Natural gas prices towards the end of 2019, were booming after dipping slightly during the third quarter. The Victorian wholesale gas market is currently trading at a price of $6.05 per gigajoule (as on 2 January 06:00-10:00), while the prices in Sydney are as high as $6.50 (Ex Ante) per gigajoule (as on 01 January 2020).

The recent spike in natural gas prices was majorly due to the higher consumption from the LNG sector, which is anticipated by the industry experts to boom further over high demand from China and reducing spread (forecasted) between the spot LNG and oil-linked contracts.

To Know More, Do Read: LNG Price Fall- A Much Needed Strategic Decline For Long-Term Impetus?

The east coast gas shortage along with the high demand from the LNG sector is propelling the natural gas prices, which are also forecasted by many industry experts to rise further over the higher consumption in electricity generation ahead.

The current gas situation is particularly providing benefits to the ASX oil & gas stocks, and many stocks such as Beach Energy Limited (ASX:BPT), Santos Limited (ASX:STO), Senex Energy Limited (ASX: SXY) are gaining momentum in the market.

Suggested Read: ASX Oil & Gas Explorer- Senex Buckles For East Coast Gas Crisis

The government is also supporting the gas project under the new generation investment program to further address the gas shortage across Australia, which is again putting the ASX oil & gas stock at the brim of emerging natural gas industry.

To Know More, Do Read: Morrison Government Delivers On The Election Promise; Backs Two Gas-Powered Generators

Natural Gas Demand and Supply Forecast

- Demand Forecast

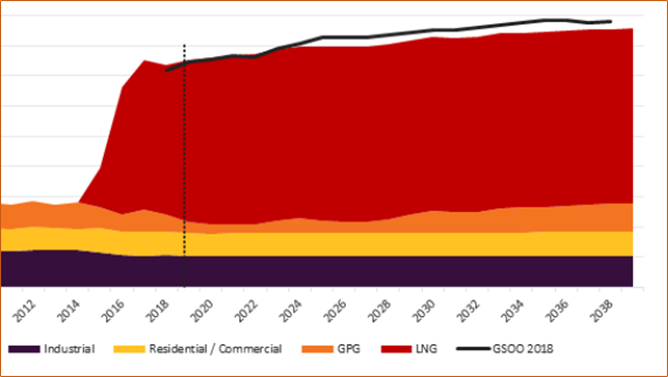

In 2019, the Gas Statement of Opportunities report published by the Australia Electricity Market Operator (or AEMO) highlighted that the total demand would be dominated by the LNG export over the short-run.

Gas Forward Trend (Source: AEMO)

- The LNG exports are forecasted by the energy market regulator to surge over the short-term to make the most of the global LNG market opportunities.

- The industrial consumption is anticipated by AEMO to remain flat as the sector continues to seek ways to maintain current operating levels in an increasingly challenging economic environment.

- The residential and commercial sector consumption is projected to increase slightly as the population increases (as projected by the Australian Bureau of Statistics).

- The demand from global power generation is predicted to decline over the years ahead as the share of renewable energy generation increases.

To Know More, Do Read: The Future Of Energy Generation In Australia; Solar To Increase Three-Fold By 2024

However, the absence of renewable energy target beyond 2020, which had already reduced the investment in renewable energy projects could support the natural gas consumption for a while in the GPG sector.

To Know How, Do Read: ASX-Listed Oil & Gas Stocks- A Perfect Buy For Short-Term Gains?

- Supply Forecast

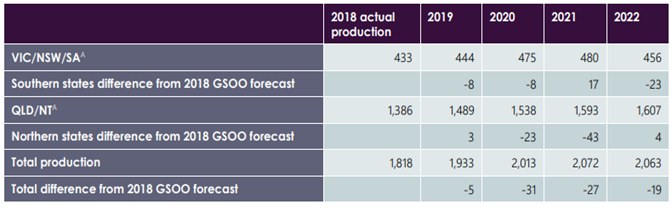

The 2019 Gas Statement of Opportunities report, which collects the data from the gas producers highlighted that the gas production from the southern states, which includes new gas projects such as Cooper Energy’s (ASX:COE) Sole project, West Barracouta project (from Esso-BHP Group Limited (ASX: BHP)), would offset the continued decline in southern production.

The northern production is anticipated by the energy market operator to increase between 2019-22.

Supply Forecast (Source: AEMO)

The supply forecast in 2019 GSOO anticipates much lower production as compared to the previous forecast of 2018 GSOO.

The northern states are expected to witness higher supply difference as compared to the projections in 2018 GSOO with -23 petajoules in 2020 and -43 petajoules in 2021.

Producers Anticipation and Feedback to AEMO

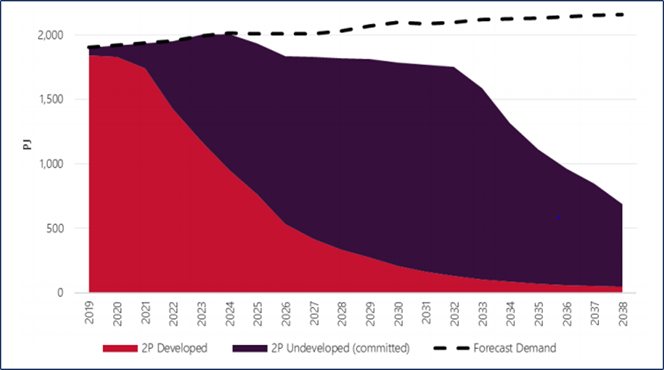

- The gas producers in the domestic market advised the energy regulator that rates of drilling in coal seam gas fields continue to increase with steady production rates, and also suggested that increasing amounts of investment would be required to keep the same amount of production. However, the discovery of new gas resources could be supportive.

- To meet the 2022 production forecast for northern states would require a 17 per cent increase in annual production against the actual levels observed in 2018.

- The producers further notified the energy regulator that the quantities of 2P developed and undeveloped resources fell by approx. 5 per cent and 6 per cent, respectively against the reserves reported by the producers to AEMO in 2018.

- However, the 2C contingent resources surged by approx. 27 per cent, and while some 2P reserves have been downgraded, further exploration drilling has increased quantities of contingent resources.

- Albeit, the 2C resources surged, but it cannot be considered as commercially viable.

Southern states witnessed the highest shift in resources from 2P to 2C, with a drop of about 32 per cent in the 2P resources (or 1,100 petajoules) with a 270 petajoule rise in undeveloped 2P resources.

2P Resource Projections (Source: AEMO)

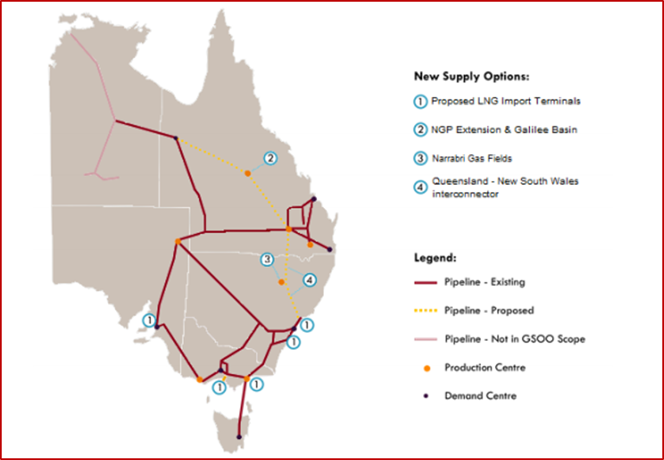

Potential Additional Supply Sources

Potential Additional Supply Sources (Source: AEMO)

- LNG Import Terminals

Floating regasification and storage units are being considered as the potential source of additional gas supply in eastern and south-eastern Australia by many gas industry experts.

The energy regulator anticipates that a generic import terminal constructed at Melbourne, Gippsland, Sydney, Newcastle, and Adelaide would increase the supply capacity to 200 petajoules a year.

- Northern Gas Pipeline Upgrade and Extension

The northern gas pipeline (or NGP) had started commercial operation in January 2019, with a transfer capacity of 90 terajoules a day, and AEMO highlighted that Jemena- a large gas distributor, anticipates the transfer capacity to expand to 700 terajoules per day.

- Interconnection Between Queensland and NSW

The southern supply tightness could be further alleviated via a further interconnection between Queensland and NSW, which would connect northern gas supply to the southern states.

A new gas transmission connection from Wallumbilla Hub in Queensland to NSW could provide the anticipated supply capacity of 400 terajoules per day.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

.jpg)