Highlights

- Danaher Corporation’s (NYSE:DHR) gross profit was US$4.35 billion in Q3, FY21.

- AT&T Inc. (NYSE:T) adds 928,000 postpaid phone subscribers in the third quarter.

- AT&T’s operating income was US$7.10 billion in Q3, FY21.

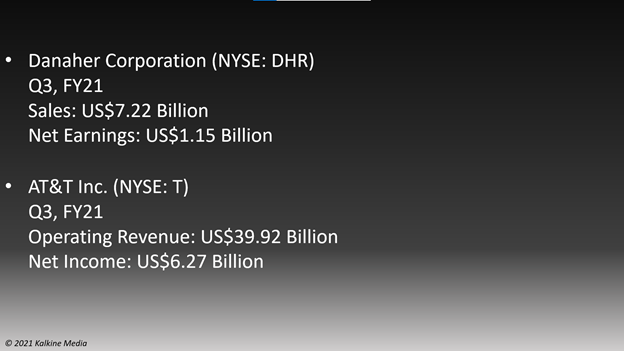

Danaher Corporation (NYSE:DHR) and AT&T Inc. (NYSE:T) on Thursday reported solid net earnings in their third quarter, lifted by bigger sales volumes.

The DHR stock traded at US$307.50, down 2.33%, while the AT&T stock traded at US$26.23, up 1.24%, on Thursday morning from their previous closes.

Here’s a look at their quarterly earnings.

Danaher Corporation

Danaher Corporation is a diversified conglomerate based in Washington, D.C. It manufactures industrial medical products.

The company's total sales rose to US$7.22 billion in Q3, FY21, from US$5.88 billion a year ago. The gross profit increased to US$4.35 billion from US$3.22 billion in the year-ago quarter.

Danaher’s operating profit was US$1.30 billion compared to US$1.08 billion in Q3 of FY2020.

Its net earnings rose to US$1.15 billion, or US$1.54 per diluted share, from US$883 million, or US$1.16 per diluted share in Q3, FY20.

Danaher’s market cap is US$224.74 billion, the P/E ratio is 41.92, and the forward P/E one year is 33.10. Its EPS is US$7.51. The stock saw the highest price of US$333.96 and the lowest price of US$211.22 in the last 52 weeks. Its share volume on October 20 was 2,587,261.

Also Read: Bitcoin soars to an all-time high, on track to close year at US$80,000

Also Read: Taiwan’s Foxconn eyes EV manufacturing in India, Europe

AT&T Inc. (NYSE:T)

AT&T Inc. is a telecommunication holding company based in Dallas, Texas. It is one of the leading mobile telephone service providers in the US.

The company registered 928,000 postpaid phone net adds, and 1,218,000 postpaid net adds in the third quarter of FY21.

Its operating revenue declined to US$39.92 billion in Q3, FY21, from US$42.34 billion in the year-ago quarter. However, its operating income rose to US$7.10 billion from US$6.13 billion a year ago.

The adjusted EBITDA was US$13.01 billion compared to US$13.31 billion in Q3 FY20.

AT&T’s net income rose to US$6.27 billion, or US$0.82 per diluted share, from US$3.16 billion, or US$0.39 per diluted share, in Q3, FY20.

It has a market cap of US$184.99 billion and a forward P/E one year of 7.73. Its EPS is US$-0.31. The 52-week highest and lowest stock prices were US$33.88 and US$25.01, respectively. Its trading volume was 48,283,410 on October 20.

Also Read: NextEra Energy (NEE) posts solid Q3 results, EPS up 12%

Bottomline

The DHR stocks saw significant growth in recent quarters, while AT&T stock declined. However, AT&T’s revenue and phone subscriptions topped analysts' expectations in Q3. In addition, the stock price of DHR grew by 41.03% YTD, while AT&T stocks plummeted 11.99% YTD.