Dow Jones and S&P 500 fell, but tech-savvy Nasdaq crawled back up to close the session mixed on Thursday, May 12, after a vital economic gauge showed that demand for manufactured goods slowed in April.

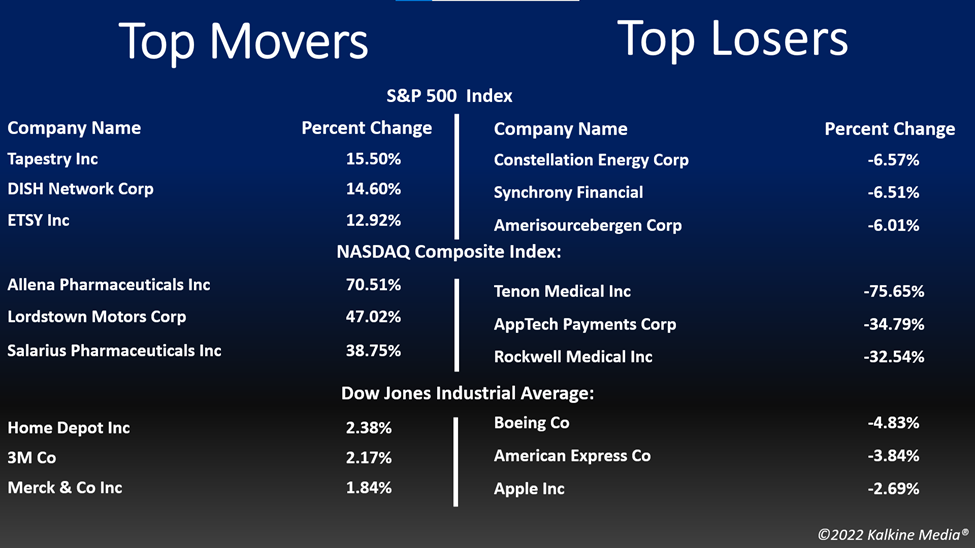

The S&P 500 was down 0.13% to 3,930.08. The Dow Jones fell 0.33% to 31,730.30. The NASDAQ Composite increased by 0.06% to 11,370.96, and the small-cap Russell 2000 was up 1.24% to 1,739.38.

The Labor Department on Thursday said the producer-price index, a key indicator for economic growth, rose 0.5% in April after sprinting 1.6% in the previous month. The final demand price rose 11% on an annual basis in April, the fifth consecutive double-digit monthly gain, but down from 11.5% in March.

Mega-cap stocks that outperformed their rivals in the low-interest-rate period were the hardest hit this year. Traders are now weighing the latest CPI data that showed inflation grew relatively slowly last month, signaling the inflation peak may be over that won’t warrant further aggressive rate hikes.

In a separate report, the Labor Department also said that unemployment benefits claims rose by 1,000 to 203,000 in the previous week, following an increase of 2,000 in the prior week.

The healthcare and consumer discretionary sectors were the top movers on Thursday. Six out of 11 S&P 500 sectors closed in the green. Technology and utility segments were the bottom movers.

Shares of AppLovin Corporation (APP) rose 34% after reporting weak first-quarter quarterly earnings.

The Walt Disney Company (DIS) stock fell over 2% after its operating losses widened in the latest quarter and warned of slow growth in its streaming business.

Meme-stock shares, GameStop Corp. (GME), and AMC Entertainment Holdings Inc. (AMC) gained 14.36% and 6.56%, respectively, on Thursday.

In the consumer discretionary sector, Amazon.com, Inc. (AMZN) increased by 1.11%, The Home Depot, Inc. (HD) rose 2.14%, and Lowe's Companies, Inc. (LOW) soared 1.87%. The TJX Companies, Inc. (TJX) and Honda Motor Co., Ltd. (HMC) advanced 1.65% and 1.46%, respectively.

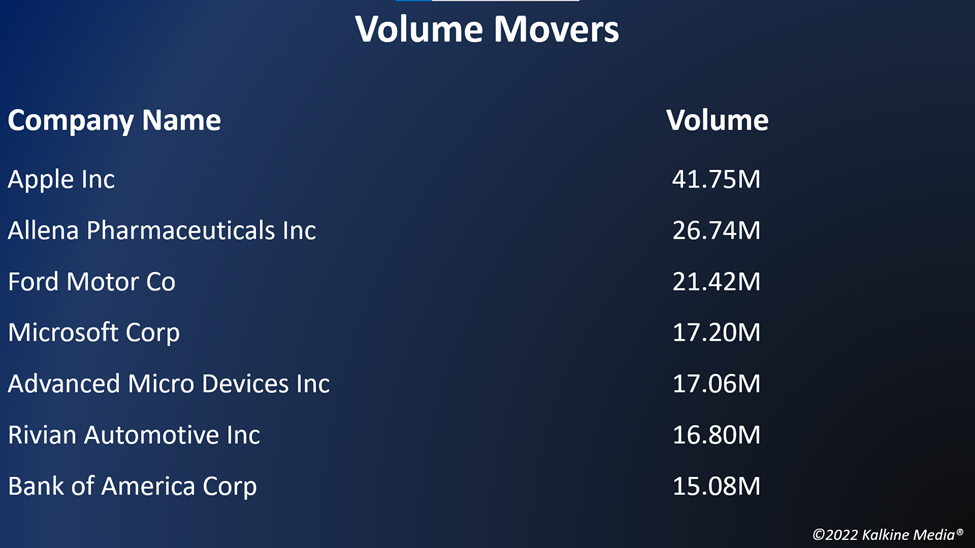

In technology stocks, Apple Inc. (AAPL) decreased by 3.09%, Microsoft Corporation (MSFT) fell 2.31%, and NVIDIA Corporation (NVDA) declined by 3.21%. Qualcomm Incorporated (QCOM) and Advanced Micro Devices, Inc. (AMD) plummeted by 1.02% and 1.44%, respectively.

In the healthcare stocks, Pfizer Inc. (PFE) surged 2.05%, Eli Lilly and Company (LLY) gained 1.34%, and AbbVie Inc. (ABBV) added 1.07%. Merck & Co., Inc. (MRK) and Novartis AG (NVS) ticked up 1.49% and 1.40%, respectively.

In the crypto space, Bitcoin (BTC) and Ethereum (ETH) declined 2.73% and 8.27%, respectively. The global crypto market cap tumbled 4.53% to US$1.22 trillion at 3:56 pm ET on May 12.

Also Read: Why is Dogecoin (DOGE) crypto gaining attention amid a dip?

Also Read: Global cryptocurrency regulatory body on the anvil, says top official

Also Read: OLN, SWBI & RGR among top 5 US gun stocks to watch in Q2

Futures & Commodities

Gold futures were down 1.77% to US$1,820.92 per ounce. Silver decreased by 4.24% to US$20.660 per ounce, while copper fell 2.93% to US$4.0857.

Brent oil futures increased by 0.43% to US$107.97 per barrel and WTI crude was up 0.88% to US$106.64.

Also Read: Delivery app Instacart privately files for IPO - What we know so far

Bond Market

The 30-year Treasury bond yields were down 0.70% to 3.021, while the 10-year bond yields fell 2.11% to 2.852.

US Dollar Futures Index increased by 0.89% to US$104.795.