Escrow Services

Escrow allows a third-party entity to hold the financial instrument/asset on behalf of the parties involved in the escrow arrangements. It allows the parties involved in the agreement to access the asset only after the formal obligations have been fulfilled.

Generally, escrow services are used in situations like internet transactions, banking, intellectual property, mergers & acquisitions, real estate, law, capital raising, performance remunerations etc.

Escrow services can be used as securing funds to initiate any transaction related to real estate acquisitions that require due diligence, audit, examining financial records, etc. It provides a more ethical way to deal in a transaction, while also depicting interest in the transaction by placing funds into an escrow account.

In capital market, escrow services have widespread applications from IPO to performance shares. The holder of the underlying asset held in the escrow account is bound by the obligations that must be fulfilled in order to release the assets of the holders from the escrow account.

Companies enter formal obligations that are required to be satisfied to release the escrowed assets. As an example, letâs say CDE Limited acquired ABC Limited in cash & stock, and the stock received by Directors of ABC was escrowed. CDE had defined in the contract that release of the stock from escrow account is depended on ABC achieving $500 million in revenue. Therefore, the holders of the stock would be able to release the stock after achieving $500 million in revenue.

Further, the escrow activities undertaken by any listed company is generally reported to the stock exchange. Companies also report escrow transactions arising out of any deal related to mergers, capital raising, performance rights, etc.

Escrow services are also used in facilitating trade deals as well. For example â XYZ Limited have agreed with a supplier to receive 500 tonnes of sugar. XYZ may use escrow service to deposit the consideration in an escrow account with a condition of release upon the receipt of the sugar from a supplier.

AppsVillage Australia Limited (ASX:APV)

The company recently released an announcement citing 457,560 fully paid ordinary shares would be released from escrow on 26 September 2019. This follows the announcement made previously on 11 September 2019. It was also noted that the holders of these shares have agreed to a further voluntary escrow period to 14 September 2020. Meanwhile, the company had applied for the quotation on ASX for these shares.

On 11 September 2019, the company had notified that it would release 457,560 fully paid ordinary shares on 26 September 2019. 248,609 fully paid ordinary shares would be released from escrow on 28 September 2019, and the company would apply for quotation subsequently.

Recently, the company has expanded its operations to emerging markets. It had extended its Facebook advertising offering in the Philippines, India, Malaysia and multiple countries within Africa. The companyâs one-click advertisement capabilities allow its small-to-medium business users to create promotional and advertorial content through its mobile application and advertise on the Facebook platform.

On 27 September 2019, APV last traded at $0.170, up by 3.03% relative to the previous close.

STEMify Limited (ASX: SF1)

On 11 September 2019, the company had reported that 924,894 fully paid ordinary shares were to be released from escrow on 26 September 2019.

Earlier this month, the company released full-year results for the period ended 30 June 2019. Accordingly, the revenue of the company was $2.21 million for the period, down by 62.7% compared to the $5.93 million in the previous year.

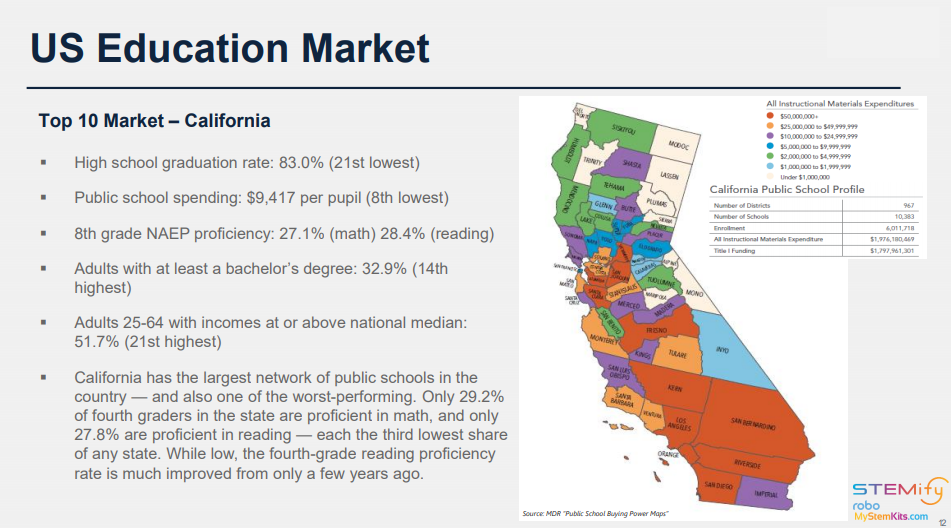

US Education Market (Source: Investor Presentation, November 2018)

US Education Market (Source: Investor Presentation, November 2018)

During FY 2019, SF1 concluded the strategic acquisition of curriculum software business MyStemKits, LLC that allowed the company to become an education software innovator for the K-12 education market in the USA from a designer and manufacturer of 3D printer hardware.

Further, the company undertook a strategic review, resulting in an increased emphasis on developing SAAS education software business to tap the education market in the USA. It also adopted a strategy to pursue sales through national resellers, training and onboarding of new staff and incentive structure, among others.

On 26 September 2019, SF1 last traded flat at $0.028, relative to the previous close.

Janison Education Group Limited (ASX: JAN)

On 16 September 2019, the company reported that 6,060,606 fully paid ordinary shares were to be released from escrow on 1 October 2019.

Concurrently, the company announced that its recent acquisition of exam management business â LTC (Language Testing Consultants) had a very successful year to 30 June 2019. LTC has a dominant market share position with 57 high-profile clients.

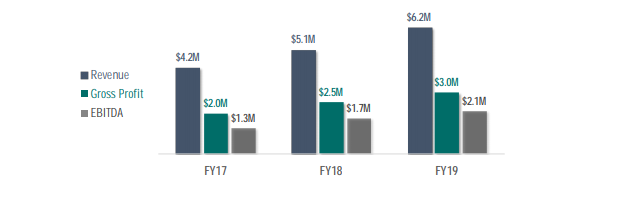

LTC Financial Overview (Source: JANâs Announcement)

Reportedly, LTC presents a strategic opportunity for the company to digitise assessments within the Higher Education sector. Acquisition of LTC enables the company to work closely with each client on their digital transformation journey. Further, the revenue of LTC is being classified as non-recurring âServicesâ revenue with the companyâs consolidated group results.

On 27 September 2019, JAN last traded at $0.32, down by 1.538% relative to the previous close.

Tymlez Group Limited (ASX: TYM)

On 18 September 2019, the company announced that 1,497,936 ordinary fully paid shares were to be released from escrow on 5 October 2019. These shares are related to the fully paid shares held by pre-IPO investors for a period of 12 months.

On 25 September 2019, TYM notified the selection of MatrixThread Pty Ltd as a tech collaborator for the market of Australia. MatrixThread is an IT solution provider focused on Distributed Ledger Technology (DLT), Artificial Intelligence (AI), Machine Learning and Cloud Infrastructure.

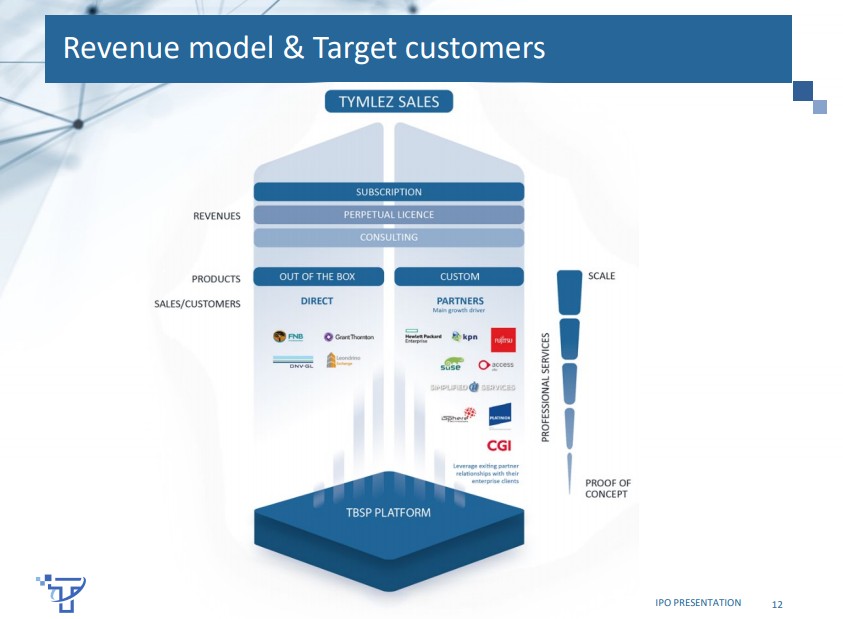

TBSP Platform (Source: TYM Presentation)

TBSP Platform (Source: TYM Presentation)

According to the release, MatrixThread would use the companyâs platform â YMLEZ Blockchain Solutions Platform (TBSP) to help Australian enterprises to quickly prototype blockchain solutions, and seamlessly integrate with their legacy systems.

Meanwhile, MatrixThread provides the expertise to build solutions for various industries using modern technology stack along with experience in application development for startups and larger enterprises.

TYM last traded on ASX at a price of $0.065 on 24 September 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.