Highlights

- GQG’s funds under management (FUM), as of 31 May 2022, stands at US$94.6 billion.

- GQG management reported increase in funds under management across all strategies.

- GQG is a US-based investment firm.

Investment management firm, GQG Partners Inc (ASX:GQG) has shared the Funds Under Management (FUM) update as of 31 May 2022. In a month, FUM has improved across all strategies of GQG.

In April, GQG recorded a significant fall in its FUM over the month. The emerging markets equity clocked the highest loss, falling from US$24.9 billion to US$23.7 billion.

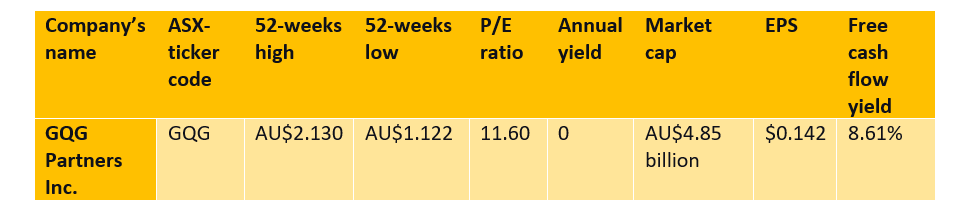

On the ASX, GQG was spotted trading 0.91% up at AU$1.660 apiece with a market capitalisation of AU$4.85 billion at 11:33 AM AEST.

Suggested reading: What’s ailing ASX media giants - NEC, NWS, OML, and others

FUM across all strategies

In the ASX announcement today, GQG informed its investors that the total FUM of the company has increased from US$90.4 billion to US$94.6 billion in a month. Here is the strategies’ wise division of FUM:

- In international equity, FUM increased from US$31.9 billion to US$33.7 billion.

- Global equity’s FUM surged from US$28.9 billion to US$29.7 billion.

- Emerging markets equity jumps from US$23.7 billion to US$24.7 billion.

- Lastly, US Equity rose from US$5.9 billion to US$6.5 billion.

Image source: © Felixcasio | Megapixl.com

Share performance of GQG

Including today’s gain, the share price of GQG has surged by around 20% in a month. However, the share price has decreased by 6% in last six months.

Image source: ©2022 Kalkine Media®

GQG – a dividend-paying stock

In May 2022, GQG declared a quarterly dividend of US$0.020 per share, which is payable on 28 June 2022. In Feb 2022, the company announced a dividend of US$0.0154 per share. The dividend was paid on 30 March 2022.

Do read: What is Splintershards (SPS) crypto? know price & performance