Highlights

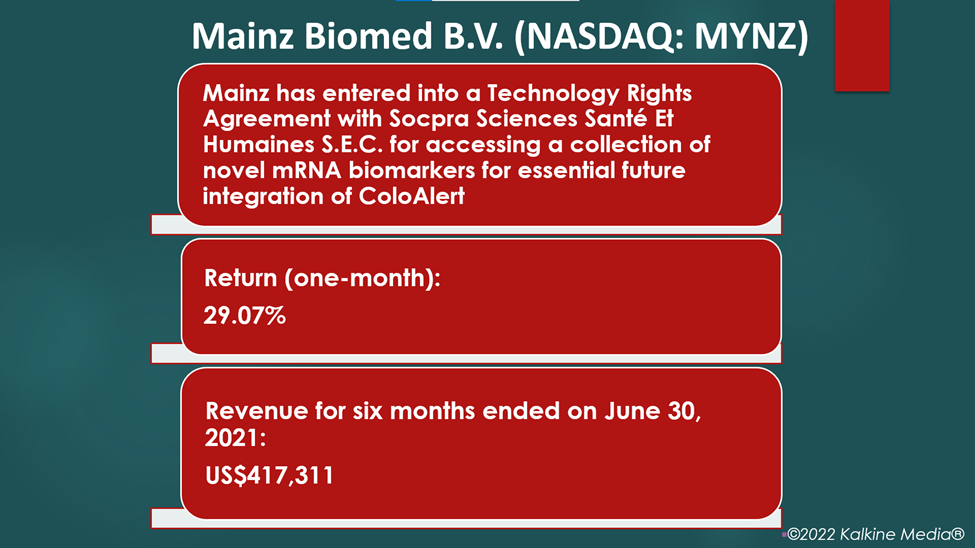

- The company entered into a Technology Rights Agreement with Colombo’s Socpra Sciences Sante Et Humaines S.E.C.

- Its revenue was US$0.41 million for the six months ended June 30, 2021.

- The stock price surged more than 29% over the last month.

The stocks of Mainz Biomed (MYNZ) zoomed 58% higher on Wednesday after it brokered a deal with a Colombian institute to gain access to novel mRNA biomarkers for potential integration with its highly effective colorectal cancer (CRC) detection test called ColoAlert in the future.

The German-headquartered company said it has entered into a Technology Rights Agreement with Colombia’s Socpra Sciences Santé Et Humaines S.E.C.

The deal would help Mainz gain access to a collection of novel mRNA biomarkers for future integration with its user-friendly colorectal cancer (CRC) detection test ColoAlert.

Mainz is a molecular genetics diagnostic firm that specializes in detecting early-stage cancer.

Its flagship product is ColoAlert, currently marketed in Europe.

A clinical study is also in progress for ColoAlert in the US for FDA approval in 2022.

Also Read: The Great Resignation: Will it continue in 2022?

In Europe, it markets ColoAlert in partnership with third-party laboratories.

As per the deal, Mainz has the unilateral option to license exclusive global rights to five gene expression biomarkers that demonstrate a higher efficacy for detecting CRC lesions.

Reacting to the deal, Mainz CEO Guido Baechler said it is a great opportunity to upgrade ColoAlert's technical profile, which will make it the most effective at-home testing kit for CRC.

Also Read: Seven hottest IPOs to explore in 2022

Also Read: Top fake meat stocks to keep an eye on in 2022

Stock performance and financial highlights of Mainz Biomed B.V. (NASDAQ:MYNZ):

The MYNZ stocks were priced at U$16.44 at 11:14 am ET on Jan 5, up 58.23% from their previous close. Its market cap is US$181.97 million.

The stock gave a 29.07% return in the last 30 days.

Also Read: Why is Ribbon Finance (RBN) crypto in focus?

The stock saw the highest price of US$18.00 and the lowest price of US$7.80 in the last 52 weeks. Its trading volume on Jan 4 was 43,497.

For the six months ended June 30, 2021, it reported a revenue of US$0.41 million compared to US$0.16 million a year ago. Its net loss was US$0.26 million against a loss of US$0.34 million for the six months ended June 30, 2020.

Also Read: What is Helium (HNT) token? HNT crypto gains 2645% in 12 months

Bottomline

The stock saw steady gains in recent days. Overall, the healthcare sector has been in the spotlight due to the Covid-19 emergency. Investors, however, should exercise due diligence before investing in the stock market.

.jpg)