Highlights:

- The DMS stock increased by more than 73 per cent in the morning trading on September 9.

- The company said that it had received an acquisition offer for its outstanding Class A common stock.

- DMS's trading volume was more than 12.08 million on Friday.

The stocks of Digital Media Solutions, Inc. (NYSE:DMS) gained notable attention on Friday, September 9, as seen by the significant jump in its price. The stock price of the advertising solutions provider jumped more than 73 per cent in the morning trading.

Digital Media is a technology-focused digital media firm that provides advertising-related services to connect advertisers with consumers.

Now, what could be the reason for the significant growth in its stock price on Friday? Let's find out with Kalkine Media®.

Why is Digital Media Solutions, Inc. (DMS) stock soaring?

The NYSE-listed firm witnessed a notable surge after it announced receiving an acquisition offer for its stock on Friday. Digital Media said that Prism Data, LLC had proposed an offer to the firm's board of directors to acquire all the outstanding Class A common stock of the firm at US$ 2.5 per share in cash.

Prism Data, LLC is an investment vehicle that is affiliated with Digital Media's Chief Executive Officer Joseph Marinucci, and Chief Operating Officer, Fernando Borghese

Meanwhile, the Clearwater, Florida-based media firm said its board of directors would carefully review the offer before considering the proposal while focusing on its fiduciary duties and consultations with its advisors.

Source: ©Kalkine Media®; © Canva via Canva.com

Source: ©Kalkine Media®; © Canva via Canva.com

Financial Highlights of fiscal 2022 second quarter:

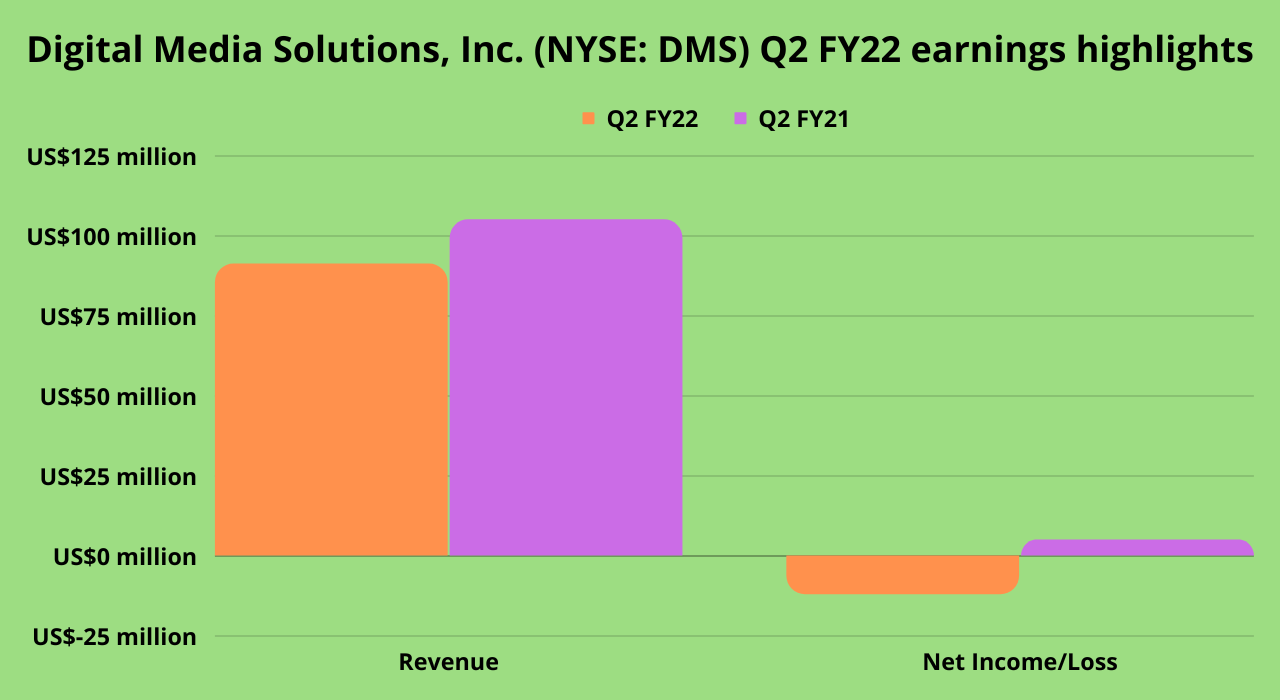

Digital Media Solutions reported a revenue of US$ 91 million in the latest quarter, noting a fall of 13 per cent YoY. The firm's net loss totalled US$ 12 million, against an income of US$ 5 million in the year-ago quarter.

For the fiscal 2022 third quarter, the company expects its net revenue to be between US4 87 million and US$ 90 million. For fiscal 2022, it provided a guidance range of US$ 390 million to US$ 400 million for its revenue.

Bottom line

The price of the DMS stock was US$ 2.22 at 9:46 am ET on September 9, an increase of 73.44 per cent from its previous close of US$ 1.28. It closed at about 8.5 per cent higher than the previous session.

During writing, the share volume of the DMS stock was more than 12.08 million. The market cap of Digital Media Solutions stood at US$ 86.23 million at its current trading price.