Highlights:

- AMD’s revenue soared 71% YoY in Q1 FY22.

- Moderna recently got a new supply contract from the government of the United States.

- LLY stock rose over 34 per cent year-to-date (YTD).

Investors often keep a close watch on the corporate filings and the earnings season is currently going on in the United States. This year has not been good for the market due to soaring inflation and other macroeconomic factors.

The indices notched their H1 worst percentage decline in decades. However, as earnings season lifted the market spirit, the market shrugged off some of its losses in the prior month.

In economic data, Labor Department is expected to release job openings, nonfarm payrolls, and unemployment rate data on Friday, August 5, among other key indicators.

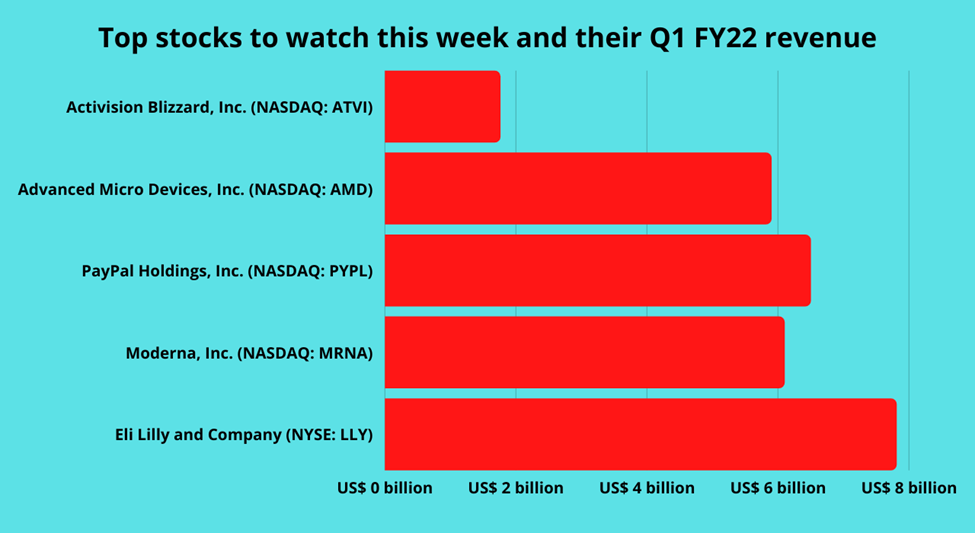

All these five companies- Activision Blizzard, Inc (NASDAQ:ATVI), Advanced Micro Devices, Inc. (NASDAQ:AMD), PayPal Holdings Inc. (NASDAQ: PYPL), Moderna Inc. (NASDAQ:MRNA), and Eli Lilly and Company (NYSE: LLY), are important players in their respective fields and they released their earnings report. Let's look at the financial performances:

Source: ©Kalkine Media®; © Canva via Canva.com

Source: ©Kalkine Media®; © Canva via Canva.com

Activision Blizzard, Inc. (NASDAQ:ATVI)

The company reported its financial report on Monday, August 1. Activision’s total net revenues were US$ 1,644 million compared to US$ 2,296 million in Q2 2021.

Meanwhile, the net income of Activision Blizzard narrowed down to US$ 280 million from US$ 876 million in the same comparable period.

ATVI stock closed at US$ 80.66 on August 4 after rising 0.087 per cent during the trading session on Thursday, August 4.

The decline in Activision’s financial performance was observed in the first quarter as in Q1 FY22, its total net revenue was US$ 1.76 billion, relatively less than US$ 2.27 billion in the year-ago period. Also, the net income was US$ 395 million, down from US$ 619 million.

Advanced Micro Devices, Inc. (NASDAQ:AMD)

The semiconductor firm recently reported its second-quarter results and said that the revenue climbed 70 per cent year-over-year (YoY) to US$ 6,550 million.

The AMD stock closed at US$ 103.91 on Thursday, August 4, up 5.9 per cent from its closing price of August 3. The US$ 153.73 billion market firm provided gains of about 23.5 per cent in the prior month.

AMD reported a 71 per cent increase annually in its revenue of US$ 5.9 billion in the first quarter of fiscal 2022. On a quarter-over-quarter basis (QoQ), its revenue rose 22 per cent in the first quarter.

PayPal Holdings, Inc. (NASDAQ:PYPL)

This week, PayPal reported its quarterly earnings and posted earnings of US$ 0.93 per share on revenue of US$ 6.81 billion.

The financial technology firm has a market cap of US$ 100.20 billion and the PYPL stock gained 23.89 per cent in July. On Thursday, the stock declined by about one per cent and closed at US$ 96.98 per share.

In the first half of 2022, Paypal repurchased $2.25 billion worth of shares and plans to do it again this year for a total of $4 billion. In Q1 2022, Paypal’s net revenue grew by 8 per cent YoY to US$ 6.5 billion.

Moderna, Inc. (NASDAQ:MRNA)

The healthcare firm reported its earnings results on August 3 and said its revenue increased to US$ 4.7 billion in Q2 2022 from US$ 4.4 billion.

Meanwhile, the company's net income was US$ 2.2 billion, down from US$ 2.8 billion in the same comparable period.

The biotechnology firm was awarded a new supply contract on Friday. An award of up to US$ 1.74 billion is included in the contract for 66 million doses that Moderna has to deliver in 2022. In addition, it may raise a total to about 300 million doses if exercised.

Eli Lilly and Company (NYSE:LLY)

Another healthcare firm, Eli Lilly, reported its earnings on Thursday, August 4. The US$ 313.25 billion market cap company reported a four per cent decrease in its second quarter fiscal 2022 revenue.

The net income was US$ 952.5 million in Q2 2022, significantly down from US$ 1,390.2 million in Q2 2021.

LLY stock gained 34.33 per cent YoY and 19.31 per cent YTD. In July 2022, it rose by 1.64 per cent.

Bottom line

GDP data showed that the US economy further retreated in the second quarter as it fell at a rate of 0.9 per cent annually in the second quarter, following a 1.6 per cent decrease in the prior quarter. Amid economic uncertainty, maintaining an investment portfolio is tricky. Hence, Kalkine Media advises people to stay alert and cautious.