Highlights

- Cintas Corporation’s (NASDAQ:CTAS) revenue increased by 8.2% YoY in Q1, FY22.

- Jabil Inc. (NYSE:JBL) reported a revenue of US$29.28 Bn in the fiscal year 2021.

- JBL expects its Q1, FY22, revenue to be between US$8.0 Bn and US$8.6 Bn.

Stocks of Cintas Corporation (NASDAQ:CTAS) and Jabil Inc. (NYSE:JBL) caught the eyes of investors on Wednesday after reporting their quarterly earnings before the opening bell. The former rose more than 2 percent, while the latter tumbled around 2 percent in pre-market trading.

The CTAS stock was priced at US$395.00 at 9:01 am ET, up 2.31 percent from its previous closing price, while the shares of JBL traded at US$59.64 at 8:47 am ET on September 29, down by 2.13 percent from its closing price of September 28.

Here we explore the earnings of the companies.

Also Read: Why are NAKD, BBIG stocks drawing investors’ attention?

Cintas Corporation (NASDAQ:CTAS)

Cintas Corporation provides a range of products and services like corporate uniforms, entrance mats, restroom supplies, and other related business services. It is based in Cincinnati, Ohio.

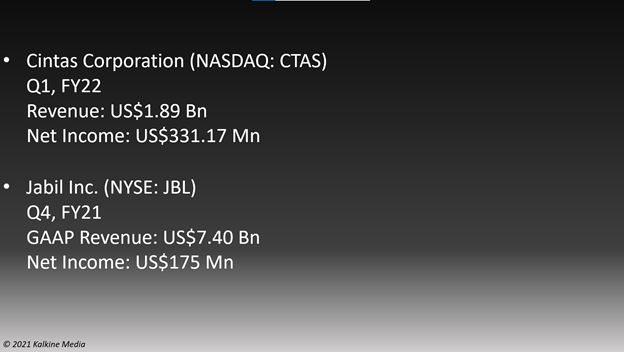

The total revenue of the company was US$1.89 billion in Q1, FY22, representing an increase of 8.2 percent YoY. Its operating income came in at US$394.10 million, compared to US$349.70 million in the same quarter of the previous year.

Also Read: Why did Moderna (MRNA), Altimmune (ALT) stocks nosedive today?

The net income of the company came in at US$331.17 million, or US$3.11 per diluted share, compared to US$300.00 million, or US$2.78 per diluted share in Q1, FY21.

The firm has a market cap of US$40.15 billion, a P/E ratio of 37.7, and a forward P/E one year of 36.12. Its EPS is US$10.24.

The highest and lowest prices of the stocks for the last 52 weeks were US$409.80 and US$311.69, respectively. Its trading volume was 479,523 on September 28.

Also Read: Mastercard (MA) launches buy now, pay later (BNPL) scheme

Also Read: Earnings Update: IHS Markit (INFO), FactSet (FDS) revenue rises

Jabil Inc. (NYSE:JBL)

Jabil is a Florida-based technology company that provides advanced manufacturing solutions. It provides various electronic manufacturing solutions globally.

The company's net revenue was US$7.40 billion in Q4, FY21, compared to US$7.30 billion in the year-ago quarter. Its gross profit was US$587 million, as compared to US$491 million in the previous year's second quarter.

The operating income of the company was US$265 million, against an income of US$197 million in Q4, FY20. It reported a net income of US$175 million, or US$1.16 per diluted share, compared to US$68 million or US$0.44 per diluted share in the same quarter of the previous year.

Also Read: US indices close in red as tech, consumer stocks slump

For the full fiscal year, the company's net income came in at US$698 million on revenue of US$29.28 billion.

The firm also projected its net revenue to be between US$8.0 billion and US$8.6 billion in Q1, FY22.

The market cap of the company is US$8.88 billion, the P/E Ratio is 15.79, and the forward P/E one year is 13.33. Its EPS is US$3.86.

The highest and lowest stock prices of the firm for the last 52 weeks were US$63.78 and US$31.41, respectively. Its share volume on September 28 was 1,180,275.

Also Read: Five clean energy stocks to watch as renewables take centerstage

Bottomline

The stock value of Cintas Corporation increased by 12.36 percent YTD, whereas the JBL stock surged 44.51 percent YTD, suggesting that the stocks have performed well in past quarters. However, before considering an investment, an investor should also evaluate the companies and the market's current volatility.