Highlights

- Jindalee Resources (ASX:JRL) has released its Mineral Resources as at 31 August 2022 in accordance with the 2012 JORC code.

- The company reported a significant increase and upgrade to the McDermitt Mineral Resource from 30 June 2021 to 31 August 2022.

- The indicated resource at the McDermitt Lithium Project saw a 170% increase.

- JRL remains well funded to advance its projects.

Jindalee Resources Limited (ASX:JRL) recently provided an annual review of its Mineral Resources as at 31 August 2022 in accordance with the 2012 JORC code. The company has direct and indirect exposure to various commodities, including lithium, gold, and base and strategic metals.

JRL has a strong financial position with approximately AU$10.8 million in cash and marketable securities. Moreover, the company has a tight capital structure with only 57.4 million shares on issue.

The strong financial position and tight capital structure enable the company to advance its currently held projects while leveraging into new opportunities.

Here’s a snapshot of the company’s recently released annual mineral resources statement.

McDermitt Lithium Project Mineral Resource Estimate (MRE)

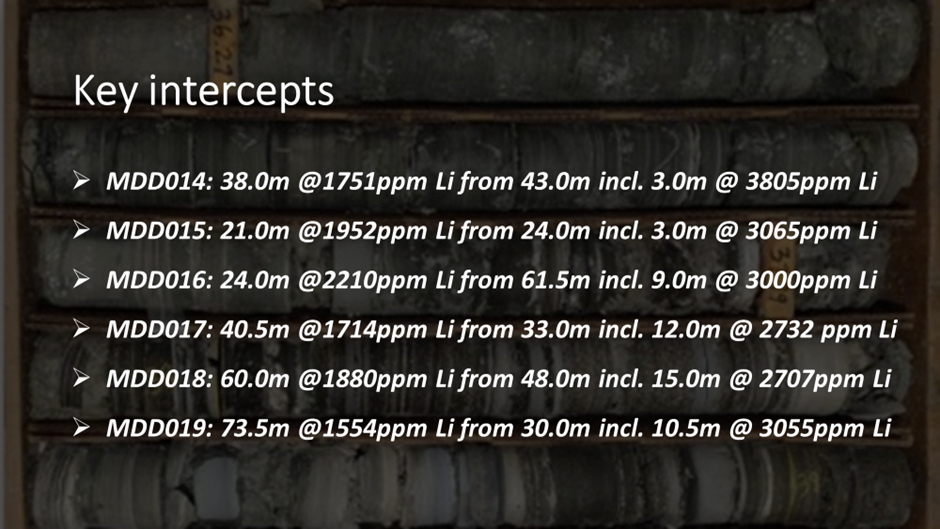

In late 2021, JRL drilled a total of 6 RC and 6 diamond holes at the McDermitt Lithium Project with an objective to boost confidence in the mineral resource to convert the Inferred Mineral Resource to Indicated category.

Source: ©2022 Kalkine Media® | Data Source: JRL | Image Source: JRL

Subsequent to the completion of the 2021 drill program, JRL commissioned H&S Consultants Pty Ltd (H&SC) to update the MRE.

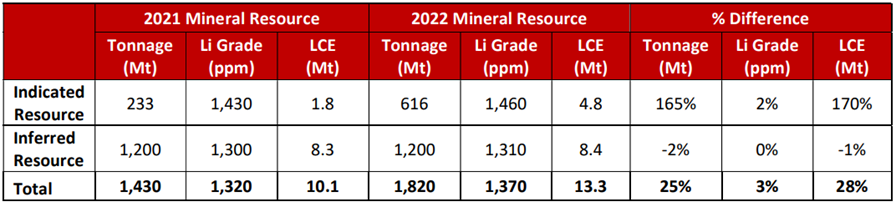

Increase in McDermitt Mineral Resource

The 2022 combined Indicated and Inferred Mineral Resource update suggests a year-on-year increase in tonnage of 25%, with a 3% boost in grade for a 28% rise in contained lithium.

Notably, there was more than a 165% increase in the Indicated Mineral Resource by tonnage and 2% in grade for a total 170% increase in contained metal at this higher confidence classification.

Source: JRL Announcement

The changes in the Mineral Resource were due to the extensional drilling along strike and the extension of the Mineral Resource classification. This classification was to 100m from the surface in the earlier resource update to 120m below the surface.

The positive open pit optimisation work that was finalised as part of the Scoping Study supported the resource update, while the Scoping Study indicated that prospective economic extraction could occur at depths to 120m below surface.

Prospect Ridge Project MRE

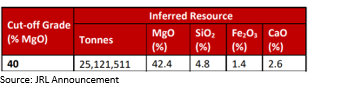

The Prospect Ridge Project, including the Arthur River and Lyons River magnesite deposits, is owned by JRL via wholly owned subsidiary HiTec Minerals Pty Ltd.

In October 2017, JRL declared an Inferred MRE of 25.1Mt @ 42.4% MgO at a 40% MgO cut-off at the Arthur River deposit. The MRE for Arthur River remains unchanged since this date.

JRL signed a binding term sheet in January 2022 for the sale of 70% of its interest in the Prospect Ridge Project for a consideration of AU$1 million payable in cash and shares to a wholly-owned subsidiary of GWR Group Ltd (ASX:GWR).

The subsidiary is required to make a minimum expenditure of AU$2 million and finalise a Scoping Study within 5 years, with HiTec’s 30% free carried to Decision to Mine.

Joyners JV MRE

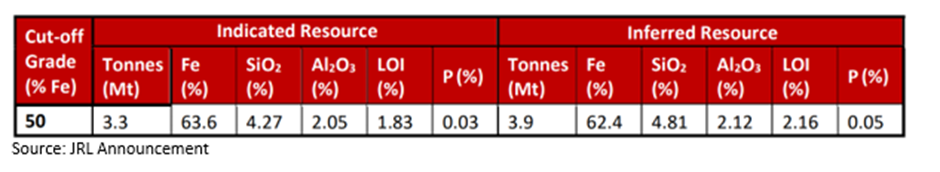

GWR holds 80% of the interest in the JV for Joyners project, which extends across the eastern part of the Joyners Find greenstone belt.

Notably, JRL retains a 20% equity position, free carried through to completion of a Bankable Feasibility Study.

An Indicated and Inferred MRE of 7.9Mt @ 62.2% Fe at 50% Fe cut-off at the Joyners JV was announced in 2011 by GWR. The MRE remains unchanged in the Joyners JV MRE since this update.

JRL shares were trading at AU$2.240 in the early hours of 04 October 2022.