Highlights:

- Bank of America Corporation (NYSE:BAC) touched its 52-week low on October 12, 2022.

- Johnson & Johnson (NYSE:JNJ) noted three per cent growth in its Q2 FY22 net sales.

- Tesla, Inc. (NASDAQ:TSLA) is slated to provide its third-quarter financial updates on October 19.

The third-quarter earnings season started this week, with many big companies reporting their quarterly earnings results. Investors have kept a close watch on the financial releases from these corporations for cues on how they have performed in the recent quarter, amid a flurry of economic challenges affecting the businesses.

So, next week also, some popular names are on the list that would announce their financial results for the latest quarter. Some big companies, including Bank of America Corporation (NYSE: BAC), Johnson & Johnson (NYSE:JNJ), Tesla, Inc. (NASDAQ: TSLA), Netflix, Inc. (NASDAQ: NFLX), and Union Pacific Corporation (NYSE: UNP) would release their quarterly earnings this week.

The starting three quarters of the year haven't been smooth for the overall market, with all three indices hovering near or in the bear market territory. The volatile market trend has forced the investors to run for the hills due to high inflation and Federal Reserve's strict commitment to clobber it.

Despite the increasing interest rates by the central bank, inflation is still at an elevated level. While the economy although slowed, appears to be resilient. This gave another reason to the Federal Reserve to walk on the restrictive path in their fight against soaring inflation.

Let's discuss the second quarter earnings and the stock details of the companies ahead of their scheduled release for the latest quarter next week:

Bank of America Corporation (NYSE:BAC)

Bank of America Corporation is a financial services company that holds a dividend yield of 2.96 per cent. The US$ 235.79 billion market cap company, with a P/E ratio of 9.33, provides a range of financial and investment banking solutions to its clients.

The stock price of the financial services company fell over 30 per cent YTD while decreasing around 27 per cent YoY. However, it showed gains of about three per cent in the last three months. Meanwhile, the BAC stock fell to its 52-week lowest level of US$ 29.48 on Wednesday, October 12.

The investment banking company is scheduled to report its latest quarterly financial results on Monday, October 17 at around 6:45 am ET.

Bank of America Corporation's revenue, net of interest expense was US$ 22.7 billion in Q2 FY22, and its diluted EPS was US$ 0.73 apiece. In the year-ago quarter, the investment banking firm's diluted EPS was US$ 1.03 per share of revenue, net of interest expense of US$ 21.5 billion.

Johnson & Johnson (NYSE:JNJ)

Johnson & Johnson is a leading company with a dividend yield of 2.78 per cent, that engages in pharmaceutical businesses. The company, with a P/E ratio of 23.68, specializes in developing medical devices, consumer packaged goods, and other related products.

The stock price of the pharmaceutical firm lost around five per cent YTD and about seven per cent in the last three months. However, the price of JNJ stock ticked up about two per cent YoY. The company said that it would announce its Q3 FY22 earnings results on October 18, at 8:30 am ET.

Meanwhile, in Q2 FY22, Johnson & Johnson's total sales grew three per cent YoY to US$ 24.02 billion, while its total earnings fell 23.3 per cent YoY to US$ 4.81 billion.

Source: ©Kalkine Media®; © Canva Creative Studio via Canva.com

Source: ©Kalkine Media®; © Canva Creative Studio via Canva.com

Tesla, Inc. (NASDAQ:TSLA)

Tesla is a leading EV maker with a P/E ratio of 79.01. The electric vehicle manufacturer said that it would provide its third quarter financial updates on October 19, after the market close.

The TSLA price fell around 37 per cent YTD, 19 per cent YoY, and about eight per cent in the last three months through October 13. The company said that it has produced more than 365,000 vehicles and delivered more than 343,000 vehicles in the latest quarter.

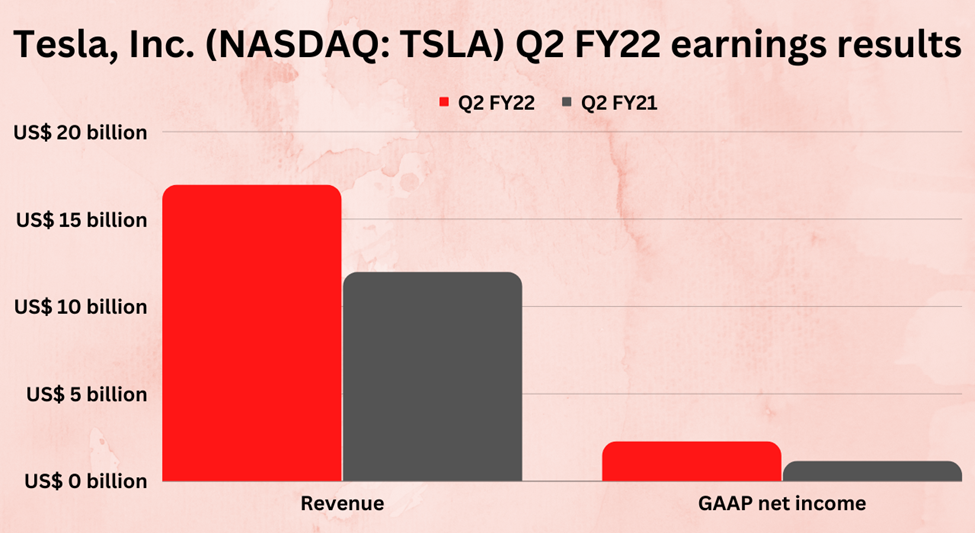

In Q2 FY22, Tesla, Inc.'s revenue rose 42 per cent YoY to US$ 16.93 billion, and its GAAP net income jumped 98 per cent YoY to US$ 2.25 billion.

Netflix, Inc. (NASDAQ:NFLX)

The subscription-based streaming services company, Netflix also witnessed gloomy trading so far this year. The NFLX stock fell 63 per cent YTD and 64 per cent YoY. In the last three months through October 13, its price soared around 27 per cent.

Netflix said that it would provide its earnings update for the third quarter on October 18, at around 1:00 pm Pacific Time. Meanwhile, in Q2 FY22, its diluted EPS was US$ 3.20 apiece on revenue of US$ 7.97 billion.

In the year-ago period, the streaming services provider's diluted EPS was US$ 2.97 apiece on revenue of US$ 7.34 billion.

Union Pacific Corporation (NYSE:UNP)

Union Pacific Corporation is a transportation company with a dividend yield of 2.7 per cent. The company would publish its Q3 FY22 earnings results on Friday, October 20, at 7:45 am ET.

The UNP stock retreated nearly 23 per cent YTD, and 10 per cent YoY. Meanwhile, the US$ 121.90 billion market cap company stock touched its 52-week low of US$ 191.6481 on Tuesday, October 11.

In Q2 FY22, Union Pacific Corporation's revenue rose 14 per cent YoY to US$ 6.3 billion, and its operating income was up one per cent YoY to US$ 2.5 billion.

Bottom line:

This week marked a crucial period for the market, with investors keeping a close watch on the earnings from some big companies like PepsiCo, Inc. (NASDAQ:PEP), Taiwan Semiconductor Manufacturing Company (NYSE:TSM), Delta Air Lines, Inc. (NYSE:DAL), as well as some big banks like JP Morgan Chase & Co (JPM), Wells Fargo & Company (WFC), etc.

In addition to that, the CPI data, which is a key gauge to measure inflation, also came out. The Nasdaq Composite Index too fell into the bear market territory for the second time this year in October amid choppy trading in the broader market. On the other hand, the minutes from Fed's September meeting showed that the policymakers are committed to being hawkish in the coming days to bring down the increasing costs.

The policymakers have signaled that they would keep increasing the policy rates to fight inflation, even if it tips the economy into a recession. So, before putting any bets, investors should explore all the uncertainties hovering over the market.