Highlights

Australian shares opened lower on Thursday.

The ASX 200 fell 61.90 points, or 0.89% to 6,924.90 at the open.

The index has lost 1.75% in the past five days.

Australian shares opened lower on Thursday, after another weak overnight closing on Wall Street on concerns related to aggressive interest rate hikes from the US Federal Reserve. US shares closed with a fourth consecutive fall in August. It was the weakest point for US shares in August in seven years.

The ASX 200 index fell 61.90 points, or 0.89% to 6,924.90 at the open. The index has lost 1.75% in the past five days but has fallen 8% in the last 52 weeks.

The ASX All Ordinaries index fell 0.763% to 7,171, while the A-VIX dipped 0.89% to 15.15 at the open. On Wednesday, the benchmark finished 0.15% lower at 6,986.8 points. The benchmark index was trading at 6,851.60, down 135.20 points, or 1.94% in the first 15 minutes of the trade.

Meanwhile, Accent Group, Iress, and Bega Cheese are scheduled to go ex-dividend today.

In Europe, the Stoxx 50 fell 1.3%, the FTSE declined 1.1%, the CAC dipped 1.4%, and the DAX dropped 1%. On the other hand, the MSCI all-country stock index fell 0.2%.

Market action

On Wednesday, US Treasury yields traded mixed on concerns related to rising consumer prices. Benchmark US Treasury 10-year yields surged to 3.13%, while two-year note yields stood at 3.448%.

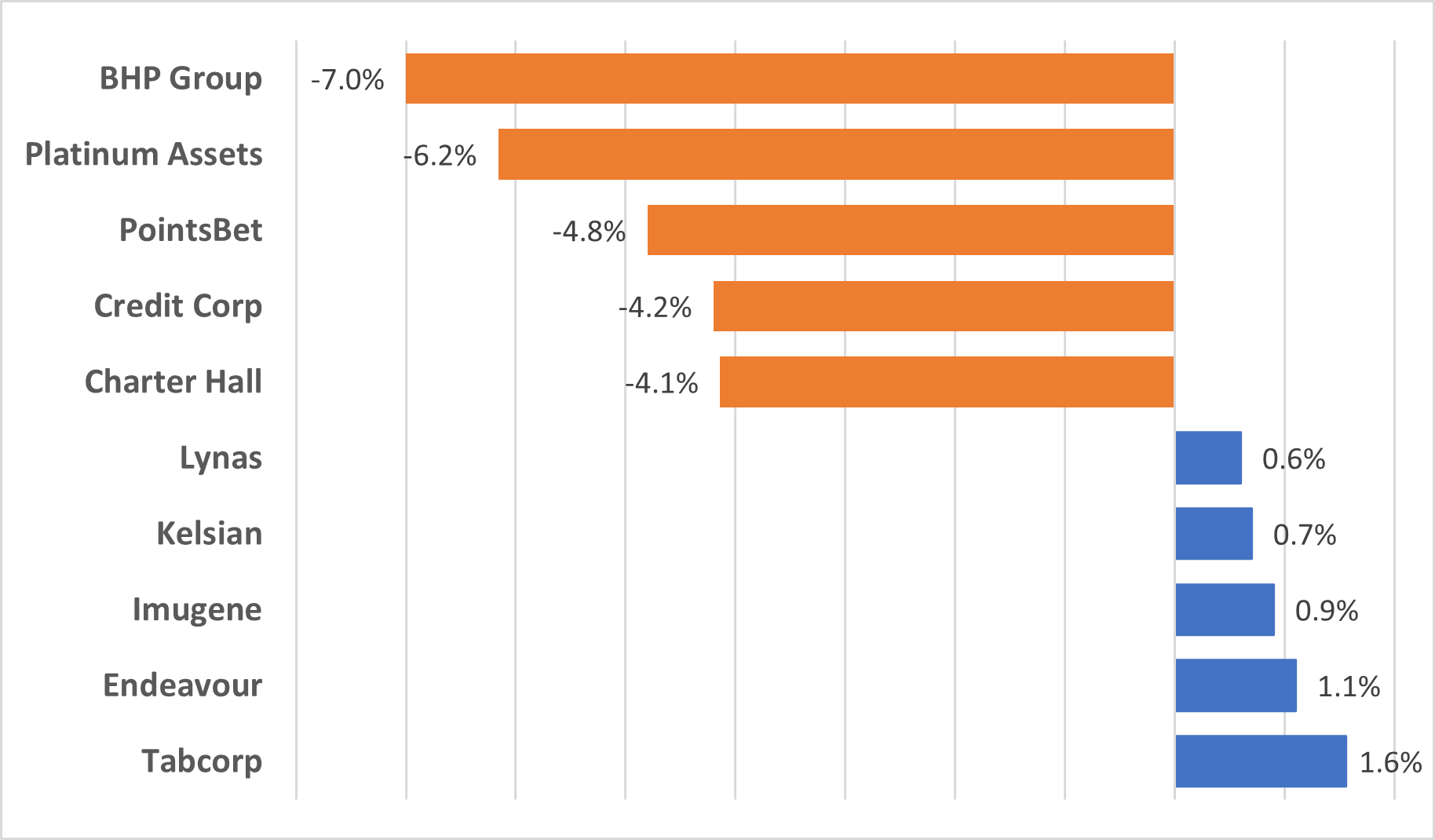

Data Source: ASX (as of 1 September 2022, 10:30 AM AEST)

Image Source: © 2022 Kalkine Media®

BHP Group was the top loser, while Tabcorp was the top gainer.

On the ASX, consumer staples was the only sector trading in the green in the early hours.

Newsmakers

- Fisher &Paykel has signed a NZ$275 million deal to acquire a 105-hectare land site in Auckland.

- Droneshield announced that it had received an order worth AU$2 million from a European government.

- AVZ Minerals said that it would suspend its shares from trade until the release of an announcement regarding its mining rights for the Manono lithium project in Congo, Africa.

- BHP Billiton traded without the rights to a US$1.75 per share final dividend.