The UK’s mortgage and consumer credit markets have displayed significant underperformance in recent months, reflecting broader economic challenges.

The latest data from the Bank of England reveals consumer lending growth has slowed to its weakest pace since mid-2022, while mortgage approvals have fallen short of expectations.

These trends highlight the cautious stance of British households, influenced by economic stagnation, uncertain fiscal policies, and a shifting financial landscape.

Consumer spending patterns and borrowing habits are shifting, with households prioritising savings amidst an unstable future for the country’s economy.

The broader implications of this slowdown extend beyond consumer behaviour, hinting at potential challenges for the housing market, lenders, and the government’s growth strategies.

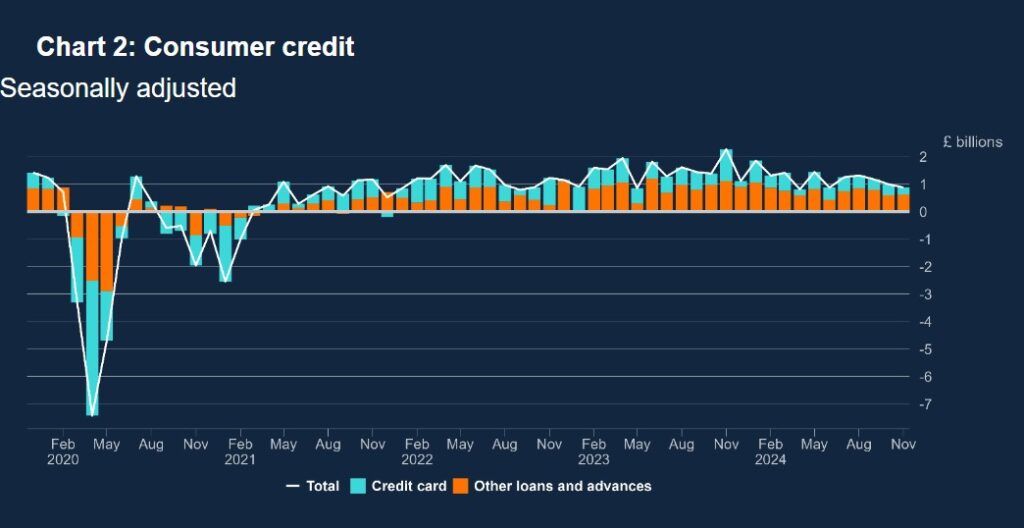

Weak consumer credit growth signals caution

The growth rate of consumer credit cooled to 6.6% in November, down from 7.3% in October, marking its slowest pace since June 2022.

In cash terms, the net increase was £878 million, significantly below the £1.2 billion anticipated by economists.

Source: Bank of England

This cautious borrowing behaviour reflects households’ growing concerns about economic uncertainty, compounded by high inflation, stagnating wages, and the looming spectre of higher interest rates.

Consumer sentiment has also been influenced by the Labour government’s recent budget, which included tax increases on businesses and plans for higher public spending.

While these measures aim to bolster long-term growth, they have created short-term uncertainty for households and businesses alike.

Retail and consumer surveys indicate a decline in confidence, underscoring the public’s hesitancy to take on additional debt amidst potential economic headwinds.

The impact of this credit slowdown is far-reaching, with implications for retailers, financial institutions, and overall GDP growth.

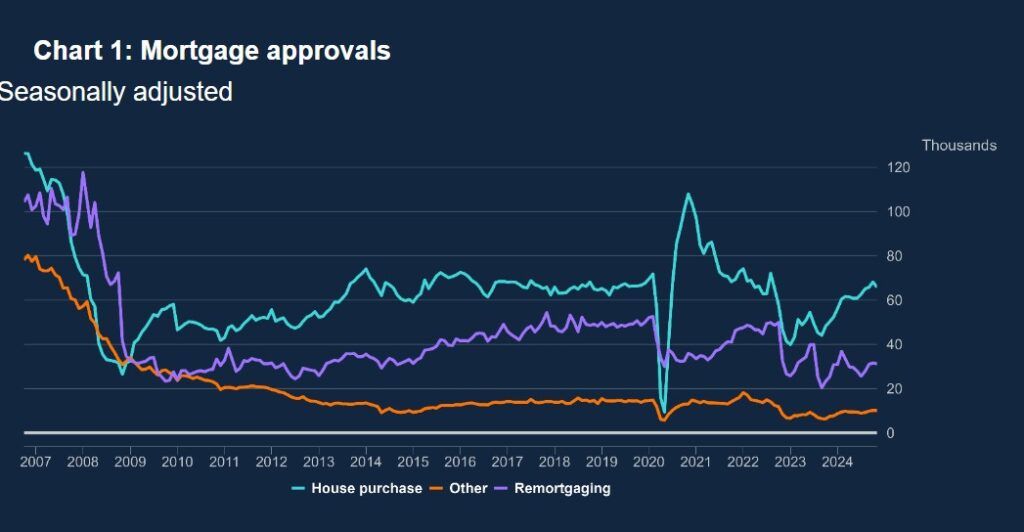

UK’s mortgage market shows signs of weakness

The housing market, which has so far been resilient to economic pressures, is beginning to show cracks. Mortgage approvals dropped to 65,720 in November.

Source: Bank of England

This decline reflects both reduced demand from prospective buyers and tighter lending conditions implemented by financial institutions wary of economic volatility.

Nationwide Building Society and other major lenders have recently reported modest house price increases, but experts warn that these gains may not be sustainable.

The slowdown in approvals signals potential trouble ahead for the housing market in 2025, with affordability challenges and cautious buyer sentiment expected to weigh heavily on property transactions.

Rising interest rates have added further pressure, increasing the cost of borrowing and discouraging new mortgage applications.

For existing homeowners, higher rates stretch household budgets, limit disposable income, and dampen spending power.

As a result, the ripple effects of the mortgage market’s underperformance are expected to extend into other sectors of the economy, including construction and home-related retail.

Balancing growth with caution

The Labour government faces a delicate balancing act as it aims to revitalise economic growth while managing the immediate risks posed by sluggish consumer and mortgage activity.

Finance Minister Rachel Reeves’ fiscal policies, which rely on increased public spending and tax revenues, have yet to translate into tangible growth.

Some economists anticipate a temporary boost to GDP in 2025 as public spending filters through the economy, but global uncertainties such as eurozone economic struggles and US trade policies could derail these projections.

For now, the Bank of England’s data underscores the fragile state of the UK economy, with cautious consumers and a softening housing market adding to the complexity of the economic landscape.

The post UK’s credit and housing markets signal economic strains heading into 2025 appeared first on Invezz