Highlights:

- The NLSN stock grew about 35 per cent YTD.

- W. Grainger, Inc. (NYSE:GWW) revenue soared nearly 20 per cent YoY in Q2 FY22.

- H. Robinson Worldwide, Inc. (NASDAQ:CHRW) net income jumped about 80 per cent YoY in Q2 FY22.

Nielsen N.V. (NYSE:NLSN), Northrop Grumman Corporation (NYSE: NOC), Quanta Services, Inc. (NYSE:PWR), W.W. Grainger, Inc. (NYSE:GWW), and C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW), are among the major players in the industrials sector.

The companies have attracted the eyes of the market participants as they managed to maintain a steady momentum amid choppy trading so far in the broader market.

The market had witnessed a rocky journey before a summer rally at the start of the third quarter. However, the rally didn't persist for long, as the renewed fears over rate hikes, inflation, and a potential economic recession had weighed on sentiments.

Investors are growing more concerned about the economic health and the aggressive monetary plans by the US Federal Reserve.

The recent job data by the Labor Department showed that although the wage growth was moderate, it had hired more workers in the prior month. The unemployment rate increased to 3.7 per cent.

The loosening of the labor market also renewed the investors' concerns, giving another reason for the central bank to keep raising the interest rates to battle inflation. Additionally, recent hawkish comments from the regulators also weighed on sentiments.

Let's look at the stock performance of some of the top industrial companies and see how they have recently performed.

Nielsen N.V. (NYSE:NLSN)

Nielsen Holdings is an information, data, and market measurement firm with operations in several countries. The firm's stock closed at US$ 27.85 on September 2, down by 0.14 per cent from its previous close.

The US$ 10.02 billion market cap firm had a price-to-earnings ratio (P/E) of 18.95, and its current yield is 0.86 per cent. The NLSN stock grew nearly 32 per cent year-to-date (YTD), and in the running quarter, Nielsen's stock showed gains of about 20 per cent.

The New York-based company noted a 2.4 per cent annual growth on a reported basis in its quarterly revenue of US$ 882 million in the latest quarter. The net income attributable to Nielsen shareholders was US$ 111 million in Q2 FY22, relatively up from an income of US$ 76 million in the year-ago quarter.

Meanwhile, on July 14, the information and data provider board announced a quarterly dividend of US$ 0.06 apiece, payable on September 2, 2022.

Northrop Grumman Corporation (NYSE:NOC)

Northrop Grumman is a leading aerospace and defense technology firm that has maintained a steady momentum this year. The firm had a dividend yield of 1.45 per cent, and its annualized dividend is US$ 6.92.

The NOC stock returned gains of over 23 per cent in the ongoing year while soaring about 30 per cent year-over-year (YoY).

The US$ 74.13 billion market cap firm declared a quarterly dividend of US$ 1.73 per share of its common stock on August 17 while providing the payable date of September 14, 2022.

The total sales of Northrop Grumman decreased by four per cent YoY to US$ 8.80 billion in Q2 FY22, from sales of US$ 9.15 billion in the same quarter of the previous year. The net earnings of the Falls Church, Virginia-based firm was US$ 946 million in the fiscal 2022 second quarter, down by nine per cent from US$ 1.03 billion in Q2 FY21.

Source: ©Kalkine Media®; © Canva via Canva.com

Source: ©Kalkine Media®; © Canva via Canva.com

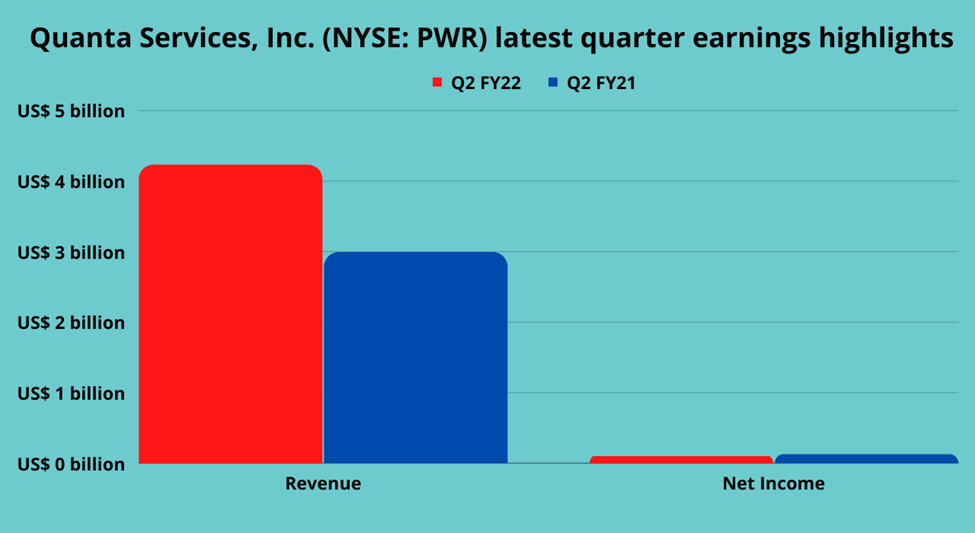

Quanta Services, Inc. (NYSE:PWR)

The PWR stock closed at US$ 140.60 on September 2, noting an increase of 1.08 per cent from its previous close. It had a dividend yield of 0.2 per cent, and its P/E ratio was 45.65.

The US$ 20.20 billion market cap firm primarily focuses on providing infrastructure services for electric power, pipeline, and other related aspects. The stock of Quanta Services touched a 52-week high of US$ 149.33 on August 25, 2022.

The PWR stock added over 22 per cent YTD while showing gains of about 12 per cent quarter-to-date (QTD). On August 31, the firm's board declared a quarterly cash dividend of US$ 0.07 per share, which would be payable to the investors on October 14, 2022.

Regarding its financials, it noted significant growth in its latest quarter revenue. The firm's revenue was US$ 4.23 billion in Q2 FY22, up from US$ 3 billion in the year-ago quarter. However, the net income of the Houston, Texas-based firm was US$ 88 million in Q2 FY22, down from US$ 117 million in the year-ago period.

Quanta expects its revenue to be between US$ 16.6 billion and US$ 17 billion in fiscal 20222. For its net income, it provided a guidance range of US$ 491 million and US$ 541 million.

W.W. Grainger, Inc. (NYSE:GWW)

The GWW stock touched a 52-week high of US$ 588.62 on August 16, 2022. It gained about seven per cent YTD while adding more than 22 per cent QTD and about 29 per cent YoY. It closed at US$ 555.31 on September 2.

The US$ 28.37 billion market cap firm had a dividend yield of 1.24 per cent. Meanwhile, the net sales of the industrial supplies and equipment provider rose 19.6 per cent YoY to US$ 3.8 billion in Q2 FY22. Its attributable net earnings were US$ 371 million in Q2 FY22, noting a surge of 65 per cent YoY from US$ 225 million in Q2 FY21.

C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW)

The CHRW grew more than seven per cent YTD while adding about 13 per cent QTD and around 27 per cent YoY. At its closing price of September 2, it traded about five per cent below its 52-week high of US$ 121.23 noted on August 25, 2022.

The dividend yield of the transportation and logistics firm was 1.91 per cent. The US$ 14.68 billion market cap firm had a P/E ratio of 13.88.

Taking about its latest quarter earnings, C.H. Robinson noted a 22.9 per cent jump in its second quarter fiscal 2022 revenue of US$ 6.79 billion. The net income of the Eden Prairie, Minnesota-based firm rose 79.7 per cent to US$ 348.18 million in Q2 FY22, up from an income of US$ 193.78 million in Q2 FY21.

Bottom line:

Investors generally watch industrial stocks closely, as the industrial sector is considered cyclical. In other words, the performance of the industrials sector moves in tandem with the economy's health.

The sector that manufactures and distributes capital goods, and provides other related commercial and professional services, is also known as the backbone of the economy. Hence, the sector might witness a bumpy road during a recession period.

The S&P 500 industrial sector decreased by more than 12 per cent in the last 12 months while falling about 13 per cent in 2022. However, in the running quarter, it showed over five per cent gains through September 2.