The mayhem created in the global scenario following the outbreak of novel Coronavirus in China appears to be disrupting the business operations and affecting the profitability of the array of sectors. Coronavirus, a contagious respiratory illness, till date has spread to many countries since China recognised its first case on 31st December 2019. Approximately, 28,285 confirmed cases and 565 deaths have been reported for the disease with the fatality rate of 2.0%. US has updated about 11 cases with positive virus signs, whereas the UK reportedly witnessed two patients with Coronavirus. Australian authorities confirmed 15 cases, 5 recovered, and 165 people show symptoms for the virus.

The extensive outreach of the Chinese economy and its pivotal role in international trade has further magnified the effect of the epidemic on a global scale. The economic downturn has been witnessed in the varying sectors following the temporary culmination of exports from China and the travel ban by the governments. Industry players profoundly felt the repercussions of the imposition of varying quarantine measures and repression in the trade activity.

Risk Aversion Sentiments Among the Investors

Australia, still reeling from the aftermath of the Bushfire, is confronted with another inevitable hurdle that has exacerbated the economic issues of the country. Phillip Lowe, the governor of Reserve Bank of Australia, expressed concerns regarding the looming uncertainty that the outbreak poses on the world economy.

The unpredictability of the situation is felt primarily by the volatile securities as the risk appetite of the investors appears to be cooling. Owing to the returning of the risk-aversion sentiments, the Australian Dollar Pullback for a long term could affect the Australian economy. The Australian dollar has plunged from 0.6995 USD on 31st December 2019 to 0.6722 USD on 31st January 2020. While the rest of the world remains moderately affected by the impacts of Coronavirus, Australian trade being tightly integrated with that of China is expected to suffer relatively higher setbacks.

The investors have moved towards the safer havens over the past one month with the opening spot gold price rising from AUD 2,176.07 on 31st December 2019 to AUD 2,376.27 on 31st January 2020. However, visualising the trend in the second month after the outbreak, the gold prices have continuously slumped in February garnering positive outlook among the investors.

Luxury Market losing its magnetism

The Consumer Discretionary sector encompassing the stocks of the industries sensitive to the economic cycle is likely to be impacted by the Coronavirus outbreak. The industries such as luxury products, textiles and leisure products are most prominently affected by the outburst of Coronavirus.

When wondering about the Luxury retail stores, your mind most often stumbles across the image of a Chinese customer making the engaging purchase. Well, strikingly that’s the real scenario because most of the Luxury Companies look up to the Chinese consumers for the sale of a significant portion of their products. However, the sales of luxury products have tumbled down recently.

The economic impacts of the Coronavirus slowly reached the Australian subcontinent with the effects on the luxury market felt after the first week of January 2020. Michael Hill International Limited that provides a range of luxury products such as jewellery and watches have continuously recorded the downfall in the share prices that have reached from $0.735 on 9 January to $0.605 on 3 January this year.

Education and Travel Industry Bearing Major Toll of Coronavirus Preventive Measures

The sight of a Chinese traveller exploring the different popular destinations in Australia might appear like a routine for someone staying in Yarra Valley or Gold Cost. According to the reports by the Tourism Research Australia, Chinese travellers alone contributes $12.3 Billion towards the revenue generated by the Australian tourism sector.

However, if you are one of those backpackers or someone working in the leisure business, the chances are you must not be as frequently spotting your Chinse counterparts these days.

The ban imposed by the Australian Government that prevents Chinese nationals from entering Australia till 15 February 2019 can severely affect the travel sector in Australia. The shares of the Crown Resorts Limited have persistently slumped following the intensification of outbreak thereby reaching from $12.670 on 16 January to $11.50 on 3 February.

The Australian airports bereft of the flights carrying Chinese consumers have cumulatively affected the performance of both the airlines and the airports. Sydney airports performance whoppingly went from +8.4% on 15 January to -2.16% on 28 January. However, the stock has started to improve slightly in February.

The travel ban is directly impacting the education industry as the Chinese students are not able to return to the colleges. The release by the Ministry of Home Affairs in Australia highlights that around 82.214 student visa holders from China would be affected alone in Australia.

The Australian Education Industry stands to lose a massive amount if similar circumstances continue. While many of the universities have postponed their session, they are exposed to substantial potential risk if the same epidemic condition prevails.

Metals and Mining Shares Risk Exposure

Australia bears a robust strategic relationship with China in terms of trade and commerce. China being one of its prominent importers could primarily affect the demand for iron ore as the demand for steel slows down. The outbreak has substantially paused the infrastructural activities in the mainland, which is resulting in low orders.

The report by S&P Global highlights that the many producers are cutting the steel production rate in the face of low steel demands. However, quite contrarily many end-users are also willing to maintain the stockpiles of raw materials to avoid the probable logistic issues at the Australian ports.

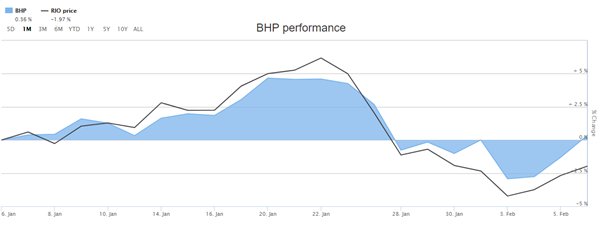

The shares of BHP Group and Rio Tinto, despite the looming threat, recorded positive share growth from 2nd January to 20th January 2020 by around 5.9% and 5.79% are now rolling down due to stockpiling of steel. It would be interesting to note the turn taken by Chinese producers which would ultimately affect the shares in the Australian market.

Source: ASX

HealthCare Stocks Gaining Momentum

Ever wondered how much the health cost burden would increase if the Wuhan epidemic spreads extensively around the globe? Even if you did not, the investors were quick to analyse the growing dependency of the ones affected with the respiratory illness on the shares of different drugs.

Although the absence of a specific cure has prevented the stocks from springing to the zenith, many healthcare-related stocks, especially in China, have witnessed significant growth since the outbreak.

According to the local Chinese media report, China Health group has seen record high performance as the shares have surged by 280.5 per cent. Even the world market shows signs of good prospects for the health sector. S&P/ASX 200 INDEX has demonstrated a positive trend with the growth rate of 9.56 per cent reported from 2nd January to 20th January 2020.

CSL Limited observed share increase from $275.76 on 31st January to $320.60 on 6th February 2020. Similarly, another healthcare company acknowledged a steady rise in its share prices, approximately 9.2 per cent in January.

Will the Coronavirus continue Plaguing Stock Market for a long-term?

If you are planning to wear the lenses of the past to gauge the prospective impact of Coronavirus, chances are you might overlook the other factors. Every third person is found comparing the present respiratory epidemic with SARS that broke in China in 2003.

Historically, when looking at SARS that occurred in 2003, one would find that while the epidemic dipped the prices of stocks for initial three months, the shares were able to regain the normal flow after the fear downsized.

However, the trade relation of China in the past decade, especially with Australia, has soared high. The surging in the number of Chinese travellers and the emerged pivotal role of China in moderating the world economy in the current scenario cannot be neglected. Moreover, it is noteworthy that the ongoing US-Iraq war during the 2003 pandemic could have catalytically driven the investor’s sentiments.

The international spillovers would largely depend on the extent of success with which China can effectively control the virus. It would be too early to comment if the economic impact of the Wuhan epidemic would be short-term or would extend far beyond the threshold level.

.jpg)