Highlights

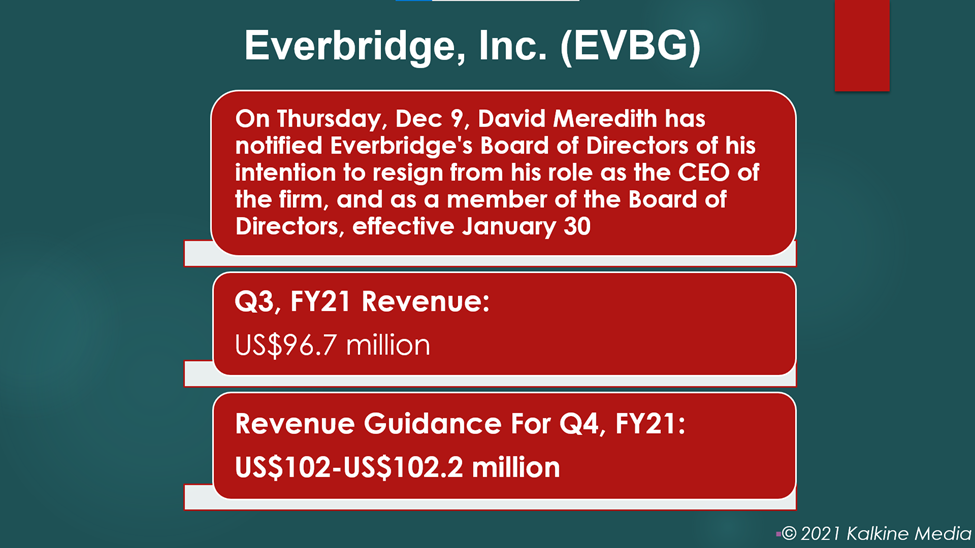

- Everbridge CEO David Meredith said he is resigning from the post.

- Patric Brickley and Vernon Irvin will partner as co-CEOs to manage the strategic and operational aspects of the business.

- For the fourth quarter of fiscal 2021, the firm expects revenue to be between US$102 million and US$102.2 million.

Shares of Everbridge, Inc. (NASDAQ:EVBG) plunged over 46% on Friday after its Chief Executive Officer David Meredith said he was resigning from his position.

On Thursday, Meredith notified the Everbridge Board of Directors of his plan to resign from his CEO role and as a board member, effective on Jan 30. The Everbridge Board has accepted Meredith's resignation.

Also Read: Veritaseum (VERI) token hits all-time high - Know Why?

For now, the company's Executive Vice President and Chief Financial Officer Patrick Brickley and Executive Vice President and Chief Revenue Officer Vernon Irvin will partner as co-CEOs to manage the strategic and operational aspects of the business. Meanwhile, the firm will look for a permanent CEO and consider both internal and external candidates for the role.

The Burlington, Massachusetts-based company offers enterprise software applications that automate and accelerate the operations of organizations. Its applications provide information on critical events to aid personal safety and business continuity.

Also Read: Measurable Data Token (MDT) climbs 326% in a year - worth considering?

Chairman Jaime Ellertson has expressed his confidence in Brickley and Irvin for leading the company as co-CEOs. “We are fortunate to have two incredibly respected and seasoned executives taking on this partnership. Both Patrick and Vernon are strong leaders with deep hands-on operating knowledge and a commitment to the continued success of Everbridge in the future,” Ellertson said.

According to the company, Meredith’s resignation does not relate to Everbridge's financial condition, results, internal and disclosure control, and procedures.

Also Read: Top cryptocurrencies that led conversations on Reddit in 2021

Also Read: Polygon buys Mir Coin (MIR) for US$400 million – All you need to know

Stock performance and financial highlights of Everbridge, Inc. (NASDAQ:EVBG):

The EVBG stocks traded at US$62.00 at 11:54 am ET on Dec 10, down 46.26% from their previous close. The firm has a market cap of US$2.40 billion, with a forward P/E one year of -76.91. Its EPS is US$-2.94. The company's stock saw the highest price of US$178.98 and the lowest price of US$103.28 in the last 52 weeks. Its trading volume on Dec 9 was 401,310.

The total revenue of the firm surged 36% YoY to US$96.7 million in Q3, FY21. On a GAAP basis, it reported a net loss of US$28.7 million against a loss of US$24.2 million in Q3, FY20.

For the fourth quarter of fiscal 2021, the firm expects its revenue to be between US$102 million and US$102.2 million. It expects its full fiscal revenue to be between US$367.6 million and US$367.8 million.

Also Read: Novi wallet starts crypto payment service on WhatsApp - How it works?

Bottomline

The technology companies saw significant gains in 2021, driven by pandemic-fuelled demand. The S&P 500 information technology sector rose 31.22% YTD while increasing 14.59% QTD. By contrast, the EVBG stock value tumbled 21.78% YTD.