Wall Street’s main indexes fell sharply on Monday, March 7, after oil prices surged to a new record as Russian forces continued attacks on Ukraine, stoking fears of a global recession.

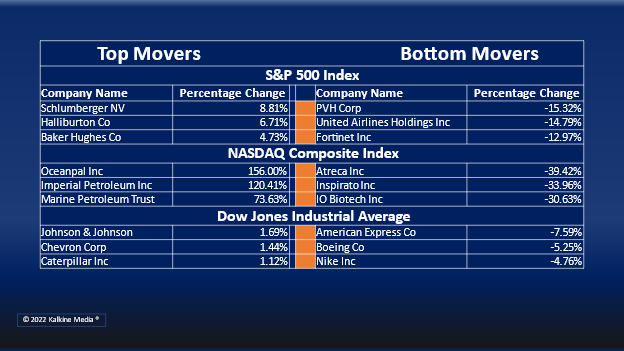

The S&P 500 fell 2.95% to 4,201.09. The Dow Jones declined 2.37% to 32,817.38. The NASDAQ Composite fell 3.62% at 12,830.96, and the small-cap Russell 2000 was down 2.48% to 1,951.33.

Economists feared the continued Russian aggression in Ukraine might spell doom for the economy, already reeling under the weight of inflation and supply chain disruptions.

They said the uptick in oil prices will have a knock-on effect on the cost of other commodities. Consequently, the impact might push the economy into another recession.

On Monday, Brent crude jumped to US$130 a barrel, the highest since 2008. The spike comes after the US and allies purportedly considered banning Russian oil imports. Likewise, wheat prices jumped to a 14-year high, while gold breached the US$2,000 mark.

Nine out of 11 sectors of the S&P 500 closed in the red. Energy and Utility were the top gainers, while consumer discretionary, financials, and technology stocks were the bottom movers.

Energy stocks saw robust gains in intraday trading. Imperial Petroleum Inc. (IMPP) stock surged over 132%, and Camber Energy, Inc. (CEI) stock jumped about 84% in intraday trading.

In other energy stocks, Exxon Mobile Corporation (XOM) surged 3.59%, Chevron Corporation (CVX) rose 1.76%, and ConocoPhillips (COP) increased by 1.00%. EOG Resources Inc. (EOG) was up 1.24%, and Shell Plc (SHEL) increased by 4.43%.

Bed Bath & Beyond Inc (BBBY) stock gained over 24% after billionaire investor and Chairman of GameStop Corporation (GME) Ryan Cohen announced a 10% stake in the home furnishing retailer. However, the shares of the video game company slid more than 11% after the news.

Technology stock Meta Platforms, Inc. (FB) fell over 5%, and Apple Inc. (AAPL) stock was down more than 1.5% on Monday. Ciena Corporation (CIEN) stock fell about 10% after posting quarterly results. The technology company reported first-quarter revenue of US$844.4 million.

In the utility sector, Duke Energy Corporation (DUK) stock surged 1.38%, Southern Company (SO) rose 2.46%, and Dominion Energy (D) increased by 0.81%. Sempra (SRE) rose 0.61%, and American Electric Power Company Inc. (AEP) increased by 0.97%.

In the consumer discretionary sector, Tesla Inc. (TSLA) stock declined 4.02%, Amazon.com Inc. (AMZN) fell 5.62%, and Nike Inc. (NKE) fell 5.12%. McDonald’s Corporation (MCD) and Lowe's Companies, Inc. (LOW) fell 4.87% and 0.81%, respectively.

The global cryptocurrency market was down 3.51% to US$1.69 trillion at 34:00 pm ET, as per coinmarketcap.com. Bitcoin (BTC) price fell by 3.19% to US$37,623.22 in the last 24 hours.

Also Read: Why did Imperial Petroleum (IMPP) stock surge over 344% in a month?

Also Read: Why Bed Bath & Beyond (BBBY) stock skyrocketed today?

Also Read: Why is NFT game Alien Worlds’ (TLM) offer catching attention?

Futures & Commodities

Gold futures surged 1.71% to US$2,000.30 per ounce. Silver futures increased by 0.17% to US$25.832 per ounce, while copper futures declined 3.68% to US$4.7560.

Brent oil futures increased by 4.78% to US$123.75 per barrel and WTI crude futures were up by 3.92% to US$120.22.

Bond Market

The 30-year Treasury bond yields increased 1.39% to 2.178, while the 10-year bond yields were up 3.08% to 1.775.

US Dollar Futures Index surged 0.49% at US$99.155.

.jpg)