CIMIC Group Limited (ASX: CIM)

Industrial sector giant CIMIC Group Limited (ASX:CIM) got hit really hard on the stock exchange this morning. Investors rushed to press the sell button after the international contractor reported a bleak result of its half-year performance.

On ASX, the stock has crashed over 18.5% to trade at $37.130, hanging near to its 52-week low of $37.00 as at 18 July 2019 (12:51 PM AEST).

Whatâs there in CIMIC 1HFY19 results that stock drifted to its lowest levels?

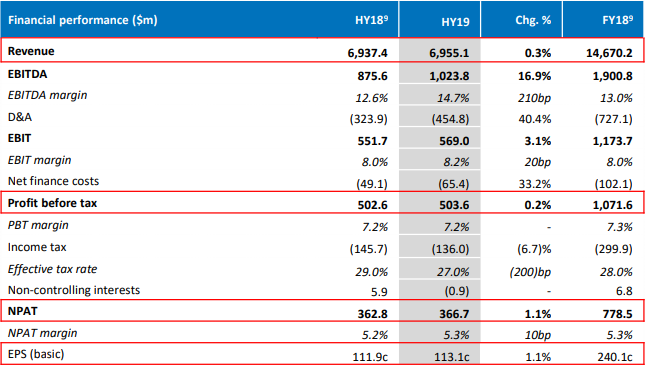

CIMIC reported a marginal growth of 1.1% in half-year profit, well below the market expectation of 6-7% that led the bearish market sentiments to follow. 1HFY19 Net Profit After Tax (NPAT) of the company landed to $366.7 million compared to $362.8 million in 1HFY18.

On the top line front, the Group reported total revenue of $6.95 billion, slightly up by 0.3% on pcp, for the six months ended 30 June 2019. It seems that the flesh of CIMIC groupâs revenue was majorly impacted by the negative performance of its construction segment, which forms the highest proportion in Groupâs revenue with respect to both the market and the activity.

Snapshot of CIMICâs 1HFY19 Performance (Source: Company Presentation)

Construction segmentâs revenue declined 7.0% to $3.63 billion; however, it was significantly offset by the 16.2% growth in CIMICâs Mining and Mineral Processing business to $2.057 billion. The company informed that encouraging revenue of its mineral and mining segment reflects a number of contract extensions and increased production levels due to the Group benefitting from its diversified portfolio across commodities and geographic markets.

More interestingly, CIMIC secured $8.3 billion of new work in 1HFY19 that also took its Operating Companiesâ total work-in-hand up $2.5 billion year-on-year to $34.3 billion as at the end of June 2019. The major contracts awarded during the first half of the year included Regional Rail Project PPP, NSW, Cross River Rail Tunnel, Stations and Development PPP, QLD, Christchurch Metro Sports Facility, NZ, Mining services contract at Jwaneng Mine Cut 9, Botswana and Mining services contract at Jwaneng Mine Cut 9, Botswana, among others.

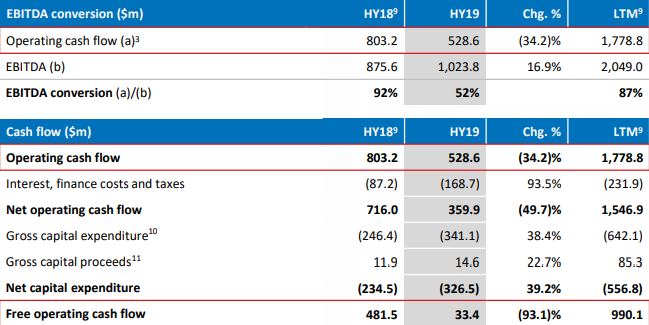

But the disappointment among investors continues to emerge mainly due to the weak cash flows reported for 1HFY19. CIMIC posted a 34.2% decline in its operating cash flow to $528.6 million, which led to the sharp decline in EBITDA conversation rate from 92% in 1HFY18 to 52% in 1HFY19.

Snapshot of CIMICâs 1HFY19 Cash Flows (Source: Company Presentation)

The weak operating cash flows coupled with the higher interest expenses and an increase of 39.2% in net capital expenditure resulted in 93.1% reduction in free operating cash flow to $33.4 million in 1HFY19, compared to $481.5 million in 1HFY18.

However, the company continued to deliver shareholder returns via an attractive dividend. This outlines a fully franked interim dividend of 71 cents per share, up 1.4% YoY, declared for the half-year ended 30 June 2019. It further represents a payout ratio of 62.8% and is reported to be paid on 3 October 2019 to shareholders present as on the record date of 12 September 2019.

As at 30 June 2019, the cash position of the company stood at $2.00 billion, a reduction of 6.5%, or $139.0 million, compared to 31 December 2018.

What company has to say about its future?

CIMIC confirmed its FY19 NPAT guidance to $790-840 million on the back of positive outlook across the Groupâs core markets. This is in comparison to reported NPAT of $779 million in FY18.

CIMIC stated:

Mining continues to strengthen with a positive outlook for volumes, both domestically and globally Construction and Services opportunities boosted by strong infrastructure pipeline and investment in PPPs

Strong balance sheet continues to provide flexibility to pursue strategic growth initiatives and capital allocation opportunities and to deliver shareholder returns.

Stock Performance

CIM shares have experienced a positive price change of 6.25% over the past 12 months despite a meltdown of 8.30% hit in the past three months. Moreover, its Year-to-Date return stands positive at 5.33%.

The stock is currently trading at $37.13 with a price to earnings multiple of 19.020x and a market capitalisation of $14.84 billion as at 18 July 2019 (12:51 PM AEST).

Also Read: CIMIC Group Announced two Significant Contracts for its Construction Business- CPB Contractors

Downer EDI Limited (ASX: DOW)

On Wednesday, Downer EDI Limited in collaboration with Works Finance (NZ) Limited announced that the Dividend Rate on the ROADS preference shares for the period 15 June 2019 to the next reset date of 15 June 2020 has been set to 5.49% per annum, payable quarterly in arrears. This figure is reportedly equal to the One Year Swap Rate on 17 June 2019 of 1.44% per annum plus the Step-up Margin of 4.05% per annum.

The decision is stated to be in accordance with the terms of the ROADS preference shares and the dividend is intended to remain fully imputed.

Murra Warra Wind Farm Update

Last Year, Downer inked a work contract Stage One of the Murra Warra Wind Farm near Horsham in Western Victoria in collaboration with partner Senvion GmbH, a leading global manufacturer of wind turbines based in Germany.

The contract involves the electrical, procurement and construction work for Stage One of the Plant, including the installation of 61 wind turbines. It is valued at ~$380 million with Downerâs share of ~$100 million.

In the latest update to the market, Downer informed that ~95% of its balance of plant work has been completed on budget and on schedule. The construction and delivery of Stage One of the Murra Warra Wind Farm have been trending at an advanced stage with 26 of the 61 wind turbine generators been erected, as per the companyâs information.

The remaining towers and blades are stated to lie either at the port, manufacturerâs premises or at the Murra Warra site. Three of 61 nacelles are reportedly completed, further three at the manufacturing stage, and the remaining are statedly either in Australia or in route to Australia.

Downer told that the work continues to remain in progress, and it has started the discussion with the owner of the wind farm- Partners Group, Senvionâs court-appointed Custodian and other key stakeholders to evaluate the process for delivery of outstanding equipment and finishing Stage One.

Downerâs FY2019 Guidance

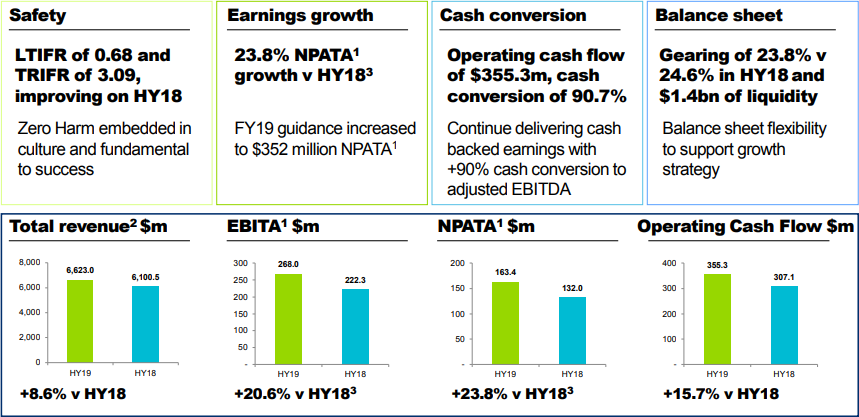

In 1HFY19 results, Downer upgraded its target guidance for FY2019 to $352 million consolidated net profit after tax and before amortisation of acquired intangible assets (NPATA) before minority interests. The guidance was increased on the fair value gain of $17 million from the takeover of remaining 50% holdings in the Downer Mouchel JV in late 1H19.

Snapshot of Downerâs 1HFY19 Performance (Source: Company Presentation)

The other key highlights of the companyâs outlook include:

- EPS- Deliver EPS growth of 19% in Fiscal 2019. For the half-year ended 31 December 2018, Downer reported diluted EPS of 21.7 cents per share, immensely up from -2.6 cents in December 2017.

- Returns- The Group aims to maintain dividend payout ratio within 50 â 60% of NPATA, on the back of active capital management.

- Cash flow- It targets to maintain robust cash flow conversion consistent with recent periods. In 1HFY19, Downerâs operating cash flow was strong at $355.3 million, up 15.7% from the previous corresponding period, representing cash conversion of 90.7% of adjusted EBITDA.

- Work-in-Hand- The Group expects its work-in-hand to remain strong. As at the end of December 2018, work-in-hand stood at attractive $43.5 billion that includes transport and facilities services forming most of the portfolio.

Stock Performance

DOW shares are trading at $6.860, down 0.435%, as at 18 July 2019 (3:37 PM AEST). The price to earnings multiple stands at 19.150x with a market capitalisation of $4.1 billion.

Over the last 12 months, the stock has dropped 1.71% including a massive negative performance change of 10.64% recorded over the past three months.

Take a more extensive look at Downerâs stock price.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.