Highlights:

- Corporate Travel Management Limited (ASX:CTD) has been awarded the Bridging Accommodation & Travel Services contract by the UK Home Office.

- CTD’s latest contract win has been estimated at £ 1.6 billion TTV, started on 1 March.

- The contract is expected to have a substantial effect on the additional growth of their European region in FY24 and ahead.

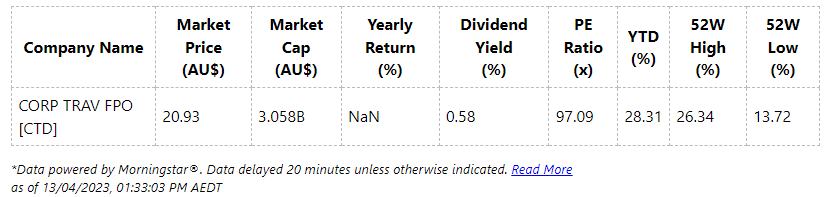

The provider of business travel management services, Corporate Travel Management Limited (ASX: CTD), increased by 11.957% and was trading at AU$21.160 on Thursday, 13 April 2023, at 12:20 pm AEST. The uptick in the stock price came after it announced that it had secured the Bridging Accommodation & Travel Services contract from the UK Home Office.

Let’s get acquainted with CTD’s latest update in detail.

On Thursday, the company’s latest contract win has been estimated at £ 1.6 billion (nearly AU$3 billion) TTV beginning 1 March this year for two years (with the ability for a one-year extension) in accordance with continuous demand requirements.

This work includes extremely complex services and logistic support that will be delivered by an established dedicated team of Corporate Travel. They have experience along with specialised knowledge to aid this work. Also, this region is already the company’s strongest contributor to its financial results. As its outcome, this contract will have a substantial effect on the additional growth of their European region in FY24 and ahead.

Corporate Travel’s 1HFY23 results

In its 1HFY23 results ended 31 December last year, the company’s revenue (and other income) grew 79% to AU$291.9 million from AU$163 million in pcp. TTV rose 102% to AU$4.2 million from AU$2 billion in pcp.

For the reported period, underlying EBITDA increased 182% to AU$51.3 million from AU$18.2 million in pcp. This result leveraged the momentum building late in the half-year period. Statutory NPAT was at AU$15.7 million, elevated from the loss of AU$10 million in pcp.

As of 31 December, last year, CTD had zero debt and a cash balance of AU$110 million. CTD’s board declared an interim dividend of an unfranked 6 cps to be paid on 14 April 2023.

On the segments front, the underlying EBITDA from North America got a boost of 177% to AU$16.6 million on pcp. In Europe, the underlying EBITDA decreased 19% to AU$17 million from AU$20.9 million in pcp.

In ANZ region, the underlying EBITDA improved 2511% to AU$23.5 million versus AU$0.9 million in pcp. The Asian region recorded an elevated underlying EBITDA of AU$3.4 million from the loss of AU$2.6 million in pcp.

On the FY23 guidance front, the company anticipates the underlying EBITDA to fall between AU$160 to AU$180 million. It anticipates the underlying PBT to be in the range of AU$120 to 140 million. It also anticipates a full recovery in FY24 (in advance of IATA’s projections for travel activity) on the back of client wins and retention.