Benchmark US indices closed missed on Thursday, January 6, after a choppy trading session amid concerns over rising cases of Omicron and Fed’s earlier-than-expected rate hike.

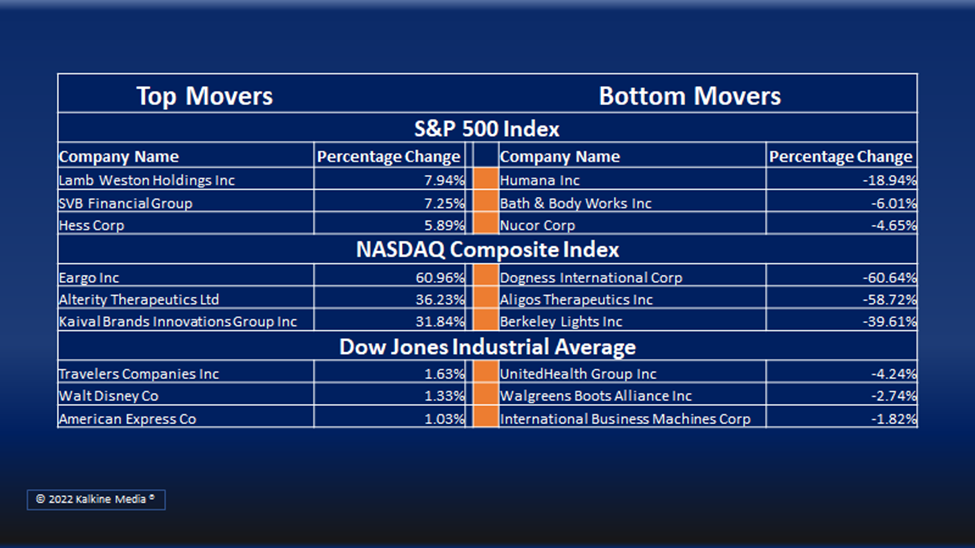

The S&P 500 declined 0.10% to 4,696.05. The Dow Jones decreased 0.47% to 36,236.47. The NASDAQ Composite was down 0.13% to 15,080.86, and the small-cap Russell 2000 was up 0.43% to 2,203.70.

The initial gains in the market fizzled out as investors tried to assess the likely impact of a sooner-than-expected rate hike indicated in the Fed’s minutes released on the previous day.

However, bond yields went up in anticipation of the central bank’s early rate hike. The current tight labor market might have also influenced the Fed’s assessment for a new rate regime.

Meanwhile, on Thursday, the Labor Department said the initial unemployment benefits claims increased by 7,000 to 207,000 last week. It will now release its December jobs report on Friday.

Also, in a separate statement, the Commerce Department said the US trade deficit grew by 19.4% in November, highlighting the economic disruptions due to covid and supply chain issues.

Five of the 11 sectors of the S&P 500 Index closed in the positive territory. Energy, financial, and communication services sectors advanced while utility, basic materials, and the healthcare segments trailed.

In technology stocks, Tesla, Inc. (TSLA) fell over 1.7%, Meta Platforms, Inc. (FB) rose more than 2.9%, and Apple Inc. (AAPL) plummeted over 1.5% in intraday trading.

Shares of Vocera Communications, Inc. (VCRA) jumped over 26% after medical device maker Stryker Corporation (SYK) announced to acquire all its outstanding shares of common stocks.

In the energy sector, Exxon Mobile Corporation (XOM) jumped 2.05%, Chevron Corporation (CVX) surged 0.62%, and ConocoPhillips (COP) rose 3.74%. EOG Resources Inc. (EOG) was up 2.14%, and Pioneer Natural Resources Company (PXD) increased by 2.99%.

In the financial sector, JP Morgan Chase & Co. (JPM) stock surged 0.70%, Bank of America Corporation (BAC) rose 1.76%, and Wells Fargo & Company (WFC) increased by 2.16%. Morgan Stanley (MS) and Charles Schwab Corporation (SCHW) were up 1.64% and 1.51%, respectively.

In the utility sector, NextEra Energy Inc. (NEE) was down 4.08%, Duke Energy Corporation (DUK) declined 0.16%, and Southern Company (SO) fell 0.15%. Dominion Energy Inc. (D) decreased by 0.18%, and Exelon Corporation (EXC) was down 0.33%.

In the global cryptocurrency market, Bitcoin (BTC) fell 2.27% in the last 24 hours to Thursday evening. The overall market was down 2.09% to US$2.07 trillion, as per coinmarketcap.com.

Also Read: Amylyx Pharmaceuticals IPO: How to buy the stock?

Also Read: Five bank stocks to explore as rate hike prospects grow

Also Read: TrumpCoin (TRUMP) gets a thumbs-up on meme contest

Futures & Commodities

Gold futures declined 2.04% to US$1,787.95 per ounce. Silver futures decreased by 4.32% to US$22.170 per ounce, while copper fell 1.29% to US$4.3567.

Brent oil futures increased by 1.46% to US$81.98 per barrel and WTI crude futures were up 2.12% to US$79.50.

Bond Market

The 30-year Treasury bond yields decreased 0.19% to 2.083, while the 10-year bond yields were up 1.37% to 1.726.

US Dollar Futures Index surged 0.14% at US$96.312.