association (TGA) for its new CardiacSense Solution

The aged care system in Australia serves elderly people over 65 years of age who can no longer live in their own homes without support. Different types of providers offer this service either in people's homes, in the community, or residential aged care facilities.

The 2022-23 budget of Australia has invested an additional AU$522 million in the aged care reforms, taking the government's commitment to these reforms to AU$18.8 billion.

This article will discuss three aged care stocks (SW1, SNZ, HSC) and their recent updates:

Swift Networks Limited (ASX:SW1)

Swift Networks is a technology company catering to residential aged care and other sectors with network infrastructure, communications, and premium entertainment technology.

Recently, the company entered a new agreement with Hubify Limited to implement its proprietary communication and entertainment solutions to one of Hubify's key Aged Care clients. The contract is for 54 months, and the total contract value of the agreement is AU$1.5 million, of which 83% is recurring revenue.

In the quarter ended 31 Mar 2022, the company secured new contracts worth AU$3.4 million with existing customers and AU$1.2 million with new customers.

Summerset Group Holdings Limited (ASX:SNZ)

Summerset Group builds, owns and operates over 30 retirement villages across New Zealand. It offers a range of independent living options within the villages with more than 7,000 residents.

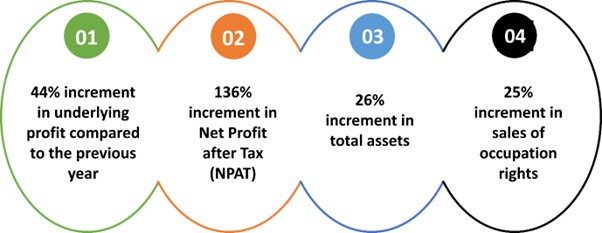

Let us look at the major highlights of the company for the year ended 31 Dec 2021,

Image source: © 2022 Kalkine Media®

The company's Chief Executive, Scott Scoullar, said that 2021 was an extraordinarily good year for Summerset with record demand and build rates.

Do read: ICR, PCK, CDX: How are these ASX telehealth stocks faring?

HSC Technology Group Ltd (ASX:HSC)

HSC provides a suite of technology-enabled care solutions to the aged and disability sectors, including retirement living, residential aged care, home, and community settings.

Earlier this month, HSC completed a AU$1.5 million placement with 150 million placement shares at an issue price of $0.01 per share.

In May, the company received approval from the Therapeutic Goods Association (TGA) for its new CardiacSense Solution, a watch that continuously measures heart rate and arrhythmias at ECG-level accuracy. Australia has nearly four million people with hypertension, presenting an addressable market prospect for the company.

Also read: Healthcare value stocks from ASX All Ordinaries: HLS, MVF, SHL, ANN