Highlights:

- Revenue of Intuit Inc. (INTU) rose 32 per cent YoY in fiscal 2022.

- Salesforce, Inc. (CRM) would report its latest quarterly earnings results on November 30.

- The diluted EPS of Dollar General (DG) surged over seven per cent YoY in Q2 FY22.

Investors generally keep a close watch on the earnings season for insights into the companies' operating performance. Especially, during times of economic and geopolitical turmoil, the earnings season plays an important role, as it provides details about how the corporations have tackled the hurdles.

Having said that, the year 2022 has been a catastrophic year due to the stubbornly high inflation, soaring interest rates, and the Russia-Ukraine war. The global economy was already hit by the COVID-19 pandemic in 2020, and as its effect started to wane, the geopolitical turmoil began to raise market concerns.

So, investors were left in the cold due to the higher inflation, and the central bank's aggressive approach towards curbing it. The economic challenges have also subdued corporate profits while forcing investors to lower their risk-bet appetite.

However, the latest quarter earnings season has remained mixed so far, with some companies afloat with positive results and guidance for the upcoming quarter.

So, today we would be discussing three companies, which include Intuit Inc. (NASDAQ:INTU), Salesforce, Inc. (NYSE: CRM), and Dollar General Corporation (NYSE: DG), and their past quarter earnings and recent stock performance:

These three companies are scheduled to release their latest quarterly operating results next week.

Intuit Inc. (NASDAQ:INTU)

The financial-focused technology and software firm, Intuit Inc. had a dividend yield of 0.83 per cent. The US$ 110.55 billion software company would report its starting quarter earnings results on Tuesday, November 29, after the Wall Street close.

The company expanded its official partnership with the NFL or National Football League in a four-year renewal contract through 2026.

Meanwhile, in fiscal 2022, Intuit Inc's revenue surged 32 per cent YoY to US$ 12.7 billion, and its GAAP EPS fell four per cent YoY to US$ 7.28 apiece. In the final quarter of the previous fiscal year, the financial technology firm's revenue plunged six per cent YoY to US$ 2.4 billion, and its loss per share totaled US$ 0.20 apiece.

Salesforce, Inc. (NYSE:CRM)

The cloud-based software firm, Salesforce, Inc. provides solutions to improve its clients' sales, customer interaction, and other related aspects. The San Francisco-based technology firm would report its Q3 FY23 earnings results on November 30, after market close.

Meanwhile, in Q2 FY23, Salesforce Inc's revenue grew 22 per cent YoY to US$ 7.72 billion, and its diluted EPS was US$ 0.07 apiece, against US$ 0.56 per share in Q2 FY22.

Source: ©Kalkine Media®; © Canva via Canva.com

Source: ©Kalkine Media®; © Canva via Canva.com

Dollar General Corporation (NYSE:DG)

The variety store chain operator, Dollar General Corporation is slated to report its Q3 FY22 earnings results on December 1, 2022, before the opening bell.

The company's earnings might be closely watched by investors amid the increasing focus on the retail sector due to the holiday season.

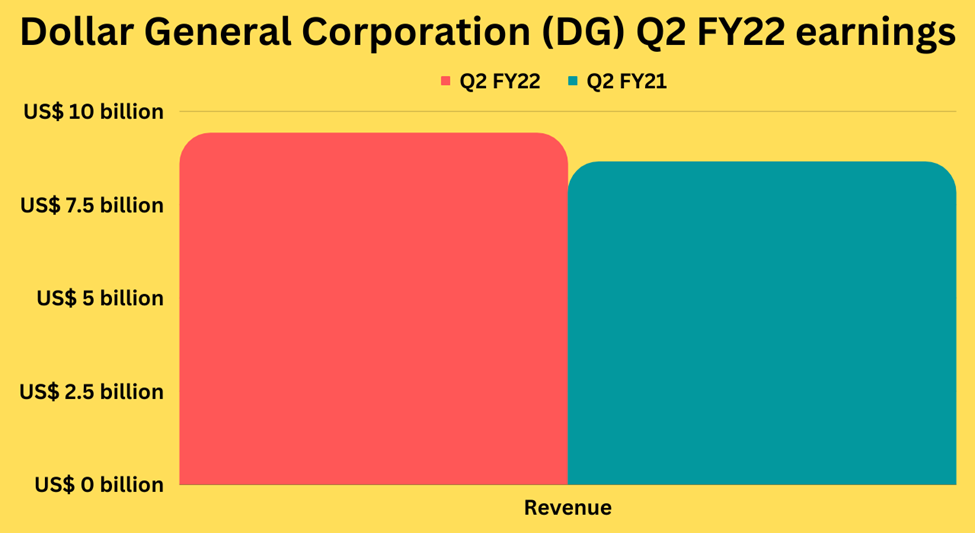

In Q2 FY22, Dollar General Corporation's net sales rose nine per cent YoY to US$ 9.4 billion, and its diluted EPS surged 7.5 per cent YoY to US$ 913 million.

Bottom line:

The latest economic data seems to have lifted the market spirits from their lows in the past few months. Inflation in October came in below the market anticipations and was also at its lowest annual advancement level in 2022.

This has given some relief to the market participants, who were anticipating more aggressive moves by the central bank, considering the racing inflation. On the other hand, traders also cheered the retail sales data from last week, which showed that the consumers have maintained their spending despite the inflationary and higher interest rate pressures.

However, the market is still sensitive and is in highly volatile condition, for which, investors should consider all the risks before investing.