Highlights

- At a time when crypto lending and the borrowing space are under pressure, Inverse Finance is gaining

- The project has a crypto called the INV token, alongside a “fully collateralised” stablecoin, DOLA

- The INV coin enables voting within the Inverse Finance ecosystem, making it a DAO

Is there a way to earn more cryptocurrencies from the existing crypto holding? The answer might be yes, and this is what underpins the concept of yield farming.

Yield farming or passive income from cryptos means making returns without liquidating holding. Here, the holder can lend cryptos in a decentralised setting, also called decentralised finance (DeFi). For participating in lending and thereby adding “liquidity” in the market, a “liquidity provider” or an LP is rewarded with more cryptos.

Amid a phase where many similar service providers like Celsius Network and Voyager Digital have suspended operations, DeFi participant Inverse Finance is making positive news. Its linked INV token is rising in value, with one-day trade volume up almost 2,000%, as of writing. Let us explore Inverse Finance.

What is Inverse Finance cryptocurrency?

Inverse Finance is into DeFi lending and borrowing services, with added focus on stablecoins. It claims to be a “positive sum DeFi”, which can provide passive income to cryptocurrency holders.

While players like Celsius Network are considered centralised as users do not have governance powers, Inverse Finance is said to be a DAO. A DAO or decentralised autonomous organisation usually has a native token which can be staked by the user to vote on governance matters. Inverse Finance states on its website that by staking the native token, rewards with over 150% APY can also accrue.

The project’s primary DeFi protocol is Frontier, which uses a stablecoin to enable lending and borrowing services.

INV token

Inverse Finance’s native cryptocurrency is INV, while stablecoin for DeFi operations is titled DOLA.

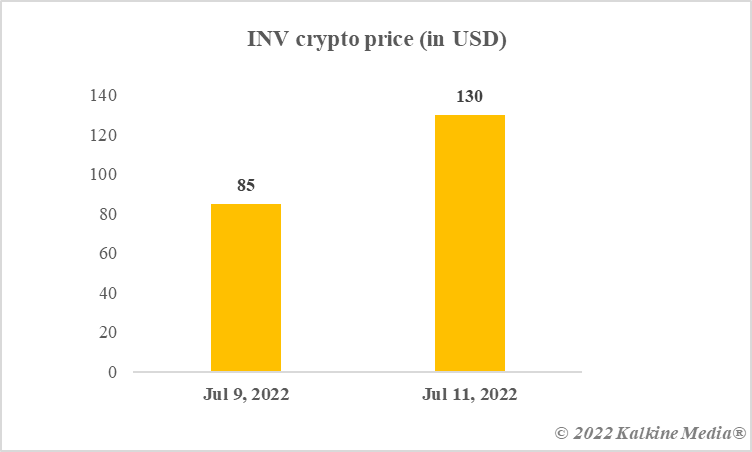

The INV token is a high-price per token cryptocurrency compared to peers like DOGE and SHIB. As of writing, the INV token is trading at nearly US$130. The market cap of INV is over US$12 million, which makes it a small-cap crypto in comparison to DOGE and SHIB.

According to CoinMarketCap, the price even touched US$160 a few hours back. It is notable that a couple of days back, the INV token was trading at under US$100.

Data provided by CoinMarketCap.com

Why is the INV token gaining?

One of the probable reasons could be the APY provided by its DOLA stablecoin. The latest tweets by Inverse Finance mention that DOLA-3POOL APY was in the range of over 50% on Convex Finance. Additionally, the INV token was added to Coinbase earlier this year, making it easy for enthusiasts to trade it.

Bottom line

Inverse Finance is a low-market cap and high-price per token cryptocurrency. It has INV and a stablecoin DOLA to provide yield farming services. The ongoing rally can be attributed to recent high APY, but caution is very important.

Also read: What are blue-chip cryptos? Here are top 3 based on YTD returns

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.