Benchmark US indices drifted on Monday, December 13, as investors stayed away from the risky bets ahead of the Fed's two-day policy meeting starting Tuesday, December 14. In addition, worries over the Omicron coronavirus variant have also raised investors' concerns.

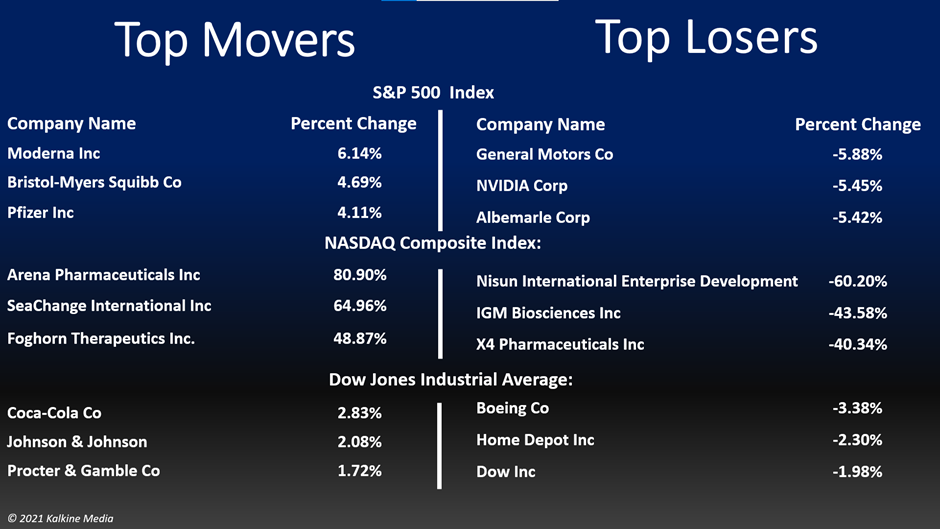

The S&P 500 was down 0.91% to 4,668.97. The Dow Jones Industrial Average decreased by 0.89% to 35,650.95. The NASDAQ Composite Index fell 1.39% to 15,413.28, and the small-cap Russell 2000 was down 1.25% to 2,184.07.

The Federal Reserve is expected to release its decision on Wednesday, after its two-day policy meeting. The investors feared that the central bank might accelerate to wind down its asset-buying program while increasing the interest rates through next year to rein inflation.

The travel-related stocks witnessed steep losses, as concerns of the Omicron variant have forced the market participants to keep their distance from the sector. The variant now accounts for about 40% of the Covid-19 infections in London and at least one death in the UK.

The utilities and real estate sector have topped the S&P 500 index on Monday. Seven of the 11 critical sectors of the S&P 500 index stayed in the negative territory, with consumer discretionary and energy sector as the bottom movers.

The shares of Nuverra Environmental Solutions Inc. (NES) jumped 89.57% in the intraday trading session after the water management services company, Select Energy Services (WTTR) has announced to acquire Nuverra for around US$45 million. On the other hand, the stocks of WTTR tumbled 3.39%.

The stocks of Arena Pharmaceuticals, Inc. (ARNA) increased by 80.48% on Monday, after the pharmaceutical and biotechnology firm Pfizer Inc. (PFE) has agreed to buy it in a deal valued at around US$6.7 billion. The PFE stocks rose 4.02%.

Harley-Davidson, Inc. (HOG) rallied 6.04% in the intraday session on Monday after the motorcycle manufacturer announced that its electric-motorcycle division, LiveWire, would go public through a merger with a blank-check company. The company's enterprise valuation would be about US$1.77 billion.

In the utility sector, NextEra Energy, Inc. (NEE) gained 1.62%, Duke Energy Corporation (DUK) rose 1.60%, and The Southern Company (SO) increased by 1.94%. Dominion Energy, Inc. (D) and American Electric Power Company, Inc. (AEP) advanced 1.05% and 1.31%, respectively.

In real estate stocks, American Tower Corporation (AMT) was up 1.23%, Prologis, Inc. (PLD) jumped 1.72%, and Crown Castle International Corp. (CCI) soared 2.71%. Equinix, Inc. (EQIX) and Public Storage (PSA) ticked up 2.66% and 2.39%, respectively.

In the consumer discretionary sector, Amazon.com, Inc. (AMZN) fell 1.22%, Tesla, Inc. (TSLA) decreased by 5.24%, and Home Depot, Inc. (HD) declined 2.35%. Nike, Inc. (NKE) and Lowe's Companies, Inc. (LOW) plummeted 1.14% and 1.76%, respectively.

Also Read: Elon Musk lands Time magazine’s person of the year for 2021

Also Read: Olympus (OHM) crypto rallies after falling for a week

Also Read: Top 8 US vaccine stocks of 2021

Futures & Commodities

Gold futures were up 0.17% to US$1,787.75 per ounce. Silver increased by 0.60% to US$22.328 per ounce, while copper rose 0.15% to US$4.2930.

Brent oil futures decreased by 0.98% to US$74.41 per barrel and WTI crude was down 0.96% to US$70.98.

Bond Market

The 30-year Treasury bond yields was down 3.55% to 1.817, while the 10-year bond yields fell 4.24% to 1.426.

US Dollar Futures Index increased by 0.27% to US$96.335.