Bargain buys are the stocks trading below their fundamental value in terms of the current price in the market. At times, the market suffers through the correction cycle, which erodes the substantial value created by the companies. Investors must consider that the stock has eroded value due to an overall market correction, and not due to the persisting structural problems in a particular company.

Legendary money manager, Peter Lynch noted that âBargains are available at all times and it is all around you. It is for you to open your eyes and ears and spot themâ.

While there are many things to consider in bargain hunting, the basic fundamentals revolve around revenue growth & profit growth, which should be consistent. Secondly, the transparency and disclosure come into the picture, as an old saying goes âa lie travels much faster than a truthâ.

Preferring companies with less debt gives a substantial edge, as there is less leverage in the business, less cash is burned on interest payments, which leaves more cash for the dividends. Small companies with low market capitalisation have better chances to create wealth, as companies having $100 million in market capitalisation would reach $200 million faster compared with the companies having a market capitalisation of $1 billion aiming to reach $2 billion.

Reliance Worldwide Corporation Limited (ASX: RWC)

The company has been in existence since 1949 in Australia. Although, it was listed on ASX in 2016 and became a publicly traded company. The stock of the company is the component of the benchmark S&P/ASX 200 Index. The company is serving in over sixty countries worldwide with 24 distribution hubs, 15 manufacturing plants & 5 R&D centres.

On 5 August 2019, the company reported on the details of Conference Call and Webcast- 2019 Full Year Earnings Announcement. Accordingly, the company has scheduled to report the full-year results on 27 August 2019.

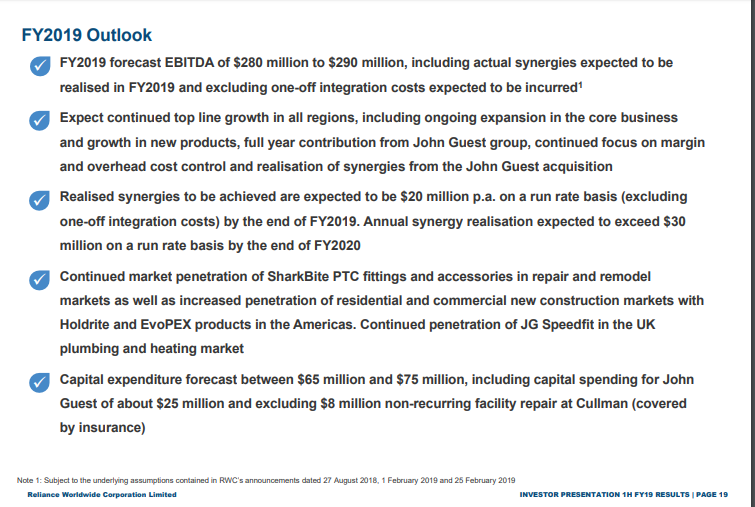

On 13 May 2019, the company provided a trading update & revised EBITDA guidance for FY2019. Accordingly, it was asserted that the companyâs operating segments had been impacted by the market-specific factors, which had resulted in negative to the performance & results. Subsequently, the company had expected that the revised FY2019 EBITDA to be in between $260 million to $270 million from $280 million to $290 million, which was advised previously. Importantly, the revised number considers some assumptions, including that a modest freeze event would be experienced in the USA.

Previous Outlook (Source: FY19 Half Year Results Presentation, February 2019)

Americas

Reportedly, the business in the region continued to achieve good underlying growth; however, there were some issues faced by the company. The first issue was nonappearance of freeze event, which occurs due to the winter storms in the USA. Besides, the freeze event boosts the sales of the company due to the broken or cracked pipes. Consequently, the absence of the event would impact the net sales by $12 million - $15 million in FY2019.

Further, the second issue relates to inventory strategy adopted by channel partners, which related to actively reduce inventory on hand. It has resulted in less than anticipated sales in the latter half of the year. The segment has been performing in line, with expectations from the costing perspective, and the John Guest business continues to perform as per expectations.

EMEA

As per the release, the EMEA segment has been performing well, backed by the initial full year inclusion of John Guest, and the John Guest business remains on track to achieve expected results. However, the RWC business has not performed as per the expectations in the UK & Spain. In the UK, the subdued business depicts the exits from some product line. In Spain, the slower sales replicate intense competition, and lower than expected demand levels across continental Europe. Meanwhile, John Guest integration activities remain ahead of the schedule.

APAC

Reportedly, the segment has underperformed during the second - half of the period due to a decline in new home construction in Australia. Previously, the company had notified regarding the delays in the launch of the two new products. Subsequently, the new products were in process to be launched after the issued were resolved.

John Guest

It was reported that the integration activities of the John Guest business were progressing ahead of the schedule, and the realised synergies are on track or might exceed the target for FY2019 period.

US Tariffs & Brexit

The announcement noted that US tariffs on imports from China would not impact on FY2019 EBITDA. However, it might have potential negative impacts on the FY2020 to the Americas segment. Reportedly, the expected impacts could be on the raw materials acquired from China, and the company would decide to act on it whenever necessary. In addition, the Brexit deadline has been postponed, and the companyâs stance remains the same as reported during the first half.

Outlook

Reportedly, the company remains a global leader in both brass and plastic push to connect (PTC) fittings technology. The company was satisfied with the progress achieved in integrating the John Guest and core RWC business. Besides, the company has retained its market leading position across multiple products. The company remains focused on developing, commercialising new products to maintain the future growth of the business.

On 16 August 2019, RWC last traded at A$3.1, down by 7.463% from the previous close. The stock is down by 24.55% over the year-to-date period.

ALS Limited (ASX: ALQ)

Headquartered in Brisbane, ALS Limited is engaged in providing services such as testing, inspection, certification & verification. The stock of the company is a component of the S&P/ASX 200 Index, S&P/ASX 200 Industrials (Sector) Index, S&P/ASX 100 Index and more.

Recently, the company had announced the acquisition of a Mexican based, founded in 1967, the largest testing laboratory in Latin America named â Laboratorios de Control ARJ S.A de C.V (ARJ). Accordingly, the acquired company is based in Mexico City, Mexico, and it has revenues of over $30 million.

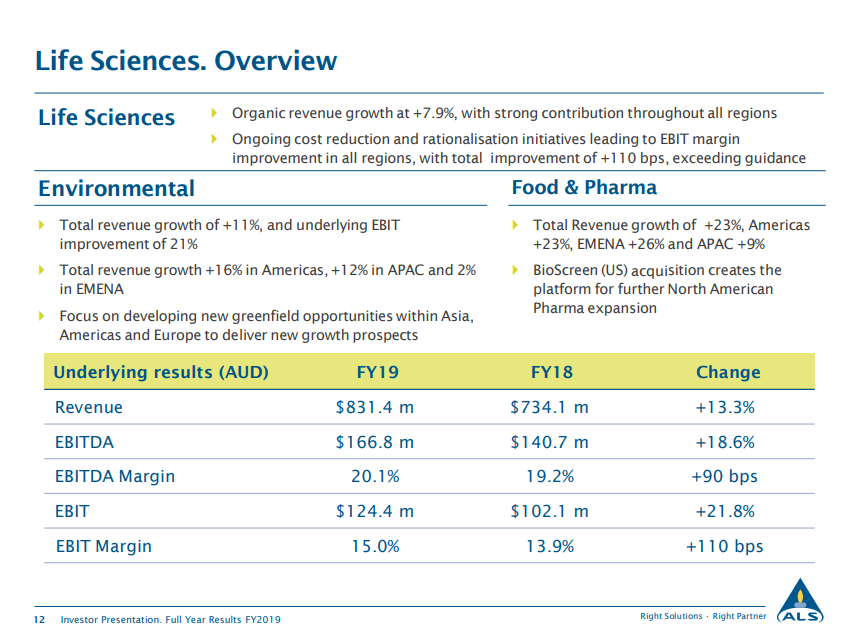

Life Sciences Business (Source: ALQâ Investor Presentation Full Year Results 2019)

In addition, ARJ is specialised in providing quality control for medicines, biosimilars, generics, biological products, medical devices and many of the global pharmaceutical companies. It employs over 500 people.

The announcement notes that Mexico is one of the growing parts of the global pharmaceutical testing market, which is estimated at $20 billion. Further, the Mexican market is the hub for the North American & Latin American markets.

In addition, the companyâs Life Sciences Latin America operations would be benefitted by the acquisition, and is anticipated to gain from the companyâs regional & global presence to expand the product suite for the clients.

Raj Naran, Managing Director & CEO of ALS, stated the acquisition as an important strategic acquisition for the company, and it was asserted that ARJ is equipped with world class operations. He also said that the client base of ARJ presents an opportunity to grow in the Latin American market, including Mexico, Colombia, Brazil & Argentina.

He mentioned that the acquisition strategy of the company is focused on pharma & food opportunities in the key growth market, and the acquisition in Latin America is in line with the strategy of the company. Additionally, the acquisition is consistent with 2022 strategic plan to grow the non-cyclical businesses with the group.

On 16 August 2019, ALQ last traded at A$7.460, down by 0.267% from the previous close. Despite crashing sharply in May, the stock has capitalised on losses, and the year-to-date return stands +12.48%.

Bingo Industries Limited (ASX: BIN)

Waste Management Company, Bingo Industries Limited operates a fully integrated recycling & waste management business. It provides end to end solution for waste management. Besides, the stock of the company is a component of the S&P/ASX 200 Index, S&P/ASX 200 Industrials (Sector) Index and more indices.

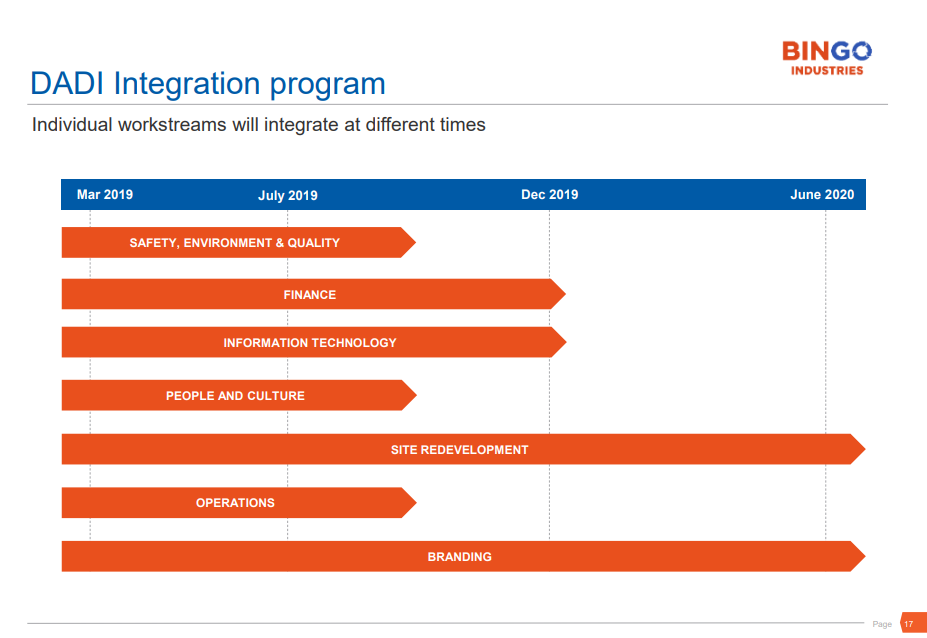

Integration Update (Source: BINGO Investor Day Presentation, June 2019)

The company would be finalising the supplements to be released for the full-year results very soon. Last year, it had released the full-year results on 21 August 2018. Besides, the company had disclosed the half-year results ended 31 December 2018 for the FY19 period in February 2019.

Reportedly, the net revenues of the company were up 25.4% to $178.7 million while underlying EBITDA increased by 4.1% to $45.6 million compared with previous corresponding period (pcp). The company asserted that underlying EBITDA margin was impacted by the redevelopment of several sites, lower margins in the Victorian business, escalated volumes of lower margin material in post-collections along with increased corporate costs.

As per the release, the underlying NPAT was up by 3.8% to $23 million compared with pcp, and statutory NPAT was down 24.9% to $13.4 million over pcp due to costs associated with transaction and integration of recent and pending acquisitions. Besides, the company generated strong free cash flow, and operating cash flow was up 33% to $47.2 million over the pcp. Further, the company had emphasised on cash collection, which resulted in cash conversion of 103%, and the company had net cash of $140 million.

On 16 August 2019, BIN last traded at A$2.38, down by 0.418% from the prior close. Over the year-to-date period, the stock has delivered a return of +30.96%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.