Highlights

- Bristol-Myers Squibb Company (NYSE:BMY) revenue surged 10% YoY to US$11.5 billion in Q3, FY21.

- BMY raised its low-end adjusted EPS guidance by US$0.05 for fiscal 2021.

- GlaxoSmithKline PLC (NYSE:GSK) sales surged 10% YoY in Q3, FY21.

Bristol-Myers Squibb Company (NYSE:BMY) and GlaxoSmithKline PLC (NYSE:GSK) reported strong revenue growth in the third quarter of fiscal 2021 on Wednesday.

The BMY stock was down 2.44% to US$56.82, while the GSK stock traded at US$40.01, down 0.42%, from their previous close at around 10:35 am ET.

Quarterly Snapshots.

Also Read: GM sees sharp fall in Q3 revenue, upbeat on full-year results

Bristol-Myers Squibb Company

Bristol-Myers is a pharmaceutical company based in New York. Its manufactures biopharmaceutical products.

The company reported better-than-expected results, helped by growth in its cancer segment, prompting it to raise its annual profit outlook.

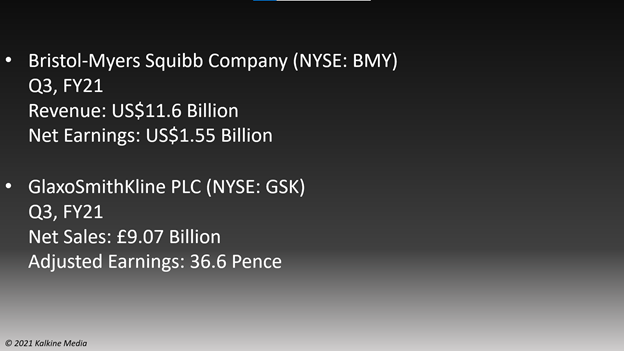

Its revenue surged 10% YoY to US$11.6 billion in the quarter. Its net earnings came in at US$1.55 billion compared to US$1.87 billion in the same quarter of the previous year.

Its adjusted profit was US$2.00 per share compared to US$1.63 per share in Q3, FY20. Analysts expected an adjusted profit of US$1.92 per share on revenue of US$11.58 billion, according to Refinitiv data.

Also Read: Visa (V) beats profit estimate; Robinhood (HOOD) monthly users jump 76%

The company raised its low-end guidance for adjusted profit by US$0.05 for fiscal 2021. It now expects its profit to be between US$7.40 and US$7.55 per share.

The New York-based company has a market cap of US$126.13 billion and a forward P/E one year of 7.79. Its EPS is US$-2.27. The 52-week highest and lowest stock prices were US$69.75 and US$56.66, respectively. Its trading volume was 9,984,561 on October 26.

Also Read: Alphabet Inc (GOOGL), Microsoft Corp see profits soar in Q3

Also Read: AMD’s Q3 profits soar, Twitter (TWTR) hits 211 mn daily active users

GlaxoSmithKline PLC (NYSE:GSK)

GlaxoSmithKline is a healthcare company based in Brentford, UK. It develops prescription medicines for acute and chronic diseases.

The company raised its earnings forecast for fiscal 2021 after strong quarterly results.

Its sales increased by 10% YoY to £9.07 billion in Q3, FY21. Its total operating profit was £1.93 billion, an increase of 15% YoY.

Its EPS was up 3% YoY to 23.3p (UK pence), while its adjusted earnings were 36.6p per share or an increase of 10% YoY. Analysts expected an adjusted EPS of 29.4p and total sales of £8.7 billion, according to Refinitiv data.

Also Read: Top stocks with digital asset exposure to keep an eye on

The drugmaker now expects its adjusted earnings to decrease between 2% and 4%, excluding Covid solutions on a YoY basis, from its previous forecast of mid-to-high single-digit drop.

Its market cap is US$100.76 billion, the P/E ratio is 16.9, and the forward P/E one year is 14.30. Its EPS is US$2.37. The stock saw the highest price of US$42.68 and the lowest price of US$33.26 in the last 52 weeks. Its share volume on October 26 was 4,960,784.

Also Read: Biden orders lifting covid travel restrictions, clamps new rules

Bottomline

The S&P 500 healthcare sector rose 16.62% YTD and 4.04% QTD. In contrast, the stock value of BMY plummeted 5.12%, while the GSK stock increased by 6.47% YTD. The healthcare sector considerable gains this year amid strong demand for medical products. However, investors should closely evaluate the stocks before considering an investment.