Highlights

- Twitter, Inc. (NYSE:TWTR) expects its Q3 revenue for fiscal 2021 to be between US$1.22 Bn and US$1.30 Bn.

- Snap Inc. (NYSE:SNAP) expects its revenue to be between US$1.07 Bn and US$1.08 Bn in Q3, FY21.

- The revenue of Pinterest, Inc. (NYSE:PINS) soared 125% YoY in Q2, FY21.

As Facebook courts controversies, here are five stocks that may benefit from its brush with regulators. Besides a raging storm triggered by a whistleblower's revelation to US lawmakers, Facebook had to bore the brunt of a global outage on Monday, costing billions of dollars to the company, said observers. Facebook, WhatsApp, and Instagram went offline for nearly six hours.

Some 3.5 billion users could not access its social media platforms. Facebook Inc. (NASDAQ:FB) said that a "faulty configuration change" had caused the disruption. CTO Mike Schroepfer has apologized to Facebook users for the shutdown.

Here we explore five alternative social media stocks to Facebook.

Also Read: Duckhorn’s (NAPA) net sales jump 35% in Q4, stocks up 4%

Twitter, Inc. (NYSE:TWTR)

Twitter is a microblogging and social media company that enables users to tweet messages. It is based in San Francisco, California.

The stock traded at US$60.34 at 10:57 am ET on Oct 5, up 3.34 percent from its previous closing price. The stock rose by 7.08 percent YTD. It has a market cap of US$47.58 billion, a P/E ratio of 126.87, and a forward P/E one year of 166.83. Its EPS is US$0.47.

The 52-week highest and lowest stock prices were US$80.75 and US$38.93, respectively. Its trading volume was 17,381,330 on October 4.

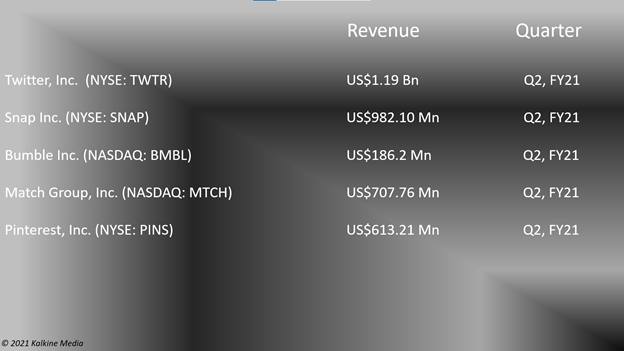

The revenue was US$1.19 billion in Q2, FY21, up 74 percent from the same quarter of the previous year. Its net income came in at US$65.64 million, or US$0.08 per diluted share, against a loss of US$1.37 billion, or a loss of US$1.75 per diluted share in Q2, FY20.

The company expects its Q3 revenue to be between US$1.22 billion and US$1.3 billion in FY21.

Also Read: Five education stocks to watch as campuses reopen

Also Read: Xenon (XENE), OpGen (OPGN) stocks soar on drug results, FDA approval

Snap Inc. (NYSE:SNAP)

Snap Inc. is a social media and camera company. It runs the popular camera application Snapchat that allows users to interact through short videos and images. It is headquartered in Santa Monica, California.

The stock was priced at US$73.44 at 11:05 am ET on Oct 5, up 3.10 percent from its previous closing price. The SNAP stock rose 43.64 percent YTD.

Also Read: Key dividend dates: Why are they important for investors?

Its market cap is US$114.96 billion, and the forward P/E one year is -178.08. Its EPS is US$-0.51.

The 52-week highest and lowest stock prices were US$83.34 and US$26.13, respectively. Its share volume on October 4 was 18,142,550.

The revenue increased by 116 percent YoY to US$982.10 million in Q2, FY21. It reported a net loss of US$151.66 million, compared to a loss of US$325.95 million in Q2, FY20.

The company expects its Q3 revenue to be between US$1.07 billion and US$1.08 billion for fiscal 2021.

Also Read: US markets retreat as technology stocks dip

Bumble Inc. (NASDAQ:BMBL)

Bumble is an Austin, Texas-based online dating platform that provides a mobile dating application. Its users can connect through its platform according to their preferences. It has mainly two applications: Bumble and Badoo.

The stock traded at US$49.85 at 11:13 am ET on Oct 5, up 3.27 percent from its closing price of October 4. The stock declined 31.35 percent YTD.

It has a market cap of US$6.45 billion and a forward P/E one year of -201.13.

Also Read: Top stocks, quarterly earnings to watch this week

The 52-week highest and lowest stock prices were US$84.80 and US$38.91, respectively. Its trading volume was 1,492,857 on October 4.

The company reported revenue of US$186.2 million in Q2, FY21, representing an increase of 38 percent YoY. Its net loss was US$11.14 million against a loss of US$5.46 million in Q2, FY20.

The company expects its Q3 revenue to be between US$195 million and US$198 million for fiscal 2021. It expects FY 2021 revenue to be between US$752 million and US$762 million.

Also Read: Seven stocks to go ex-dividend this week: Check the details here

Match Group, Inc. (NASDAQ:MTCH)

Match Group is a Dallas, Texas-based technology company that offers dating services globally through applications like Tinder, Match, Meetic, Pairs, etc.

The stock was priced at US$153.71 at 11:21 am ET on Oct 5, up 0.69 percent from its previous closing price. The MTCH stock ticked up 1.82 percent YTD.

Its market cap is US$42.73 billion, the P/E ratio is 78.36, and the forward P/E one year is 73.39. Its EPS is US$1.97.

Also Read: Top IPOs to watch this week as markets ring in the fourth quarter

The 52-week highest and lowest stock prices were US$174.68 and US$107.05, respectively. Its share volume on October 4 was 2,997,763.

On Oct 4, the company said that it repurchased around US$414 million principal amount of 0.875 percent exchangeable senior notes due 2022 for around US$1.5 billion.

The revenue was US$707.76 million in Q2, FY21, compared to US$555.45 million in the second quarter of the previous year. It reported net earnings of US$140.52 million compared to US$106.78 million in Q2, FY20.

Also Read: Firms that are likely to raise dividends in October: Know more here

Source: Pixabay

Also Read: Otonomo (OTMO) & Amplify (AMPY): Two trending stocks on Monday

Pinterest, Inc. (NYSE:PINS)

Pinterest is a San Francisco, California-based visual discovery engine and social media company. It provides image-sharing services through its platform.

The stock traded at US$50.19 at 11:32 am ET on Oct 5, up 1.15 percent from its closing price of Oct 4. Its stock value tumbled 27.1 percent YTD. It has a market cap of US$32.45 billion, a P/E ratio of 239.73, and a forward P/E one year of 198.48. Its EPS is US$0.21.

The 52-week highest and lowest stock prices were US$89.90 and US$42.32, respectively. Its trading volume was 10,998,960 on October 4.

The company's revenue surged 125 percent YoY to US$613.21 million in Q2, FY21. It reported a net income of US$69.41 million against a loss of US$100.74 million in Q2, FY20.

Also Read: Top high yield dividend-paying stocks to explore in October

Bottomline

The social media stocks saw steady growth with their rising popularity over the past few years. Fast technological innovations and ease of access have accelerated their growth. Today, an overwhelming number of enterprises, in addition to individual customers, are their subscribers. The S&P 500 communication services sector jumped 20.34% YTD, indicating the sector’s sustained stride forward. However, investors should evaluate the stocks carefully before investing.