Medical devices are considered as an essential part of the health care industry and range from a bandage to high-risk products for implanting in the human body such as pacemakers. Medical devices differ from the general medicines as they are used for the measurement of body functions or have some mechanical or physical effect on the human body. Medical devices include various products such as syringes, medical gloves, X-ray equipment and blood pressure monitors.

Medical device industry in Australia-

In Australia, the Therapeutic Goods Administration (TGA) regulates the medical devices. A sponsor, who is an individual or a company legally responsible for supplying medical devices or medicine, must apply to Therapeutic Goods Administration for including their device on the Australian Register of Therapeutic Goods (ARTG). For the assessment and approval of medical devices for use in Australia, TGA uses its risk-based approach.

Therapeutic Goods Administration reviews the evidence for ascertaining whether the advantages of the medical device offset any potential risks. Medical devices must be incorporated in the Australian Register of Therapeutic Goods prior to the availability for sale in Australia.

There are a few important parameters documented in the law for every medical device to meet before the approval for supply in Australia. These principles are-

- Safety requirements;

- The device must have chemical, physical and biological properties;

- Infection and microbial contamination protection;

- Appropriate construction and environmental properties;

- Information about the device to be supplied with the medical device.

After the approval of the use of the medical device in Australia, TGA monitors the devices to make sure that they meet all the regulatory requirements and safety standards, under the post-market monitoring. Some of the post-market monitoring actions are;

Let us discuss ASX listed medical device stocks-

An ASX listed health care player Cochlear Limited (ASX:COH) is a medical device company which is into designing, development and supply of implantable hearing solutions for providing a lifetime of hearing outcomes. A cochlear implant system has two parts; the external sound processor and the implant surgeons put under the skin and attach to an electrode array they place in the inner ear. Cochlear operates via the divisions across Americas, the Asia Pacific regions and EMEA, and supply its implants in more than 100 countries.

New board appointment-

On 10 December 2019, the company announced the appointment of Michael Daniell, he will be the new board member of Cochlear and his appointment would be effective from 1 January 2020. Mr Daniell has extensive executive leadership experience and has 40 years of work experience in the medical device industry.

Stock information- The companyâs stock traded at $225.10, down by 2.05% from its previous close on 13 December 2019. The stock has a market cap of approximately $13.29 billion with 57.83 million outstanding shares on ASX.

California-based medical equipment company ResMed Inc (ASX:RMD) is engaged in providing innovative solutions to treat patients with chronic diseases, including chronic obstructive pulmonary disease (COPD) and sleep apnoea. The company offers cloud-connected medical devices at a lower cost for the health care system and consumers in over 120 countries.

Update of Dividend/Distribution:

In an ASX announcement on 8 November 2019, ResMed updated its formerly disclosed dividend distribution for the quarter ended 30 September 2019. ResMed revealed that the update of foreign exchange rate for the forthcoming dividend as the reason for the latest dividend/distribution update. A dividend of approximately USD 0.0390 per security on ResMed (RMD) â CDI 10:1 Foreign Exempt NYSE is scheduled for payment on Thursday, 12 December 2019.

Stock information- RMDâs stock settled the dayâs trade at $21.93 on 13 December 2019, up by 0.27% from its previous close. The stock has a market cap of approximately $31.35 billion with 1.43 billion outstanding shares on ASX.

Fisher & Paykel Healthcare Corporation Limited (ASX:FPH)

An ASX listed medical device company Fisher & Paykel Healthcare Corporation Limited (ASX:FPH) is engaged in the designing, developing and marketing of the products for providing acute care, respiratory care, surgery & treatment to the patients of obstructive sleep apnea (OSA). Fisher & Paykel sells its products all over the world in nearly 120 countries.

Dividend/Distribution update-

On 12 December 2019, Fisher & Paykel announced an update to a formerly unveiled dividend distribution for the half-year ended 30 September 2019. The company mentioned, providing details of the AUD equivalent total dividend/distribution amount per security as the reason for the latest dividend/distribution update. A dividend of approximately $0.1411 on FPH ordinary fully paid foreign exempt NZX is due for payment on Thursday, 19 December 2019.

Stock information- FPHâs stock settled the day at $20.49 on 13 December 2019, down by 2.28% from its previous close. The stock has a market cap of approximately $12.05 billion with 574.42 million outstanding shares on ASX.

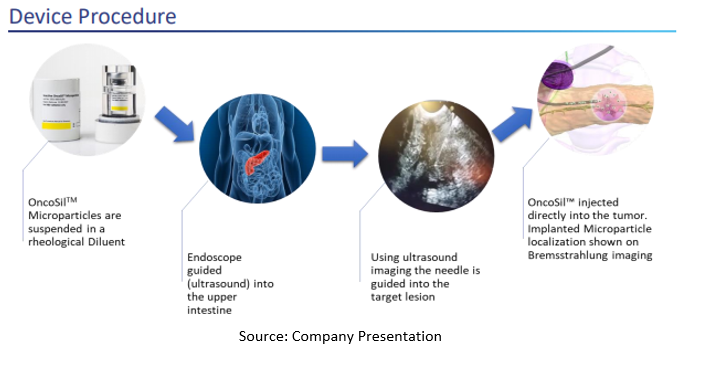

OncoSil Medical Limited (ASX:OSL)

New South Wales headquartered medical device company OncoSil Medical Limited (ASX:OSL) is focused on the liver and pancreatic interventional oncology. The companyâs lead product OncoSilTM is a brachytherapy device that emits pre-determined dose of beta particles and implants on malignant tissue, which is currently under clinical development. The clinical data would be used for regulatory submissions in the United States, Australia, Europe and Asia.

Positive CE Mark update-

On 19 November 2019, the company updated about CE Marking review after a meeting with BSI Management on 14 November 2019. OncoSil mentioned that a positive and constructive meeting with BSI Management concerning its Post Market Surveillance plan and Post Market Clinical Follow-up programme was held. On the basis of the discussion held with BSI management team, OncoSil would now officially submit OncoSil⢠device post-market surveillance and post-market clinical follow-up plans for the final review to BSI.

Stock information- OSLâs stock settled the dayâs trade at $0.160 on 13 December 2019. It has a market cap of approximately $100.91 million and outstanding shares of nearly 630.71 million on ASX.

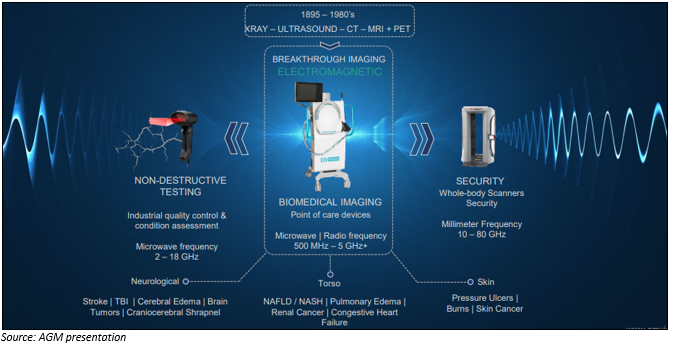

EMvision Medical Devices Limited (ASX:EMV)

An ASX listed health care sector player EMvision Medical Devices Ltd (ASX:EMV) is engaged in developing portable brain scanner for rapid diagnosis and monitoring of stroke, and it is completely focused on the development of medical imaging technology.

Completion of $4.5 million placement-

On 5 November 2019, EMvision medical announced that the company had received binding commitments from institutional as well as sophisticated investors, with existing shareholders, to raise $4,500,000 effectively. The fund raised would be utilized for the commercial product development of EMvision Medicalâs portable brain scanner and to progress clinical validation.

2019 AGM presentation-

The company updated the market with its Annual General Meeting (AGM) presentation on 26 November 2019. The quick highlights from AGM presentation are-

- Clinical trial progressing to plan- Clinician and nursing staff have started preliminary training with the clinical prototype, and it is expected to start patient scanning in December.

- The company is developing breakthrough portable diagnostics which has the following functions;

- Non-ionising

- Miniaturised hardware

- Cost-Effective

- Non-invasive

- Powerful functional imaging capabilities

- The New IP generated in FY2019 in hardware and software integration, providing reliable protection.

- EMVâs and Keysight are now partners for the development of a low cost, small footprint Vector Network Analyst (VNA).

- In FY2019 the company joined the Australian Stroke Alliance for clinical input and MRFF funding application in 2020.

Stock information- EMVâs stock settled the dayâs trade at $0.705, down 3.4% on 13 December 2019. It has a market cap of nearly $46.47 million with outstanding shares of approximately 63.66 million on ASX.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.