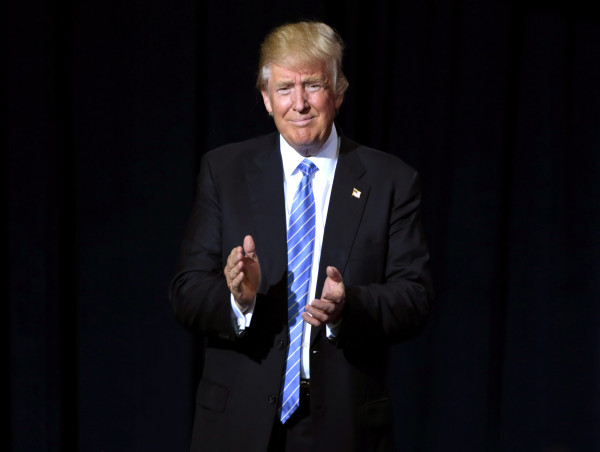

JPMorgan’s chief global economist has issued a stark warning about the potential consequences of President Donald Trump’s aggressive tariff policy, predicting that “There will be blood.”

In a research note published Thursday, JPMorgan’s Bruce Kasman, along with a team of company economists, cautioned that the probability of the global economy sliding into a recession has jumped from 40% to a concerning 60% following Wednesday’s “Liberation Day” tariff announcement.

Trump’s sweeping ‘Liberation Day’ tariffs impose a 10% levy on goods imported from all countries into the United States, with even higher tariffs slapped on 60 trading partners with persistent trade deficits with the US.

This includes major economic powerhouses such as China and Japan, as well as the European Union.

These tariffs come on top of existing duties already imposed on the United States’ top trade partners, Canada and Mexico, leading to widespread unease.

Decisively less business-friendly: a shift in US trade policy

“Disruptive US policies has been recognized as the biggest risk to the global outlook all year,” JPMorgan’s research note states.

The latest news reinforces our fears as US trade policy has turned decisively less business-friendly than we had anticipated.

The banking giant’s economists characterize tariffs as a “functional tax increase” on US household and business purchases of imported goods.

Economists and supply chain experts have previously warned that Trump’s tariff plan will likely result in higher prices for a wide range of goods, from everyday staples like coffee and sugar to apparel and major purchases such as cars and appliances.

A tax hike of historic proportions: the macroeconomic impact

JPMorgan’s analysts calculated that this week’s announcement, combined with earlier tariff increases, effectively raises the US average tax rate “by roughly 22%-pts to an estimated 24%,” equivalent to approximately 2.4% of the total value of all goods and services produced within the country, or GDP.

“A hike of this size would be on par with the largest tax hike since WWII,” the JPMorgan research note reads.

The effects could be amplified by retaliatory measures from other countries, a decline in US business sentiment, and disruptions to global supply chains.

Recession on the horizon? JPMorgan raises the alarm

“We thus emphasize that these policies, if sustained, would likely push the US and possibly global economy into recession this year. An update of our probability scenario tree makes this point, raising the risk of a recession this year to 60%,” the note continues, painting a bleak picture of the potential economic fallout.

However, JPMorgan’s economists offer a glimmer of hope, stressing that a nationwide or global recession “is not a foregone conclusion.”

Beyond the obvious point that policy actions may be changed in the coming weeks, we continue to emphasize that the US and global expansions stand on solid ground and should be able to withstand a modest-sized shock.

Despite this potential silver lining, the note emphasizes that JPMorgan’s economists “view the full implementation of announced policies as a substantial macroeconomic shock” — one that would be difficult to recover from if Trump’s policies persist.

The post JPMorgan: Donald Trump's tariffs will cause 'blood', raise recession risk to 60% appeared first on Invezz