Highlights:

- Salesforce, Inc. (NYSE:CRM) noted a 22 per cent YoY growth in its Q2 FY23 revenue.

- Snowflake said on November 1, that its Q3 FY23 earnings results will be released on November 30.

- Revenue of Zscaler, Inc. (NASDAQ:ZS) rose 62 per cent YoY in fiscal 2022.

The ongoing year was not so smooth for the overall market, especially for technology stocks. The hovering concerns over the financial market have wiped off the robust gains from the companies that they attained last year.

Meanwhile, some cloud stocks, including Salesforce, Inc. (NYSE: CRM), Datadog, Inc. (NASDAQ:DDOG), Snowflake Inc. (NYSE:SNOW), Zscaler, Inc. (NASDAQ:ZS), and CrowdStrike Holdings, Inc. (NASDAQ:CRWD), might gain attention, as global digitalization is in progress.

The recent earnings from most of the tech giants also indicated that their performance was impacted by the still-elevated inflation, strong dollar, and higher interest rates. The central bank's aggressive measures to bring down the decades of high inflation have forced investors to keep a distance from risk-bet assets.

However, while many were anticipating that the economy was heading towards a recession after the nation's GDP contracted for two consecutive quarters, the recent data by the Commerce Department came as a surprise. The data from last week showed that the economy had bounced back to the positive side in the third quarter, advancing 2.6 per cent.

While the Federal Reserve was raising its policy rates to rein the demand and cool down the economy, the recent GDP data suggested that the economy was resilient. The policymakers said earlier that they would keep raising the rates even if it tips the economy into a recession.

So, let's look at these cloud stocks and their recent performance amid a volatile condition in the market.

Salesforce, Inc. (NYSE:CRM)

Salesforce is a leading cloud-based technology company with a market cap of US$ 161.68 billion. The company primarily focuses on offering customer relationship management or CRM solutions to its customers.

The CRM software and application provider's stock fell over 36 per cent YTD and around 45 per cent YoY. However, in the current quarter, it soared over 13 per cent through November 1.

Salesforce's revenue soared 22 per cent YoY on a reported basis, and 26 per cent on constant currency to US$ 7.72 billion in Q2 FY23, and its diluted EPS declined to US$ 0.07 apiece from US$ 0.56 per share in the year-ago quarter.

During its Q2 FY23 earnings release, the company said it expects its Q3 revenue to be around US$ 7.83 billion and fiscal 2023 revenue to be between US$ 30.9 billion to US$ 31 billion.

Datadog, Inc. (NASDAQ:DDOG)

The software firm Datadog provides cloud-scale applications and holds a market cap of US$ 25.48 billion. The company specializes in monitoring-related services of servers, databases, etc., through its SaaS data analytics platform.

The SaaS-based data analytics provider's stock price fell over 54 per cent YTD and 51 per cent YoY. In the running quarter also, it went down over nine per cent through November 1.

The DDOG stock touched its 52-week low of US$ 75.535 just after the day the CRM stock fell to its 52-week low. The company will report its Q3 FY22 financial results before the market opens on Thursday, November 3.

Meanwhile, in Q2 FY22, Datadog's revenue rose 74 per cent YoY to US$ 406 million, and its GAAP net loss per qqdiluted share improved to US$ 0.02 apiece from US$ 0.03 per share in the year-ago quarter.

Snowflake Inc. (NYSE:SNOW)

Snowflake is another leading cloud computing firm with a market cap of US$ 51.36 billion. The cloud-based data storage and analytics firm's stock tumbled around 52 per cent YTD.

The company said on November 1, that its Q3 FY23 earnings results will be released on November 30. Meanwhile, in Q2 FY23, Snowflake's revenue surged 83 per cent year-over-year to US$ 497.2 million, and its net loss per share was US$ 0.7, compared to US$ 0.64 per share in the year-ago quarter.

Source: ©Kalkine Media®; © Canva via Canva.com

Source: ©Kalkine Media®; © Canva via Canva.com

Zscaler, Inc. (NASDAQ:ZS)

The cloud security and technology firm, Zscaler Inc holds a market cap of US$ 21.56 billion. The company's stock, which offers cloud migration services, was down around 52 per cent YTD and about 51 per cent year-over-year. In the running quarter, it lost over six per cent through Tuesday, November 1.

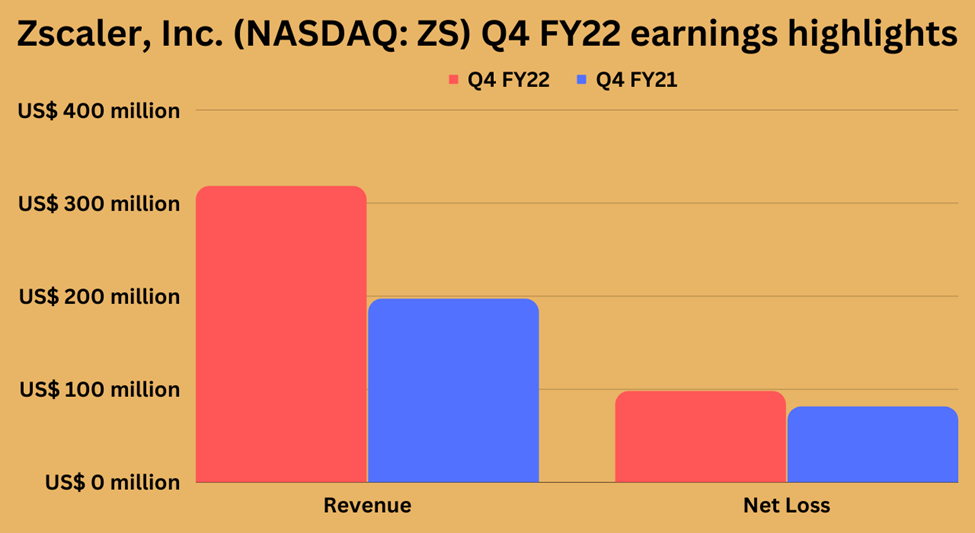

Zscaler Inc's final quarter revenue of fiscal 2022 rose 61 per cent YoY to US$ 318.1 million, while its GAAP net loss per share was US$ 0.69, against US$ 0.59 in the preceding year's same quarter.

The cloud security firm's annual revenue rose 62 per cent YoY to US$ 1.09 billion in the previous year.

CrowdStrike Holdings, Inc. (NASDAQ:CRWD)

CrowdStrike is a leading cybersecurity firm with a market cap of US$ 37.58 billion. The firm's stock that offers cloud workload and endpoint security services fell around 21 per cent YTD and 42 per cent YoY.

CrowdStrike Holding's revenue was up 58 per cent YoY to US$ 535.2 million in Q2 FY23, while its GAAP net loss per share was US$ 0.21 apiece, against US$ 0.25 per share in Q2 FY22.

Bottom line:

Some analysts are hopeful that the technology sector might regain momentum in the coming days, with global digitalization on track. Historically it is seen that the market always comes out strong after a downward trend, which also raised some investors' confidence.

But it is important to remember that the historical performance doesn't signify the future trading of the market. But some investors are still optimistic about the cloud computing sector while providing impressive growth predictions for the sector.

According to technological research and consulting firm Gartner, Inc., global spending on public cloud computing services is estimated to grow at a 20.4 per cent rate in the ongoing year to US$ 494.7 billion, from US$ 410.9 billion in the prior year.

For the next year, the firm projected the end-user spending to reach around US$ 600 billion. Meanwhile, the tech-savvy Nasdaq Composite Index fell over 29 per cent through the year while it added nearly four per cent in the running quarter.