Highlights:

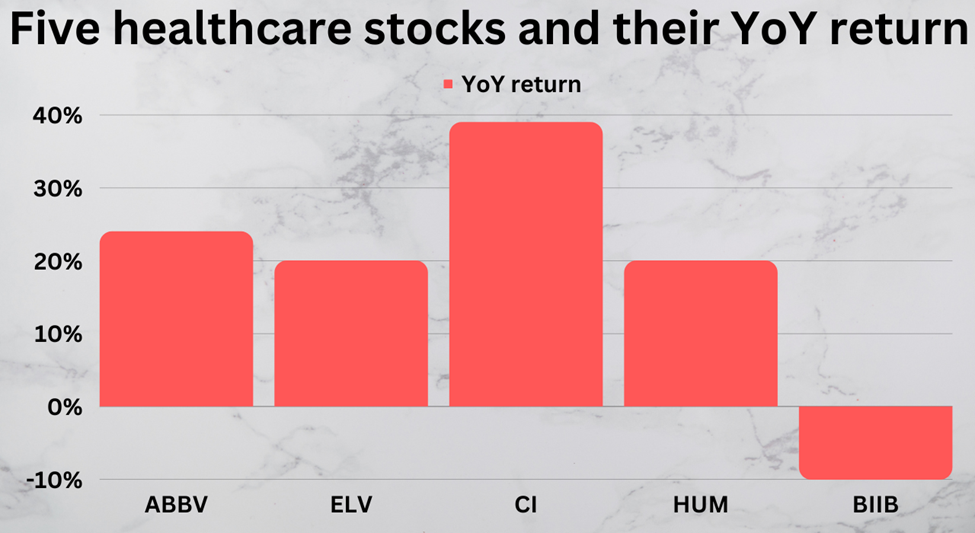

- AbbVie Inc. (NYSE:ABBV) stock jumped 24 per cent YoY.

- Elevance Health, Inc. (NYSE:ELV) is slated to report its Q3 FY22 earnings results on October 19, at 6 am EDT.

- Biogen Inc. (NASDAQ:BIIB) reported a revenue of US$ 2.58 billion in the quarter that ended on June 30, 2022.

Several companies belonging to different sectors managed to stay in the green this year. Some of the healthcare companies like AbbVie Inc. (NYSE: ABBV), Elevance Health, Inc. (NYSE:ELV), Cigna Corporation (NYSE: CI), Humana Inc. (NYSE:HUM), and Biogen Inc. (NASDAQ:BIIB), are among them.

With concerns hovering over higher interest rates, soaring costs, and geopolitical turmoil, many experts are raising their bets over a probable recession in the coming months or early next year. With these worries affecting the sentiment of the market, the investors seem to be struggling for direction guidance.

Meanwhile, the volatility in the market is visible in the performance of the indices in recent days. The tightened monetary policies by the Federal Reserve and the tensions between Russia and Ukraine heading nowhere have wiped off the robust gains the market witnessed last year.

On Monday, October 10, the Nasdaq Composite Index fell to its lowest level, as the investors treaded cautiously with several uncertainties dampening their confidence. The recent economic data also didn't come as traders anticipated. Rather it showed that there is still room for the central bank to increase its policy rates.

The economy, although slowing, has shown resilience against the higher rates so far, prompting the Federal Reserve to continue with its aggressive monetary plans. So, several experts as well as investors think that further aggressive moves by the policymakers could tip the economy into a recession.

Amid this, let's discuss healthcare stocks and their key details while there is turbulence in the market:

AbbVie Inc. (NYSE:ABBV)

AbbVie is a major biopharmaceutical company with a dividend yield of 4.06 per cent. The US$ 243.99 billion market cap company uses advanced science through its expertise in the pharmaceutical field to develop medicines and therapies. Its P/E was 19.59.

The stock price of the biopharmaceutical firm rose over two per cent YTD through October 10, soaring over 24 per cent in one year. In the last nine months, ABBV stock surged around one per cent.

The North Chicago, Illinois-based healthcare company said that it would announce its Q3 FY22 earnings results on Friday, October 28, before the opening of the market.

Meanwhile, in Q2 FY22, AbbVie's worldwide revenue totaled US$ 14.58 billion, noting a jump of 4.5 per cent YoY on a GAAP basis. The biopharmaceutical company's net income totaled US$ 924 million in Q2 FY22, compared to US$ 766 million in Q2 FY21.

Elevance Health, Inc. (NYSE:ELV)

Elevance Health is an insurance provider in the healthcare sector which has a dividend yield of 1.1 per cent. The company, with a P/E ratio of 18.84, engages in several services like pharmaceutical, dental, mental health, and other related areas.

The stock price of the US$ 112.63 billion market cap firm traded flat in 2022 while gaining nearly 21 per cent in one year. In the last nine months through October 11, the ELV stock surged about six per cent.

The Indianapolis, Indiana-based healthcare insurance provider said that it would report its Q3 FY22 earnings results on October 19, at 6 am EDT.

Meanwhile, Elevance Health's operating revenue shot up 15.6 per cent YoY to US$ 38.5 billion in Q2 FY22. On the other hand, its total revenue grew 14.1 per cent YoY to US$ 38.63 billion in the reported quarter.

However, the healthcare insurance firm’s net income fell 8.4 per cent YoY to US$ 1.65 billion in Q2 FY22.

Cigna Corporation (NYSE:CI)

Cigna Corporation is another managed healthcare and insurance company having a dividend yield of 1.55 per cent.

The stock price of the Connecticut-based company surged around 24 per cent YTD while adding nearly three per cent in the fourth quarter. In the last 12 months, the CI stock traded about 39 per cent higher.

Notably, the stock of the US$ 88.24 billion market cap insurance provider touched its 52-week high of US$ 296.285 on September 12, 2022.

The company's shareholders' net income was US$ 1.6 billion in Q2 FY22 on revenue of US$ 45.5 billion. In the year-ago quarter, Cigna Corporation's net income available to shareholders was US$ 1.46 billion on revenue of US$ 43.13 billion.

Source: ©Kalkine Media®; © Canva Creative Studio via Canva.com

Source: ©Kalkine Media®; © Canva Creative Studio via Canva.com

Humana Inc. (NYSE:HUM)

Humana is a healthcare insurance company with a P/E ratio of 20.55. The trading price of the US$ 63.60 billion market cap company rose seven per cent in 2022 while adding over 20 per cent YoY.

In the fourth quarter through October 11, it soared around two per cent. The HUM stock touched its 52-week high of US$ 514.98 on September 20, 2022.

The Kentucky-based firm said that it would announce its Q3 FY22 earnings results on November 2, at 6:30 am ET.

Meanwhile, in Q2 FY22, Humana Inc.'s GAAP diluted EPS was US$ 5.48 apiece on revenue of US$ 23.66 billion, while in Q2 FY21, its diluted EPS was US$ 4.55 per share on revenue of US$ 20.64 billion.

Biogen Inc. (NASDAQ:BIIB)

Biogen is a biotech company that had a P/E ratio of 18.38. The US$ 37.44 billion market cap company primarily specializes in discovering and developing treatments related to neurological diseases.

The stock price of the leading biotechnology firm rose about six per cent YTD while decreasing around 10 per cent YoY. However, in the last nine months through October 11, its price mounted up around eight per cent.

For the quarterly period that ended on June 30, 2020, Biogen Inc.'s net income totaled US$ 1.05 billion on revenue of US$ 2.58 billion. Meanwhile, in the year-ago period, the Massachusetts-based biotechnology company's net income was US$ 448.5 million on revenue of US$ 2.77 billion.

Bottom line:

Although the healthcare sector was one of the worst-hit sectors in recent days with investors shifting their focus to safer assets, some are still hoping that the sector might regain its momentum in the coming days.

Given that a major part of the global population is prone to health conditions and almost everyone relies on healthcare services, investors can try keeping some healthcare stocks on their watchlist.

While the recession and other concerns have forced several investors to take shelter under the safe-bet investments, some are exploring opportunities for the low costs of some premium stocks.

Meanwhile, the S&P 500 healthcare sector tumbled about 13 per cent this year, while dropping around four per cent in the last 12 months. Considering the persisting volatility in the market, investors should exercise due diligence before putting their bets into any sector.