Wall Street ended the session on a low note on Wednesday, October 12, after the investors assessed the producer price index data released by the Labor Department and minutes from Federal Reserve's last meeting in September.

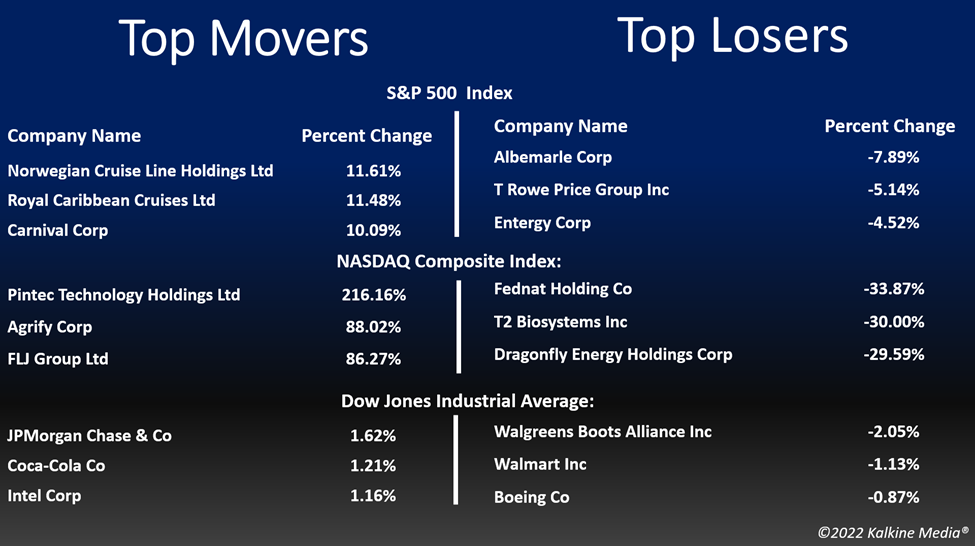

The S&P 500 fell 0.33 per cent to 3,577.03. The Dow Jones was down 0.10 per cent to 29,210.85. The NASDAQ Composite lost 0.09 per cent to 10,417.10, and the small-cap Russell 2000 fell 0.30 per cent to 1,687.76.

The minutes from Federal Reserve's last meeting signaled that the policymakers have backed maintaining a more strict stance for bringing down the still-high inflation. The policymakers indicated that they are not doing enough to curb inflation and a more aggressive stance might be required in the coming days.

Meanwhile, the Producer Price Index data by the Labor Department showed that producer prices surged 0.4 per cent last month from August, after two consecutive months of decline. On an annual basis, the producer prices advanced 8.5 per cent last month, marking a third consecutive decline on a YoY basis.

On Wednesday, four of the 11 sectors of the S&P 500 index stayed in the positive territory, with energy and consumer staples as the top movers. The utilities and real estate sectors were the bottom movers.

Shares of the food, snack, and beverage company, PepsiCo, Inc. (NASDAQ:PEP) surged more than three per cent in the intraday session after the company reported its latest quarterly earnings results. Meanwhile, the New York-based company also lifted its annual guidance amid increasing prices of its product.

The leading biotechnology company, Moderna, Inc. (NASDAQ:MRNA) increased by more than eight per cent in the intraday trading on October 12, after the company announced its plans to partner with Merck & Co., Inc. (NYSE: MRK), for developing and selling cancer vaccine.

Besides, Moderna also announced receiving FDA approval for the emergency use of Omicron-targeting Covid-19 booster shot for children.

In the energy sector, Occidental Petroleum Corporation (OXY) increased by 1.55 per cent, Marathon Petroleum Corporation (MPC) rose by 1.51 per cent, and Devon Energy Corporation (DVN) surged by 1.18 per cent. Valero Energy Corporation (VLO) and Phillips 66 (PSX) advanced 4.99 per cent and 2.83 per cent, respectively.

In consumer staples stocks, The Coca-Cola Company (KO) gained 1.25 per cent, Diageo plc (DEO) soared 1.43 per cent, and Anheuser-Busch InBev NV (BUD) added 1.70 per cent. British American Tobacco p.l.c. (BTI) and The Kraft Heinz Company (KHC) was up 1.24 per cent and 1.03 per cent, respectively.

In the utility sector, NextEra Energy, Inc. (NEE) decreased by 4.29 per cent, The Southern Company (SO) fell by 3.37 per cent, and Duke Energy Corporation (DUK) declined by 3.97 per cent. Dominion Energy, Inc. (D) and Exelon Corporation (EXC) plummeted 3.36 per cent and 4.03 per cent, respectively.

Futures & Commodities

Gold futures were down 0.27 per cent to US$1,681.40 per ounce. Silver decreased by 2.35 per cent to US$19.030 per ounce, while copper fell 1.00 per cent to US$3.4275.

Brent oil futures decreased by 2.03 per cent to US$92.38 per barrel and WTI crude was down 2.57 per cent to US$87.05.

Bond Market

The 30-year Treasury bond yields were down 0.58 per cent to 3.879, while the 10-year bond yields fell 1.04 per cent to 3.898.

US Dollar Futures Index increased by 0.05 per cent to US$113.183.