The Venezuelan bolívar has lost 24% of its value against the US dollar over the past year, exacerbating the country’s ongoing economic struggles.

In the last eight weeks alone, the official exchange rate set by the Central Bank of Venezuela has dropped from 36.7 to 45 bolívares per dollar.

This sharp decline is largely driven by growing distrust in the bolívar’s stability, compounded by the country’s deepening political and economic uncertainties following the July 28th election.

Venezuela’s currency depreciation

The looming uncertainty surrounding Venezuela’s next election has contributed to a volatile currency market, unseen in almost ten months.

As confidence in the bolívar wanes, businesses that once resumed trading in the national currency are now shifting back to foreign currencies.

Over 60% of transactions are still made in bolívares, but this marks a significant drop from the 76% two years ago, according to economist Aldo Contreras.

The bolívar’s rapid depreciation is also hurting businesses reliant on imports and dollar-based costs, leading to financial losses.

In an attempt to stem the tide, the Central Bank has injected $60 to $70 million into the foreign exchange market, but experts argue this is only a short-term fix, addressing symptoms rather than the underlying causes of the bolívar’s decline.

The Euro gaining ground in Venezuela

As Venezuela struggles with its currency crisis, the euro is becoming an increasingly popular alternative to both the bolívar and the dollar.

With unpredictable exchange rates and government restrictions on the parallel dollar market, businesses are opting to charge in euros to avoid the disparity between official and black market dollar rates.

As of November 15, the official exchange rate for the dollar was VES 45.5, while the parallel rate stood at VES 53.5, a 17.5% difference.

The euro’s growing role is a clear indicator of widespread distrust in both the bolívar and the dollar.

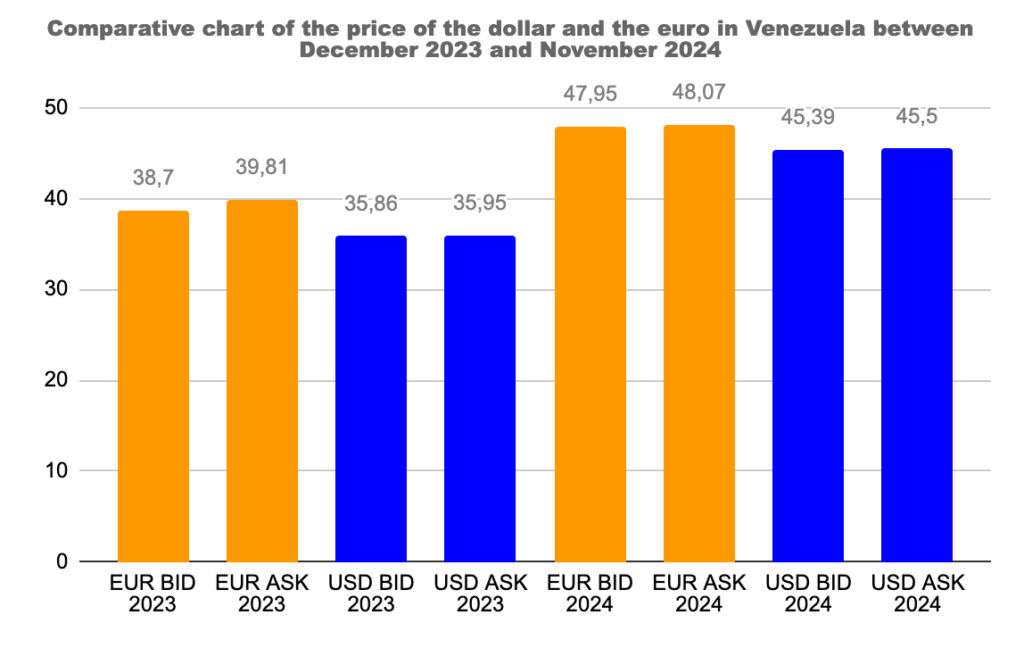

The exchange rate for the euro has surged 20.75% from December 2023 to November 2024 and by 24% against the dollar.

As a result, consumers paying in bolívares may face a 16% price increase as businesses adjust their prices to account for the currency volatility.

Chart created by Invezz using Venezuela’s Central Bank data

Reason behind bolívar’s depreciation

The bolívar’s collapse is rooted in multiple economic challenges, including political instability, an expanding money supply, and a lack of credible credit systems.

The Central Bank’s failure to implement transparent and effective economic policies further undermines investor confidence and hinders any potential recovery.

Contreras emphasizes that a coherent, transparent approach to monetary policy, along with strategic foreign investments, is critical to restoring confidence in the bolívar.

Without these measures, Venezuela’s economy remains vulnerable to further instability.

The devaluation of the bolívar is not just impacting businesses and investors—it’s also significantly affecting consumer behavior. Economists predict a 20% to 30% drop in sales during the upcoming holiday season as Venezuelans tighten their belts amid rising prices and dwindling resources.

Many are already demanding foreign currency for transactions or converting their savings into dollars, further distorting the local market.

The economic challenges facing Venezuela are vast, and the decline of the bolívar is a direct result of political and economic instability. To reverse the downward spiral, Venezuela needs comprehensive reforms that restore trust in its currency, stabilize the economy, and attract foreign investment.

Without such reforms, the country’s path to recovery remains uncertain, and the outlook for economic stability appears bleak.

As Venezuela navigates post-election changes, both domestic and international stakeholders will be watching closely to see how policymakers address these critical issues.

The post Venezuelan bolívar loses 24% against the dollar in one year: here’s why appeared first on Invezz