Highlights

- Crown was found to be executing the Chinese Union Pay process to transfer funds from China illegally.

- The Victorian Gambling and Casino Control Commission might charge a fine worth AU$100 million on Crown.

- Crown shares dip on the ASX after this announcement.

The shares of Crown Resorts Limited (ASX:CWN) traded 0.351% lower on the ASX today (6 April) at AU$12.805 per share at 10:48 AM AEST. Approximately 303,000 shares of Crown were traded till now in today’s trading session on the ASX.

The share price of Crown has gained over 8% on the ASX over the past 12 months. On the other hand, Crown’s year-to-date share price gained over 6% on the ASX today (6 April) at 10:48 AM AEST.

PLS EMBED:

https://www.youtube.com/watch?v=bbrLRP73Zqw

Why are Crown shares trading in red today?

Crown might have to pay a fine of up to AU$100 million to the Victorian Gambling and Casino Control Commission (VGCCC) for implementing the ‘China Union Pay process’.

On 5 April 2022, the Victorian Gambling and Casino Control Commission announced that Crown Melbourne Limited is initiating a disciplinary proceeding related to the Royal Commission’s findings regarding the ‘China Union Pay process’.

As per Royal Commission’s finding, Crown had devised the ‘China Union Pay process’ to evade Chinese currency restrictions and allowed the illegal transfer of funds from China.

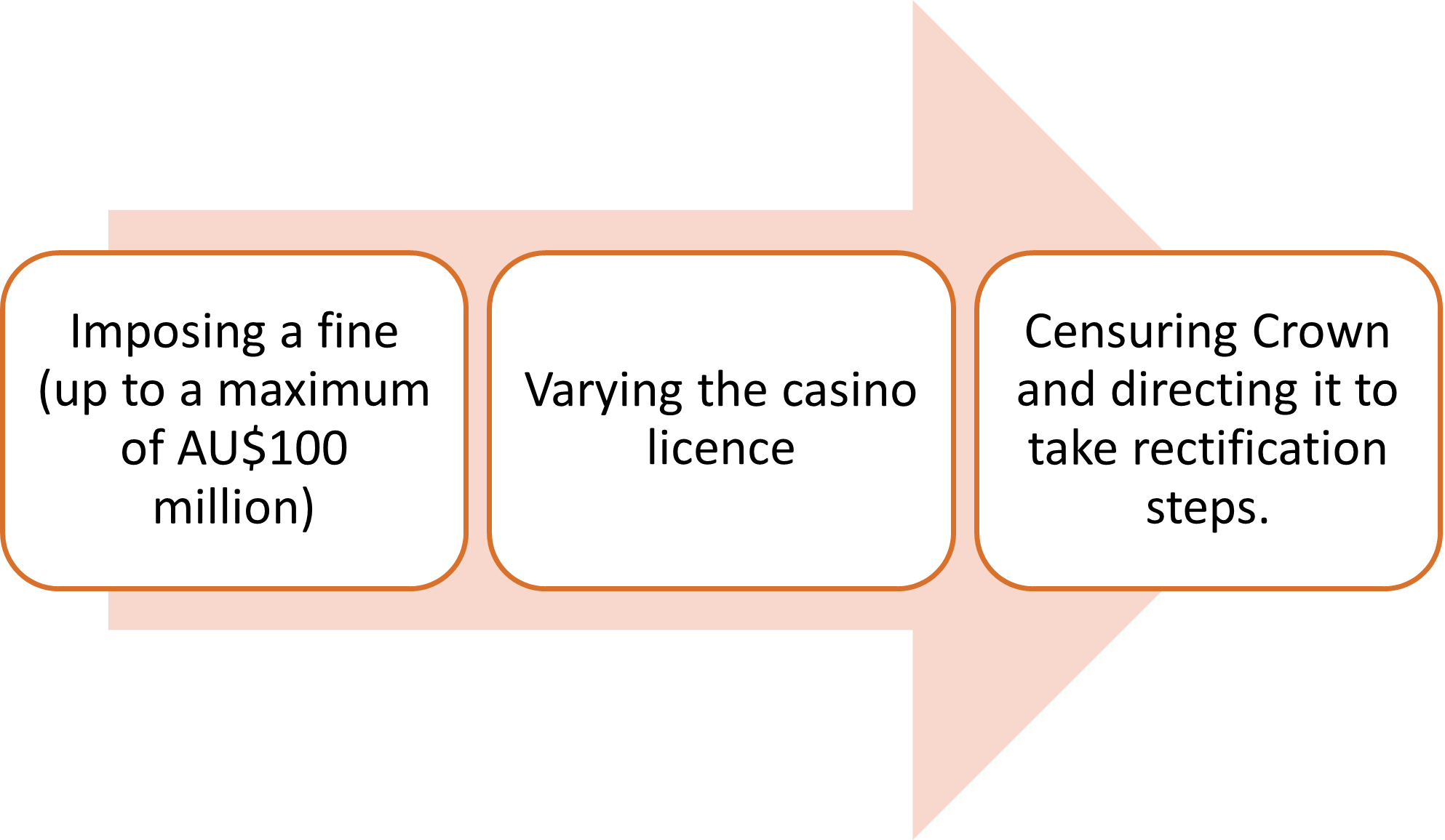

As a part of the disciplinary proceeding, the actions available to the VGCCC are:

Image Source © 2022 Kalkine Media ®

Fran Thorn, the Chair of the Victorian Gambling and Casino Control Commission, said that the regulatory body is executing legislative amendments which will further impose stronger regulatory obligations to Crown. As a result, it will also enforce greater power on VGCCC. Thus, these powers will be needed in future to prevent Crown from engaging in any such activity ever again.

In 2021, a Royal Commission was conducted within the Victorian Casino Operator and License. Out of several things, the Royal Commission began to investigate whether Crown Melbourne Ltd is suitable for holding the Melbourne Casino Licence, and it complies with the legislative terms.

The Royal Commission not only found that Crown is incapable of holding the licence, but also it has violated the terms and obligations of VGCCC.

Therefore, we assume this to be the primary reason behind Crown shares turning red on the ASX today (5 April).

Read more: FIRB approves Blackstone's acquisition of Crown (ASX:CWN)

What is the China Union Pay process?

Image source: © Tangducminh | Megapixl.com

Description: Crown (CWN) share price

The China Union Pay process is the usage of Chinese-based bank cards and China Union Pay to enable international patrons to access funds that could be further used for gambling at Crown Melbourne. This took place for a long time between 2012 and 2016.

The China Union Pay process was implemented as China had imposed restrictions on Chinese citizens from transferring money outside China. During the period 2012-2016, no Chinese citizen could transfer more than US$50,000 per year to another jurisdiction.

Crown was aware of the Chinese currency restrictions. Despite being aware of that, the company executed the Chinese Union Pay process to allow the illegal transfer of funds from China.

Read more: Crown Resorts Found Unfit For WA Gambling Licence