Highlights

- PolyNovo has delivered a return of AU$12.26 million in the March quarter.

- Proceeds for the Lorimer Street property sale is expected in July 2022.

- PolyNovo’s clinical trial programme is also on track.

Shares of PolyNovo Limited (ASX:PNV) buzzed in the green territory today (6 April 2022) as the company shared it March 2022 quarter update.

PolyNovo shares closed 4.629% up at AU$1.130 per share and outperformed the ASX 200 health care index, which was buzzing in the red territory today. Including today’s gain, the share has jumped 18% in past one month. However, the shares slipped by approximately 59% in one year, underperforming its benchmark, which is only 1% down in one year. Shares of the surgical instrument manufacturer are following a downtrend, even though it has increased significantly today. The year-to-date decline is approximately 25%.

Suggested reading: How soon will Aussies receive the AU$250 cost of living cash payment?

March 2022 quarter results shared by PolyNovo

ASX-listed medical device company has recorded revenue of AU$12.26 million in the March quarter, a 59% increase compared to last year. With this, the year-to-date (from January 2022 until now) revenue is AU$30.42 million with a run rate of around AU$48 million per annum.

The revenue was driven by a 79.4% on prior period corresponding (pcp) increase in the US sales to AU$9.53 million. In addition to this, 15 accounts were added during the quarter, and now the total stands at 169.

Australia and New Zealand’s performance was solid as sales surged by 81.9% within a year to AU$1.16 million and the year-to-date sales reached AU$2.38 million. PolyNovo said that face to face conference and access to hospitals is getting back on track.

Image Source: © 2022 Kalkine Media®

The United Kingdom and Ireland reported record sales during the third quarter as sales increased by 55.2% on pcp to AU$248k, including 152.3% on pcp surge in February. Sales in Europe were also encouraging, according to PolyNovo.

David Williams, chairman of PolyNovo, commented:

The proprietary owner of NovoSorb technology, PolyNovo, reportedly said that the revenue includes AU$1.00 million income from the Biomedical Advanced Research and Development Authority (BARDA) and a grant of AU$108k provided by the Victorian State Government.

Must read: ASX 200 tumbles at open; Polynovo rallies over 9%

Updates PolyNovo shared

PolyNovo informed its shareholders that the company has a cash balance of AU$3.80 million at the end of the March quarter, and this does not include proceeds for the Lorimer Street property sale. The company expects to receive AU$6.35 million on 13 June 2022 from the sale of the Lorimer Street property.

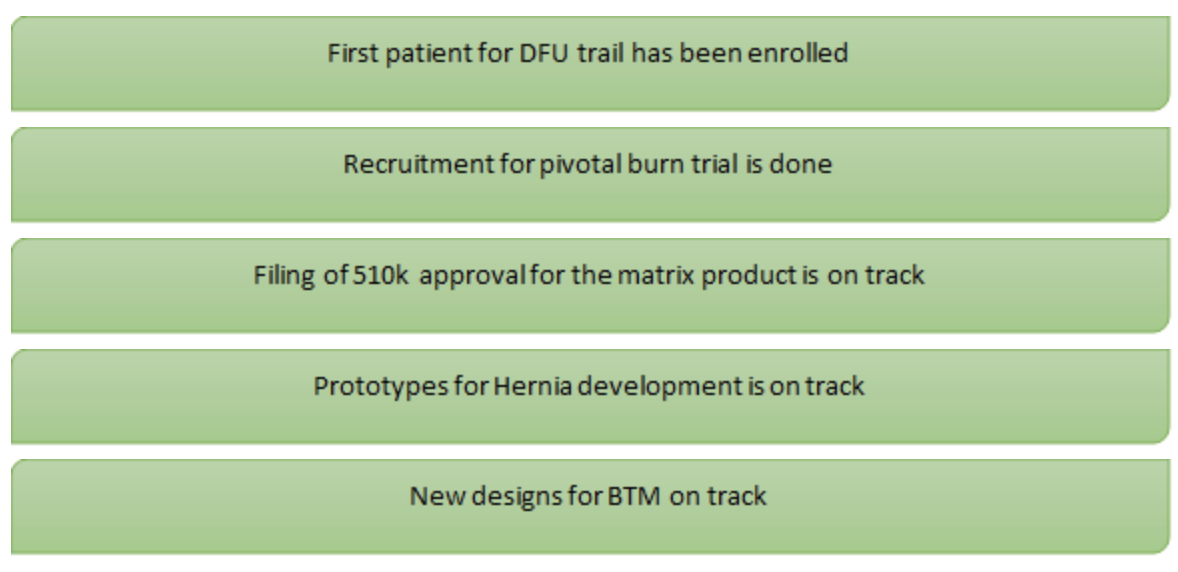

The emission from the Australian operations gained carbon neutral certification during the March quarter. PolyNovo said that company’s operations are on track as:

Image source: © 2022 Kalkine Media®