- Mineral Commodities (ASX:MRC) has reported an increase of 177% in the total ore reserve for Tormin Inland Strands

- The upgraded reserve has been estimated to be 60.3 million tonnes at 3.7% VHM (14.7% THM) containing 2.21 million tonnes of heavy mineral

- Also, the company has confirmed an ore reserve increase of 181% within the current Expanded Mining Right (EMR) of the Tormin Inland Strands

- The updated ore reserve is of 21.5 million tonnes at 5.4% VHM (21.0% THM) containing 1.17 million tonnes of heavy mineral within the EMR

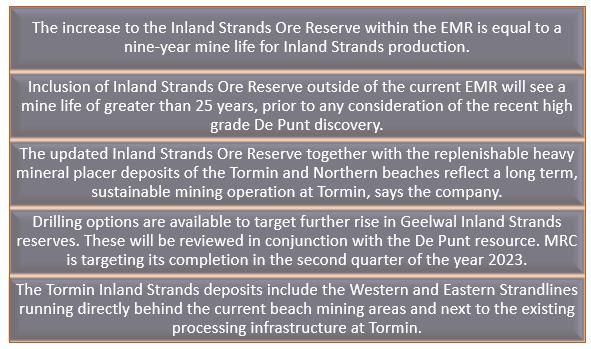

ASX-listed global mining and development company Mineral Commodities Limited (ASX:MRC) today announced that there has been a significant increase of 177% in the overall Inland Strands ore reserves. Also, the company reported a 181% boost to the Inland Strands reserves within its current Expanded Mining Right.

According to Mineral Commodities, this increase in the reserve shows the company’s focused commitment towards its Strategic Plan to amplify the asset value of Tormin by upgrading mineral reserves through organic growth and returning Tormin to historical profitability levels.

Source: © 2023 Krish Capital Pty. Ltd.

Details about the Updated Ore Reserve

The updated ore reserve estimate has been measured on the basis of the Maiden Ore Reserve with the use of new modifying factors applied on measured and indicated Mineral Resources, new cashflow grade modelling, and updated pit optimisation using Whittle 4X.

The Ore Reserve is termed as Proven and Probable, following the JORC Code 2012 and the requirements of ASX Listing Rule 5.9.

The orebody has a high grade heavy mineral assemblage and will generate profitable mineral sands products, says MRC.

The updated ore reserve has been measured to be 60.3 Mt of ore with an average VHM grade of 3.7% leading to 2.21 Mt of in-situ Heavy Minerals under the two categories - Proven and Probable. It is ~8km in length spanning over 153 hectares, next to the existing plant.

The updated ore reserve is a sub-set of the Western Strandline Mineral Resource estimate of 193Mt at 2.83% VHM (9.58% THM), based on the 74Mt of measured, indicated and stockpiled resources.

The Ore Reserve within the current EMR has been upgraded to 21.5Mt at 5.4% VHM (21.0% THM) with 1.17Mt of heavy mineral versus the Maiden Ore Reserve for the current EMR of 7.9Mt of ore with an average VHM grade of 9.4% resulting in 0.74Mt of in-situ Heavy Minerals. It marks a rise of 13.6Mt (181% higher) at 3.1% VHM for an additional 0.42Mt of heavy mineral (57% up).

Source: © 2023 Krish Capital Pty. Ltd.