Highlights:

- Deere & Company (NYSE:DE) posted a net income of US$2.098 billion for the second quarter of fiscal 2022.

- Deere’s attributable net income for the first half of 2022 was US$3.001 billion, or US$9.72 per share.

- Deere raised its profit forecast for 2022 despite missing revenue estimates in Q2.

Deere & Company (NYSE:DE) on Friday posted a second-quarter net income of US$2.098 billion or US$6.81 per share for the period ended May 1, 2022, helped by increased sales.

Its net income for the same quarter in 2021 was US$1.790 billion, or US$5.68 per share.

The Moline, Illinois-based company’s attributable net income for the first half of 2022 was US$3.001 billion, or US$9.72 per share, versus US$3.013 billion, or US$9.55 per share, for the same period last year.

John C. May, chairman and CEO of Deere & Company, said: "Deere's second-quarter performance reflected a continuation of strong demand even as we face supply-chain pressures affecting production levels and delivery schedules."

The company’s net sales and revenues soared 11% to $13.370 billion for Q2 of fiscal 2022. They rose 8% to US$22.939 billion in six months.

It posted net sales of US$12.034 billion for the quarter and US$20.565 billion for six months. It was US$10.998 billion and US$19.049 billion last year.

Also Read: US home sales drop for 3rd straight month, mortgage rates rise sharply

© Fiskness | Megapixl.com

© Fiskness | Megapixl.com

Also Read: 5 penny stocks to watch in June: PVL, SNRG, GOFF. CHKR & FDOC

Deere raises 2022 profit forecast

Deere & Co raised its profit forecast for 2022 on Friday, propelled by higher global crop prices, a direct effect of the Russian invasion of Ukraine. The company raised the estimates even though its quarterly revenues failed to keep up with market estimates.

DE raised its fiscal 2022 net income forecast from US$7.0 billion to US$7.4 billion. Its previous estimate was US$6.7 billion to US$7.1 billion.

However, the company’s financial services net income declined for the reported quarter, primarily due to higher reserves for credit losses - fallout from the Russia-Ukraine war.

Bottom line:

Deere’s net sales for its production and precision agricultural solutions got a huge boost in the reported quarter. It was up 13% from the previous year.

DE has a market cap of US$97.86 billion. It has a P/E ratio 0f 17.68, and a forward one-year P/E ratio of 16.07. Its EPS is US$18.04.

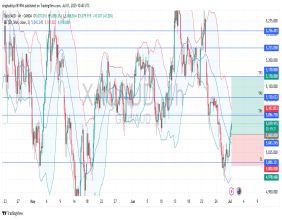

The 52-week highest and lowest stock prices were US$$446.76 and US$320.50, respectively. Its trading volume was 2,253,562 on May 19.