Summary

- Pacifico Minerals is eyeing finalisation of the Sorby Hills Optimised Prefeasibility Study in August, with all work concerning Resource, Mining, Metallurgy and Process Plant already completed.

- Pacifico is presently undertaking compilation of final capital and operating cost estimates for non-plant infrastructure.

- The exposure to both base metals and precious metals market on the back of increase in Lead and Silver resources offer a significant opportunity to Sorby Hills Project.

The splendid exploration journey of Pacifico Minerals Limited (ASX:PMY) seems to be on the right track, all set to achieve a significant milestone. The Company, updating on the progress of Optimised Pre-Feasibility Study (PFS) for its Sorby Hills Joint Venture Project, indicated several accomplished developments that marked the advancement of OPFS, bringing it to the final stages of its closure.

Pacifico Minerals has accomplished all work regarding the Resource, Mining, Metallurgy and Process Plant and is currently compiling final capital and operating cost estimates for non-plant infrastructure. The completion of Optimised PFS has been scheduled in August.

ALSO READ: Pacifico Minerals’ Remarkable June Quarter Report Full of Robust Developments

Commenting on the remarkable development, Pacifico’s Managing Director Mr Simon Noon stated that Optimised PFS is expected to validate the financial and technical robustness of the Sorby Hills Project. It would be underpinned by detailed testwork and rising Lead and Silver demand as a major component of the global transition to clean energy.

Mr Noon also indicated that substantial endowment of Lead and Silver at the flagship project is confirmed by the recently released Mineral Resource Update, providing the Company’s shareholders with exposure to both Base Metal and Precious Metal markets.

Post PFS completion, Pacifico intends to immediately begin work on the Definitive Feasibility Study, with the resumption of delineation and resource extension drilling at Sorby Hills in Q3 2020.

Optimised PFS: Background and Noteworthy Developments

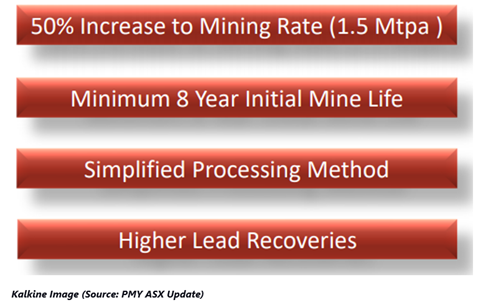

Pacifico, backed by consistent forward-moving endeavours, has advanced its Optimised Prefeasibility Study at the final stages, slated for completion in August. After the highly robust financials returned by the PFS at Sorby Hills, the Optimised PFS is targeting an increased mining rate and processing capacity in the wake of highly successful drilling and a resource inventory, along with the classification increase. Besides, it also seeks to further de-risk the project through additional testwork.

Significant developments across key study areas have marked the evolution of varying aspects of the Optimised Prefeasibility Study, including metallurgical testworks, mining, geology and resources and process plant and infrastructure Engineering. Significant increase in the plant throughput is targeted, while the improved lead recovery estimates were confirmed by extensive metallurgical testwork.

Sorby Hills Project: An Attractive Venture

Sorby Hills Project, situated not far from Kununurra’s regional centre enjoying robust infrastructure and jointly held by Pacifico Minerals (75%) and Henan Yuguang (25%), appears to demonstrate a strategic appeal owing to its substantial exposure to both the base metals and precious metals market. The project’s Updated Mineral Resource Estimate indicated a significant increase in the Lead and Silver resources, both of which remain critical to the transition towards an ecologically stable economy.

The rising momentum for the Electric Vehicles has prepared a fertile ground for the project hosting lead and silver deposits. Meanwhile, the lead supply gap in the coming years, as indicated by the Company would further propel the demand for new supply. The precious white metal, which has recognised strong attraction in the volatile COVID-19 scenario, also appears well-positioned with the accelerated growth of electronic and solar energy market.

The Strategies Beyond the Obvious

Pacifico Minerals has also executed a native title and mineral exploration agreement for the tenement E80/5317 ‘Eight Mile Creek’ which paves the way for long-term future within the region.

The Company’s hold on all unrestricted exploration property surrounding the Pincombe Inlier offers the potential for expanding the Sorby Hills mineralisation corridor. Furthermore, the strategic move lays a foundation for productive and collaborative engagement with the traditional owners, along with offering employment and economic prospects.

Eyeing to secure attractive and flexible funding package for furthering Sorby Hills development, it has also appointed BurnVoir Corporate Finance, which is a leading independent finance advisory group.

PMY stock traded at 0.017 on 30 July 2020 (at 3:58 PM AEST). Notably, the stock has generated a return of 325% in the last three months.