Benchmark US indices closed higher on Wednesday, April 13, as a new earnings season set in and growth stocks salvaged some of their recent losses as investors shrugged off inflation worries.

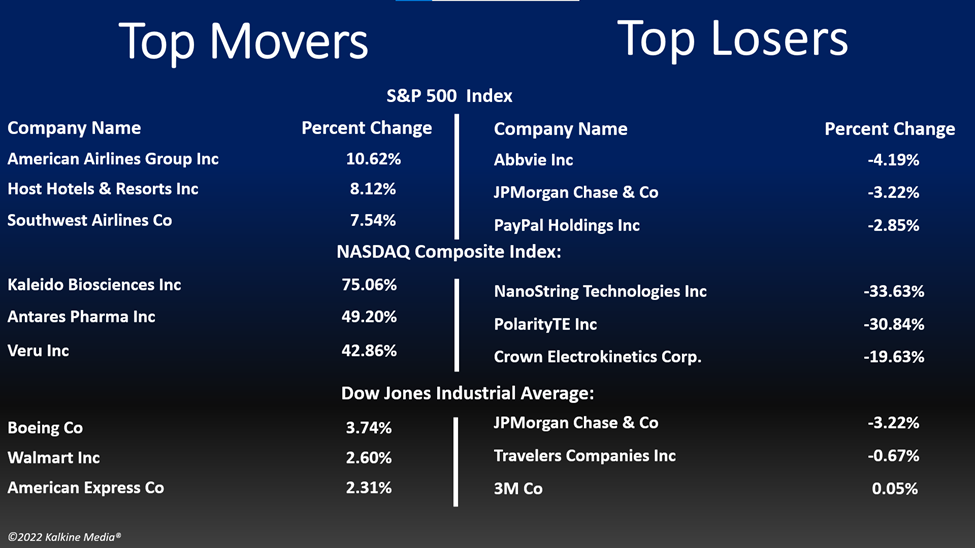

The S&P 500 was up 1.12% to 4,446.59. The Dow Jones increased by 1.01% to 34,564.59. The NASDAQ Composite rose 2.03% to 13,643.59, and the small-cap Russell 2000 up 1.92% to 2,025.10.

Investors were eagerly waiting for the first-quarter earnings for cues on how the companies may have tackled the four-decade high inflation.

On Wednesday, the Labor Department said that the US Producer Price Index, which tracks the changes in consumer prices, rose by 1.4% in March after a 0.9% increase in the prior month.

For the 12 months ended in March, the final demand prices jumped 11.2%, the highest increase since the record began in 2010. The sharp rise shows the continued supply-chain constraints.

However, traders seemed to have focused on the company earnings, shrugging off concerns over Fed’s aggressive stance on inflation.

The consumer discretionary and information technology sectors led gains in the S&P 500 index on Wednesday. Ten of the eleven critical sectors of the S&P 500 index stayed in the positive territory, with utilities sector as the bottom mover.

The shares of JP Morgan Chase & Co (JPM) declined 3.52% in intraday trading after the company reported a 42% decrease in its profit in the first quarter of fiscal 2022. The company said its profit was hit due to the Russia-Ukraine conflict and the multi-decade high inflation hindered dealmaking activity at the bank.

Some of the major banks like Morgan Stanley (MS), Wells Fargo & Company (WFC), and Goldman Sachs Group Inc. (GS) will report their financial results on April 14.

BlackRock Inc. (BLK) stock ticked down 0.53% despite posting a better-than-anticipated profit in the last quarter, as it benefited from the investors spending their money on the asset manager's various index-traded and active funds.

Delta Air Lines, Inc. (DAL) stock gained 5.80%, despite reporting a quarterly loss in its earnings results. Meanwhile, the company said that it would return to profit in the ongoing quarter as demand for airline travel reaches a record high.

Other airlines stocks like American Airlines Group Inc. (AAL) and Southwest Airlines Co. (LUV) also surged 9.84% and 6.98%, respectively, following the news.

In the consumer discretionary sector, Amazon.com, Inc. (AMZN) rose 2.52%, Tesla, Inc. (TSLA) gained 2.95%, and The Home Depot, Inc. (HD) surged 1.26%. NIKE, Inc. (NKE) and Airbnb, Inc. (ABNB) increased by 1.53% and 7.42%, respectively.

In technology stocks, Apple Inc. (AAPL) grew 1.58%, Microsoft Corporation (MSFT) soared 1.45%, and NVIDIA Corporation (NVDA) advanced 2.27%. Taiwan Semiconductor Manufacturing Company (TSM) and ASML Holding N.V. (ASML) ticked up 2.24% and 3.84%, respectively.

In the financial sector, Berkshire Hathaway Inc. (BRK-B) decreased by 1.01%, PayPal Holdings, Inc. (PYPL) fell 3.93%, and HDFC Bank Limited (HDB) declined 1.29%. Chubb Limited (CB) and US Bancorp (USB) plummeted 1.08% and 1.12%, respectively.

The cryptocurrency market was up 3.63% to US$1.91 trillion at 5:16 pm ET on Wednesday. Bitcoin (BTC) and Ethereum (ETH) rose 3.81% and 3.44% to US$41,216.32 and US$3,103.20, respectively.

Also Read: Why is metaverse-focused Meta Ruffy (MR) crypto rising?

Also Read: What is NEXO’s crypto-backed credit card? How is Mastercard involved?

Also Read: Why is GMX crypto gaining attention?

Futures & Commodities

Gold futures were up 0.07% to US$1,977.50 per ounce. Silver increased by 0.79% to US$25.938 per ounce, while copper fell 0.03% to US$4.7082.

Brent oil futures increased by 4.02% to US$108.85 per barrel and WTI crude was up 3.66% to US$104.28.

Also Read: Why is Polygon (MATIC) rising? Does it have a Robinhood connection?

Bond Market

The 30-year Treasury bond yields were down 0.63% to 2.809, while the 10-year bond yields fell 0.90% to 2.703.

US Dollar Futures Index decreased by 0.40% to US$99.885.