Highlights:

- Albemarle Corporation (NYSE:ALB) expects its net sales to be between US$5.8 billion and US$6.2 billion in fiscal 2022.

- Livent Corporation (NYSE:LTHM) revenue soared 56% YoY in Q1, FY22.

- The SQM stock returned gains of over 99% YTD.

Lithium stocks are companies that produce lithium used in power-dense batteries for laptops, mobile phones, and other electronic devices. It is also used in batteries for electric vehicles (EVs).

The high demand for these products has bumped up lithium prices. Lithium prices have more than doubled since 2015. Its demand is expected to rise with the growing market for electric vehicles. The following are five lithium stocks worth exploring in the coming days.

Also Read: Is Chainlink (LINK) crypto rising because of its updated roadmap?

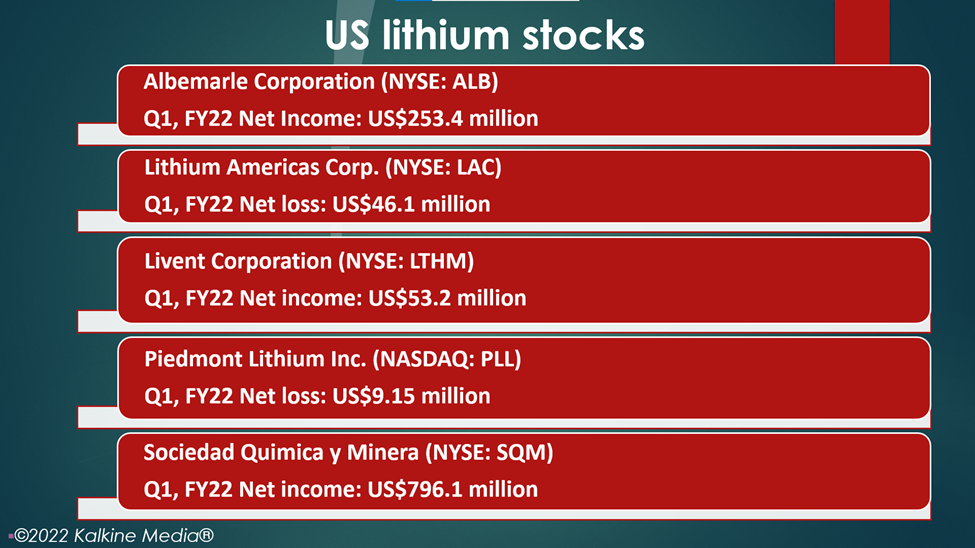

Albemarle Corporation (NYSE:ALB)

Albemarle is a specialty chemical manufacturing firm operating through three segments: lithium, bromine, and catalysts. The company is based in Charlotte, North Carolina.

Its shares traded at US$251.34 at 2:28 pm ET on June 8, down 2.54%, from their previous closing price. The stock rose nearly 9% YTD (as of June 7).

Its market cap is US$29.64 billion, the P/E ratio of 106.34, and the forward one-year P/E ratio is 19.25. Albemarle’s EPS is US$2.38. The 52-week highest and lowest stock prices were US$291.48 and US$157.82, respectively. Its trading volume was 986,091 on June 7.

The company's net sales rose 36% YoY to US$1.13 billion in Q1, FY22. Its net income was US$253.4 million, or US$2.15 per diluted share, against a net income of US$95.7 million, or US$0.84 per diluted share, in Q1, FY21.

The company expects fiscal 2022 net sales to be between US$5.8 billion and US$6.2 billion, up from its previous guidance range of US$5.2 billion to US$5.6 billion.

Also Read: Is LTO Network (LTO) crypto rising after Binance US listing?

Source: ©2022 Kalkine Media®

Source: ©2022 Kalkine Media®

Lithium Americas Corp. (NYSE:LAC)

Lithium Americas is a mining firm focused on mining lithium-bearing spodumene and pegmatite ores. It is based in Vancouver, Canada.

The stock traded at US$24.25 at 2:34 pm ET on June 8, down 4.60% from its previous close. The LAC stock fell around 17% YTD (as of June 7).

The market cap of the company is US$3.28 billion, and the forward one-year P/E ratio is 2542.00. Its EPS is US$-0.58. The stock touched its highest price of US$41.56 and the lowest price of US$12.56 in the last 52 weeks. Its share volume on June 7 was 1,821,952.

The company's total expenses were US$16 million in Q1, FY22, compared to US$8.8 million in the year-ago quarter. Its net loss came in at US$46.1 million, or US$0.35 per share, against a loss of US$10 million, or US$0.09 per share, in Q1, FY21.

Also Read: What is Bluzelle (BLZ) crypto and why did it rise 40%?

Livent Corporation (NYSE:LTHM)

Livent is a chemical manufacturing and lithium firm specializing in producing lithium and specialty polymers, etc. The company is based in Philadelphia, Pennsylvania.

Its shares traded at US$29.18 at 2:44 pm ET on June 8, down 2.99%, from their closing price of June 7. Its stock value jumped around 17% YTD (as of June 7).

The firm has a market cap of US$4.69 billion, a P/E ratio of 107.41, and a forward one-year P/E ratio of 24.46. Its EPS is US$0.27. The 52-week highest and lowest stock prices were US$34.61 and US$16.75, respectively. Its trading volume was 3,274,603 on June 7.

The company's revenue increased by 56% YoY to US$143.5 million in Q1, FY22. Its net income came in at US$53.2 million, or US$0.28 per diluted share, against a loss of US$0.8 million, or US$0.01 per diluted share, in Q1, FY21.

Also Read: Why is WOO Network (WOO) crypto generating interest?

Piedmont Lithium Inc. (NASDAQ:PLL)

Piedmont Lithium is a mineral exploration firm specializing in lithium exploration projects. It is based in North Carolina.

The stock traded at US$56.75 at 2:49 pm ET on June 8, down by 4.04% from its previous close. The PLL stock rose about 9% YTD (as of June 7).

Its market cap is US$1.02 billion, and the forward one-year P/E ratio is -38.40. The stock’s highest price was US$79.99, and the lowest price was US$40.65 in the last 52 weeks. Its share volume on June 7 was 392,644.

The loss from operations was US$5.74 million in Q1, FY22, compared to US$6.51 million in the same quarter of the previous year. Its net loss came in at US$9.15 million, or US$0.57 per share, compared to a loss of US$6.57 million, or US$0.47 per diluted share, in Q1, FY21.

Also Read: Why Heartcore Enterprises (HTCR) stock surged over 170%?

Sociedad Quimica y Minera (NYSE:SQM)

Sociedad Quimica y Minera is a chemical company specializing in products like plant nutrients, iodine, lithium, etc. The company is based in Santiago, Chile.

The shares of the company traded at US$98.00 at pm ET on June 8, down 3.34% from their closing price of June 7. Its stock value increased by 99.86% YTD (as of June 7).

The firm has a market cap of US$28.00 billion, a P/E ratio of 21.32, and a forward one-year P/E ratio of 12.72. Its EPS is US$4.60. The 52-week highest and lowest stock prices were US$115.76 and US$42.42, respectively. Its trading volume was 1,717,030 on June 7.

The company reported revenue of US$2.01 billion for the three months ended March 31, 2021, compared to US$528.5 million in the year-ago quarter.

Its net earnings came in at US$796.1 million, or US$2.79 per share, against an income of US$68 million, or US$0.26 per share, in the same period of the previous year.

Also Read: RIO to NEM: Should you consider these 5 gold stocks amid inflation?

Bottom line:

Experts anticipate robust growth for the lithium industry with the growing demand for the metal from various sectors. Metal prices have soared in recent months due to supply disruptions. The S&P 500 index fell 12.70% YTD and 1.56% over the last 12 months. Hence, investors should exercise due diligence before spending in the stock market, which is currently highly volatile.