Highlights:

- Micro Focus received an acquisition offer from a Canada-based company.

- The MFGP stock soared over 93 per cent on Friday morning.

- Its trading volume was nearly 5 million on August 26, 2022.

The Micro Focus Intl PLC (NYSE:MFGP) stock seemed to have gained traction among the market participants on August 26, reflected by the significant rise in its trading price.

The MFGP stock soared over 93 per cent on Friday morning, a day after it received an acquisition offer from a Canada-based company.

Let's dive deep into the acquisition offer that may have helped in the recent gains of the stock, before exploring the recent stock performance.

What's in the deal?

The Canadian enterprise information management solutions developer, Open Text Corporation (NASDAQ:OTEX), agreed to acquire the British software and technology firm in an all-cash deal.

The offered deal to acquire Micro Focus was valued at US$ 6 billion including debt. This would be the largest deal for Open Text and reflects its effort in expanding its operating segment.

According to the announcement, the Waterloo, Canada-based firm is offering a price of 532 pence in cash per share for the Newbury, United Kingdom-based firm. At the offered price, the deal values about US$ 6 billion on a fully-diluted basis.

The offered price reflects a 98.7 per cent premium over MFGP's closing price on August 26, while giving a market cap of US$ 2 billion to Micro Focus.

Meanwhile, Micro Focus said that the deal terms are "fair and reasonable". The British firm would ask its shareholders to vote for the proposed acquisition offer, the company release showed.

Notably, as per the latest financial results, Micro Focus had a debt of about US$ 4.4 billion. The acquisition is anticipated to be closed in the starting quarter of the next year.

Source: ©Kalkine Media®; © Canva via Canva.com

Source: ©Kalkine Media®; © Canva via Canva.com

Bottom line:

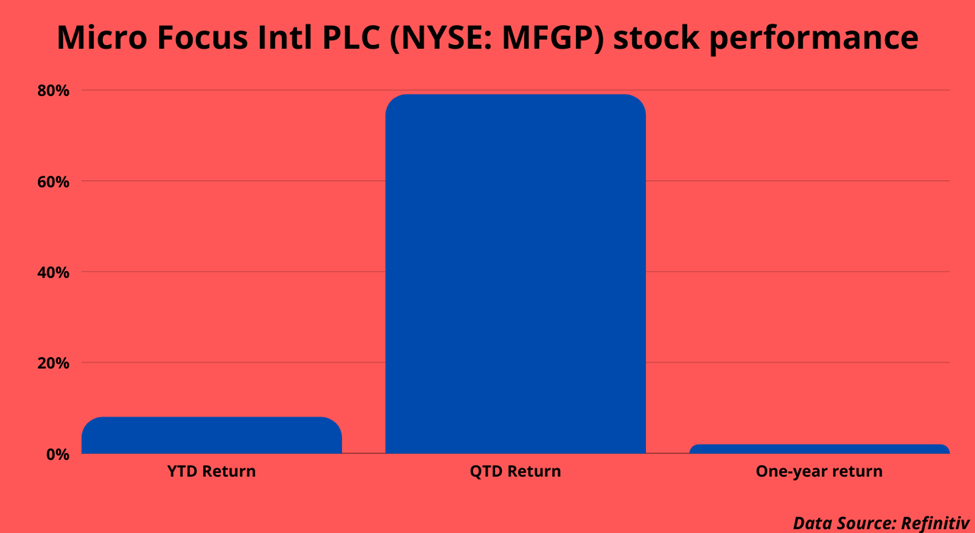

The MFGP stock traded at US$ 6.065 at 11:16 am ET on August 26, up 93.77 per cent from its previous closing price of US$ 3.13. The US$ 2.05 billion market cap firm had a dividend yield of 3.87 per cent. Micro Focus's trading volume was about 4.86 million at the time of writing.

However, the OTEX stock fell 12.75 per cent at 11:18 am ET on Friday morning, to trade at US$ 32.5175. Open Text had a dividend yield of 2.37 per cent and its market cap was US$ 8.69 billion.