In this article, we are discussing recent market updates from two ASX-listed tech sector players, DWS Limited and Security Matters Limited.

DWS Limited (ASX: DWS)

DWS Limited (ASX: DWS) is a professional services company with offices in Melbourne, Sydney, Brisbane, Adelaide and Canberra. The company is engaged in providing information technology consulting services to large corporate entities and Australian Government agencies.

At DWS, the people hired are extremely talented, and they have to pass a rigorous recruitment process in order to ensure that the company delivers high-quality work to its customers.

DWS Reports 2% Increase in 1H FY2020 Underlying EBITDA

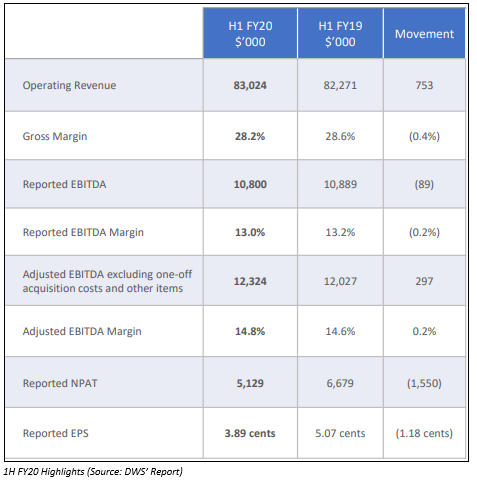

On 11 February 2020, DWS Limited announced its 1H FY2020 results for the period ended 31 December 2019, highlighting

- Revenue during the period increased by 1% to $83.02 mn as compared to the previous corresponding period (pcp).

- Underlying EBITDA was up 2% to $12.32 mn on pcp.

- Underlying net profit after tax was up 11% to $8.4 mn on pcp.

- Statutory NPAT declined by 23% year on year to $5.13 mn.

- 1H FY2020 operating cash flow (before interest and tax) was $15.1 mn, which is 122% of adjusted EBITDA.

- Declared an interim fully franked dividend of 3.0 cents per ordinary share, which was 4.0 cents per share during 1H FY2019.

The six-month period results were primarily driven by lower than anticipated demand in the banking & finance, IT&C and transport sectors. However, this got counterbalanced by a surge in demand in the government & defense sector.

The total consulting staff numbers went down from 763 in 1H FY2019 to 745 in 1H FY2020, owing to below than anticipated demand in DWS traditional services plus underperformance of the Symplicit business.

Staff utilisation was lower during the period, as consultant counts were adjusted to match the lower than anticipated client demand in DWS traditional services plus a one-off mandatory leave plan applied at short notice by a key client.

Another key driver of 1H FY2020 results was strong cost management across the DWS Group, which resulted in a 14.8% adjusted EBITDA margin.

Outlook:

Depending on the market conditions, for 2H FY2020, the company’s performance is expected to reflect:

- More progress by projects assured in Federal Government work in Canberra.

- Improved performance in Symplicit, RPA and the newly acquired Object Consulting business.

- Retaining productivity & margins in the core offering of DWS.

- Continued good cost management.

DWS would evaluate its investment in Site Supervisor during FY2020 to confirm satisfactory growth while alternatively reducing its investment or exit.

DWS would also focus on leveraging the gains from its core & acquired businesses with an objective of growing & diversifying earnings, paying down acquisition debt & giving proper shareholder returns.

On 12 February 2020, the DWS stock closed the day’s trading at $ 1.075, with a market cap of $ 141.72 million.

Security Matters Limited (ASX: SMX)

Security Matters Limited (ASX: SMX) is a technology owner, based in Victoria. The technology permanently & irrevocably “marks” any object in solid, liquid or gas state, thereby enabling identification, proof of authenticity, tracing supply chain activities along with quality assurance.

The company has also started the commercialisation of this technology, which entails a chemical-based ‘barcode’ system storing data that can be read using SMX’s exclusive ‘reader’. The data stored is protected via the blockchain technology.

JV to Develop SMX’s Patented Wine Anti-Counterfeit and Adulteration System

On 10 February 2020, Security Matters Limited announced the incorporation of a new joint venture company, Security Matters Beverages (“SMX-B”) in partnership with Global Bevco Pty Ltd to finalise the development of its patented wine anti-counterfeit & adulteration system. The JV company would also undertake the commercialise of its application.

Of the total, 50% of Security Matters Beverages would be owned by Security Matters while the remaining 50% would be held by Global Bevco, which is owned by ex-Macquarie banker Mr Peter Yates AM and Mr Leon Kempler AM.

SMX-B would licence the supply chain integrity and asset tracking technology of SMX. The alliance would be applying SMX’s solution to alcoholic beverages on a global scale. On this front, the work is already under progress with key stakeholders, aimed towards the development of global guidelines and testing of the technology.

Meanwhile, SMX’s CEO and Founder, Haggai Alon, said that the company is focusing on helping Fast Moving Consumer Goods (FMCG) organisations in demonstrating brand integrity & production visibility right from the raw material to recycling. Through this JV, the company would be able to execute its aggressive strategy in 2020. It will aim at the FMCG market & in particular, the alcohol industry, which accounts for more than $500 bn yearly of fake goods.

Post the successful demo of the SMX’s technology included in different types of wine, the company would be completing the markers to embed into wines within Australia and Europe. At the same time, the company would work on resolving the regulatory issues related to wine provenance, quality and production techniques.

SMX Signs MoU to Create World’s First Mine-To-Product Transparency Solution

On 5 February 2020, SMX signed a Memorandum of Understanding (MoU) with The Perth Mint for creating the world’s first mine-to-product transparency solution, which would leverage the proprietary technology of SMX to provide transparency and accountability from the gold mine site to the customer.

The World Gold Council (WGC) has released responsible gold mining standards. On the other hand, the London Bullion Market Association has established a responsible gold guidance for Good Delivery Refiners.

After receiving regulatory go ahead, the initiative would result in the creation of trueGold. SMX, along with The Perth Mint, would then begin the development of an advanced proprietary supply chain solution via the disruptive technology of Security Matters.

The complete launch of the solution is anticipated during Q1 2021. The patented reader of the company would be leveraged for maintaining the highest levels of gold quality and integrity.

On 12 February 2020, the SMX stock closed the day’s trading at $ 0.370, with a market cap of $ 40.7 million.