Highlights

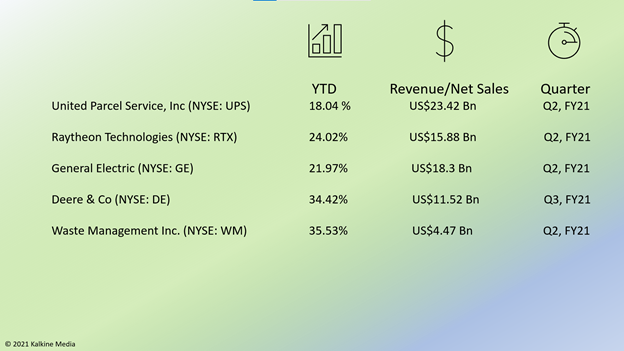

- The net income of United Parcel Service, Inc (NYSE:UPS) was US$2.67 billion in Q2, FY21.

- The stock of Raytheon Technologies (NYSE:RTX) grew by 24.02% YTD.

- General Electric’s (NYSE:GE) stock value increased by 21.97% YTD.

The industrial sector comprises companies that produce capital goods like machinery, instruments, etc., used in manufacturing, construction, and other related fields.

Industrial sector companies include those involved in aerospace, construction, waste management, and tools, etc. The sector depends on the economic health of the country.

Here we explore the top five industrial stocks that may benefit from the economic recovery.

Also Read: Dutch Bros & On Holding IPOs: Check price, lot size, other details

United Parcel Service, Inc (NYSE:UPS)

UPS is a shipping company based in Atlanta, Georgia. It provides supply management services.

The stock traded at US$191.879 at 11:27 am ET on Sep 16, down 0.76 percent from its previous closing price. The stock gained 18.04 percent YTD. It has a market cap of US$167.16 billion, a P/E ratio of 27.38, and a forward P/E one year of 17.33. Its EPS is US$7.01.

Also Read: Eleven upcoming IPOs to keep an eye on in September

UPS’ 52-week highest and lowest stock prices were US$219.59 and US$154.76, respectively. Its trading volume was 1,769,306 on September 15.

The consolidated revenue was US$23.42 billion in Q2, FY21, an increase of 14.5 percent from the year-ago quarter. The net income rose from US$11 million in Q2, FY20, to US$2.67 billion in Q2, FY21.

Also Read: Greenidge (GREE), Indaptus (INDP) among most searched stocks Wednesday

Raytheon Technologies (NYSE:RTX)

It is an aerospace and defense company that manufactures aircraft engines, avionics, etc. It is based in Waltham, Massachusetts.

The stock was priced at US$84.83 at 11:34 am ET on Sep 16, down 0.05 percent from its previous close. The RTX stock rose 24.02 percent YTD.

Also Read: US stocks gallop ahead after deals, product launches lift sentiments

Raytheon’s market cap is US$127.80 billion, the P/E ratio is 58.86, and the forward P/E one year is 21.01. And the EPS is US$1.44.

The 52-week highest and lowest stock prices were US$89.98 and US$51.92, respectively. Its share volume on September 15 was 5,673,696.

The company's net sales were US$15.88 billion in Q2, FY21, compared to US$14.06 billion in the year-ago quarter. Its net income attributable to common stockholders was US$1.03 billion, or US$0.68 per share, against a loss of US$3.83 billion, or US$2.55 apiece.

Also Read: Top betting stocks to watch amid NFL craze, Macau casino review

General Electric (NYSE:GE)

GE is a multinational company based in Boston, Massachusetts. It has interests in industrial and power generation services.

The stock traded at US$101.31 at 11:47 am ET on Sep 16, down 0.83 percent from its previous closing price. The stock rose by 21.97 percent YTD.

Also Read: Five company deals that grabbed the headlines this week

GE has a market cap of US$111.18 billion and a forward P/E one year of 51.34. Its EPS is US$-2.72. The 52-week highest and lowest stock prices were US$115.32 and US$48.00, respectively. Its trading volume was 8,103,742 on September 15.

GE’s revenue surged 9 percent YoY to US$18.3 billion in Q2, FY21. The adjusted EPS came in at US$0.05 against an adjusted loss of US$0.14 in Q2, FY20.

Also Read: Why are Microsoft (MSFT), EV maker Rivian grabbing attention today?

Deere & Co (NYSE:DE)

Deere & Co is a Moline, Illinois-based company that manufactures a range of machinery, engines, etc.

The stock was priced at US$355.155 at 11:58 am ET on September 16, down 1.28 percent from its previous closing price. The DE stock grew 34.42 percent YTD.

Also Read: Oracle (ORCL) stock dips, FuelCell (FCEL) rallies as earnings shine

Its market cap is US$110.24 billion, the P/E ratio is 20.6, and the forward P/E one year is 19.04. Its EPS is US$17.26. The 52-week highest and lowest stock prices were US$400.34 and US$210.18, respectively. Its share volume on September 15 was 1,403,611.

Deere & Co’s net sales and revenue were US$11.527 billion in Q3, FY21, representing an increase of 29 percent from the year-ago quarter.

Its net income came in at US$1.667 billion, or US$5.32 per share, compared to a net income of US$811 million, or US$2.57 per share in Q3, FY20.

Source: Pixabay

Also Read: Seanergy (SHIP) & Castor (CTRM): Two trending maritime stocks

Waste Management Inc. (NYSE:WM)

It is a waste management firm that provides garbage disposal, recycling, and other related services. It is headquartered in Houston, Texas.

The shares of the company traded at US$154.1711 at 12:03 pm ET on September 16, down 0.94 percent from its closing price. Its stock value jumped 35.53 percent YTD. It has a market cap of US$64.97 billion, a P/E ratio of 40.93, and a forward P/E one year of 31.63. Its EPS is US$3.77.

Also Read: Five online education stocks to watch as Delta cloud hangs thick

The 52-week highest and lowest stock prices were US$156.74 and US$106.11, respectively. Its trading volume was 1,054,514 on September 15.

The company's revenue rose from US$3.56 billion in Q2, FY20, to US$4.47 billion in Q2, FY21.

The adjusted net income came in at US$538 million, or US$1.27 per diluted share, compared to the adjusted income of US$372 million, or US$0.88 per diluted share in Q2, FY20.

Also Read: Bets abound as NFL season kickstarts, Arizona among top betting states

Bottomline

US factory output rose by 0.4 percent in August after rising by 0.8 percent in July, according to the Federal Reserve, indicating a recovery in the manufacturing sector. Hurricane Ida and persistent supply woes may have affected the output. However, analysts expect the manufacturing segment to maintain steady growth. The S&P 500 industrial sector grew by 14.85 percent YTD, according to Refinitiv data, suggesting a continued improvement.