Benchmark US indices closed in the red on Wednesday, January 5, after minutes of Fed’s December meeting revealed unease among economists over the current high inflation.

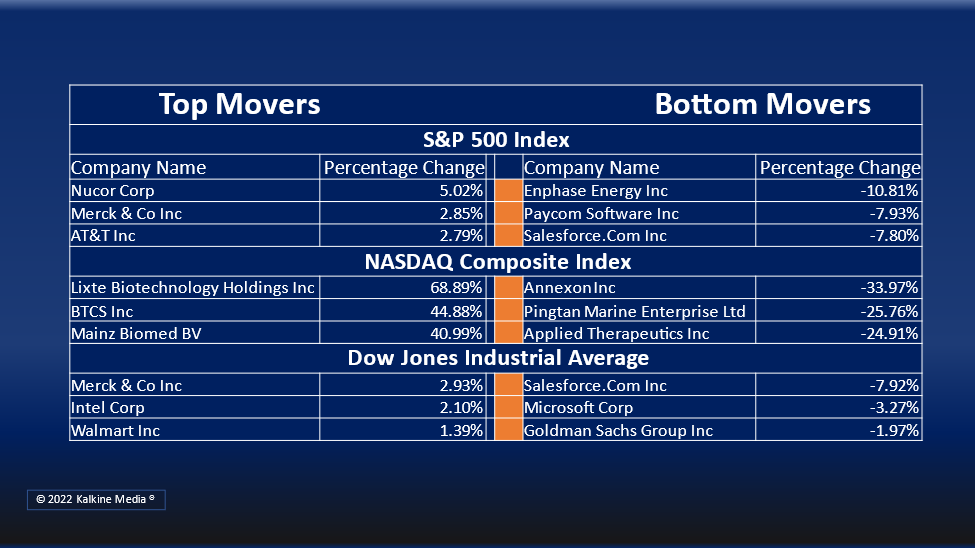

The S&P 500 fell 1.94% to 4,700.58. The Dow Jones declined 1.07% to 36,407.11. The NASDAQ Composite was down 3.34% to 15,100.17, and the small-cap Russell 2000 fell 3.08% to 2,198.96.

On Wednesday, the Fed released the minutes of its December 14-15 meeting that discussed inflation and corrective measures like a hike in short-term lending rates to tame rising prices.

Meanwhile, economists said that payrolls of US private companies increased more than expected in December, and more new jobs were added in the month amid a tight labor market.

Analysts expect slower economic growth after a potential rate hike in the coming months. The government has already withdrawn most of its stimulus measures. The persistent supply chain concerns and deceleration in corporate earnings would limit growth.

Four of 11 sectors of the S&P 500 closed in the green. Basic materials, utility, and energy stocks were the top gainers. Real estate, technology, and consumer discretionary stocks were the bottom movers.

Shares of Beyond Meat, Inc. (BYND) fell more than 4% in intraday trading after it said its plant-based alternative to fried chicken would be available at KFCs from next week.

General Motors Co (GM) stock rose over 2.5% after the electric boat and propulsion systems maker Pure Watercraft unveiled an all-electric pontoon boat, built in partnership with GM, at the CES summit.

In the healthcare sector, Lixte Biotechnology Holdings, Inc (LIXT) stock rose 92% after announcing its lead clinical compound showed increased responsiveness to cancers in preclinical studies.

The Mainz Biomed B.V. (MYNZ) stock jumped more than 58% in intraday trading after announcing its agreement with Colombia’s Socpra Sciences Santé Et Humaines S.E.C. for integrating novel mRNA biomarkers with its colorectal cancer detection test.

In the basic material sector, Linde Plc (LIN) stock jumped 0.87%, Sherwin Williams Company (SHW) rose 0.23%, and Air Products and Chemicals Inc. (APD) rose 2.19%. Ecolabs Inc. (ECL) was up 0.39%, and Newmont Corporation (NEM) increased by 0.10%.

In the utility sector, Duke Energy Corporation (DUK) stock surged 0.55%, Southern Company (SO) rose 0.48%, and Dominion Energy Inc. (D) increased by 1.87%. Exelon Corporation (EXC) and American Electric Power Company Inc. (AEP) were up 0.22% and 1.09%, respectively.

In the real estate sector, American Tower Corporation (REIT) (AMT) stock plunged 6.90%, Prologis Inc. (PLD) declined 1.80%, and Crown Castle International Corp. (CCI) fell 6.86%. Equinix Inc. (EQIX) and Public Storage (PSA) were down 3.20% and 0.53%, respectively.

The global cryptocurrency market was down 4.39% to US$2.13 trillion at 3:52 pm ET, as per coinmarketcap.com. Bitcoin fell 4.54% to US$44,244.30 in the last 24 hours to Wednesday evening.

Also Read: Stocks that could give FAANG companies a run for money

Also Read: Top fake meat stocks to keep an eye on in 2022

Also Read: The Great Resignation: Will it continue in 2022?

Futures & Commodities

Gold futures declined 0.26% to US$1,809.95 per ounce. Silver futures decreased by 1.21% to US$22.777 per ounce, while copper fell 1.96% to US$4.3872.

Brent oil futures increased by 0.14% to US$80.11 per barrel and WTI crude futures were up 0.26% to US$77.19.

Bond Market

The 30-year Treasury bond yields increased 0.63% to 2.091, while the 10-year bond yields were up 2.03% to 1.700.

US Dollar Futures Index declined 0.07% at US$96.207.

.jpg)