Highlights:

- The streaming media viewership crossed the cable viewership for the first time in the US in July, as per a Nielsen report.

- Over 34 per cent of the total US television viewership comes from the streaming services segment, the report showed.

- FUBO stock gained about 66 per cent QTD.

Netflix, Inc. (NASDAQ: NFLX), Amazon.com, Inc. (NASDAQ:AMZN), Walt Disney Company (NYSE: DIS), Roku, Inc. (NASDAQ:ROKU), and fuboTV Inc. (NYSE:FUBO) are among the major players in the streaming services sector that have attracted several users in recent months.

The streaming services firm has witnessed steady growth in recent years, with more people leaning toward the new trends. The COVID-19 pandemic seems to have boosted this trend further.

According to a report released by data measurement firm Nielsen, the viewership in streaming media had exceeded the cable viewership for the first time in the United States. The report said that the decreasing new content and declining sports programming on cable television have helped in gaining more users on the streaming services platforms.

As per the report, 34.8 per cent of the total US television viewership comes from the streaming services segment in July 2022, representing a surge of 22.6 per cent from the same month of the prior year.

On the other hand, the reported noted that cable viewership marked a drop of 8.9 per cent from the prior year's period, while declining two per cent from June to July. The cable viewership totaled 34.4 per cent of the total US television viewing.

Let's take a look at five streaming services firms and their latest stock and financial performances with Kalkine Media®.

Netflix, Inc. (NASDAQ:NFLX)

According to Nielsen’s findings, Netflix gained about eight per cent of the total US television viewership shares in July through about 18 billion minutes of Stranger Things watched and around 11 billion minutes through combined watch time of Virgin River and The Umbrella Academy.

However, NFLX stock has witnessed choppy trading so far in 2022, down about 61 per cent.

On a year-over-year (YoY) basis, it lost about 58 per cent. However, in the ongoing quarter, it gained over 32 per cent through August 24. Netflix stock had a price-to-earnings ratio of 20.6.

The subscription-based streaming services and production firm posted a revenue of US$ 7.97 billion in Q2 FY22, up from a revenue of US$ 7.34 billion in the year-ago quarter. Its net income also improved to US$ 1.44 billion in Q2 FY22 from US$ 1.35 billion in Q2 FY21.

Amazon.com, Inc. (NASDAQ:AMZN)

The leading e-commerce firm also engages in several other businesses like cloud computing, artificial intelligence (AI), and streaming services.

Amazon stock witnessed a similar situation like Netflix, having declined about 18 per cent in the last 12 months while slipping about 19 per cent year-to-date (YTD).

AMZN stock touched a 52-week low of US$ 101.26 (May 24, 2022) and a 52-week high of US$ 188.10725 (November 19, 2021).

Meanwhile, according to the Nielsen report, Amazon's Prime Video notched three per cent of the total US viewership shares in July, boosted by the new series on the platform, The Terminal List. In addition, the new season of The Boys also helped gain in it.

The Seattle, Washington-based firm was recently making headlines after it announced on August 5 that it had entered into a definitive merger agreement with iRobot under which Amazon would acquire the firm.

Talking about its financials, Amazon's net sales grew seven per cent YoY to US$ 121.2 billion in Q2 FY22, from a net sales of US$ 113.1 billion in the year-ago period. However, it posted a net loss of US$ 2.02 billion in Q2 FY22, against an income of US$ 7.77 billion in Q2 FY21.

Walt Disney Company (NYSE:DIS)

The media conglomerate had a P/E ratio of 67.85. DIS stock returned gains of about 23 per cent quarter-to-date (QTD). But on an annual basis, it lost around 34 per cent, while decreasing about 24 per cent YTD.

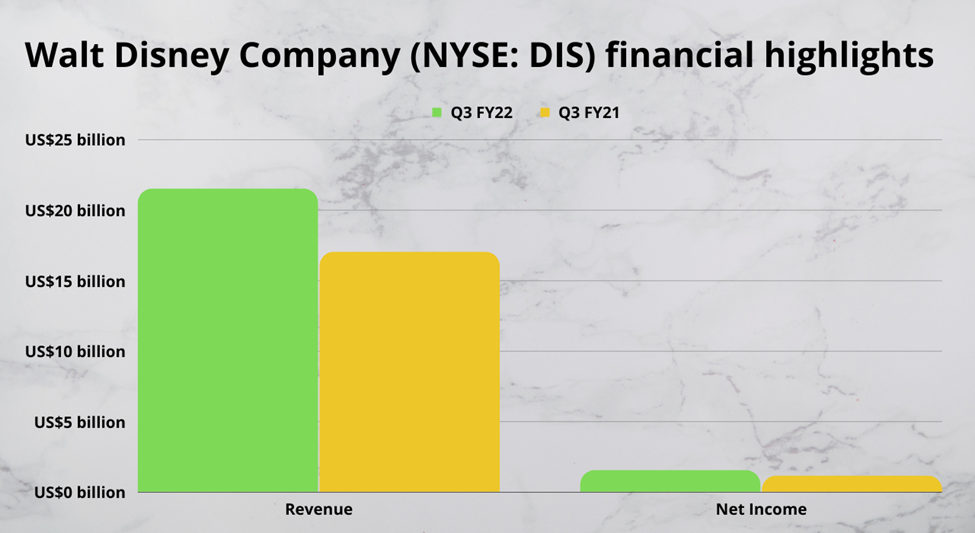

The revenue of the US$ 212.69 billion market cap firm was US$ 21.50 billion in Q3 FY22, a growth of 26 per cent from US$ 17.02 billion in the year-ago quarter. For the fiscal 2022 third quarter that ended on July 2, 2022, its attributable net income totaled US$ 1.40 billion, up from US$ 918 million in Q3 FY21.

Source: ©Kalkine Media®; © Canva Creative Studio via Canva.com

Source: ©Kalkine Media®; © Canva Creative Studio via Canva.com

Roku, Inc. (NASDAQ:ROKU)

Roku focuses on manufacturing a range of digital media players for video streaming services. It made a significant place in the television platform segment in the US and distributes content through its Roku Channel.

The total net revenue of the San Jose, California-based company improved to US$ 764.40 million in Q2 FY22 from US$ 645.11 million in Q2 FY21.

However, it posted a net loss of US$ 112.32 million in the fiscal 2022 second quarter, as compared to an income of US$ 73.46 million in Q2 FY21.

fuboTV Inc. (NYSE:FUBO)

The sports-focused live streaming services firm has witnessed notable growth in the ongoing quarter. The FUBO stock added nearly 66 per cent QTD while increasing about 63 per cent in August. On a YoY basis, it witnessed a sharp decline of about 85 per cent, while falling over 73 per cent YTD.

The North American segment (the US and Canada) of the New York-based firm reported a 65 per cent YoY growth in its Q2 FY22 revenue of US$ 216.1 million. Its ad revenue soared 32 per cent YoY to US$ 21.7 million in Q2 FY22. In the second quarter, its paid subscribers rose 41 per cent YoY to 946,735.

Its Rest of the World segment (France, Spain) ended the fiscal 2022 second quarter with around 347,000 total paid subscribers and US$ 5.8 million in total revenue.

Bottom line

The global digitalization and increasing adaptation of technology globally bumped up the demand for technology as well as the communication sector's services.

However, the communication services were among the worst hit sectors this year, amid a flurry of macroeconomic factors like soaring inflation, concerns over economic slowdown, and the central bank's move with the interest rate hikes. The investors took a safer path amid the uncertainties, affecting the mega-cap growth stocks.

The S&P 500 communication services sector declined about 32 per cent over the past 12 months, reflecting how the sector has struggled in recent quarters. It fell nearly 29 per cent YTD.