The Vanguard Dividend Appreciation Fund (VIG), WisdomTree US Quality Dividend Growth (DGRW), and the iShares Core Dividend Growth (DGRO) are some of the most popular dividend-focused ETFs in Wall Street, with $102 billion, $15 billion, and $30.7 billion in assets, respectively.

Good ETFs with solid performance

As their names suggest, these funds are designed to provide their holders with reliable dividends over time.

The VIG ETF tracks the S&P US Dividend Growers index, which aims to provide investors access to companies that have a long record of increasing their dividends.

Most of its constituent companies are in the tech sector followed by financials, healthcare, industrials, and consumer staples. Some of the top names in the fund are Apple, Broadcom, JPMorgan, UnitedHealth, Exxon, and Visa.

The WisdomTree US Quality Dividend Growth fund, on the other hand, invests in companies that have constantly grown their payouts for a long time. Like VIG, most of its constituent companies are in the tech, healthcare, industrials, and financials. The biggest firms in the fund are Microsoft, Apple, Broadcom, AbbVie, and NVIDIA.

The DGRO ETF is another popular find, which focuses on dividend growth. It tracks the Morningstar US Dividend Growth Index, which invests in 413 companies. Financials, technology, healthcare, and industrials are the biggest players in the fund, with the top companies being ExxonMobil, JPMorgan, Apple, Microsoft, and Chevron.

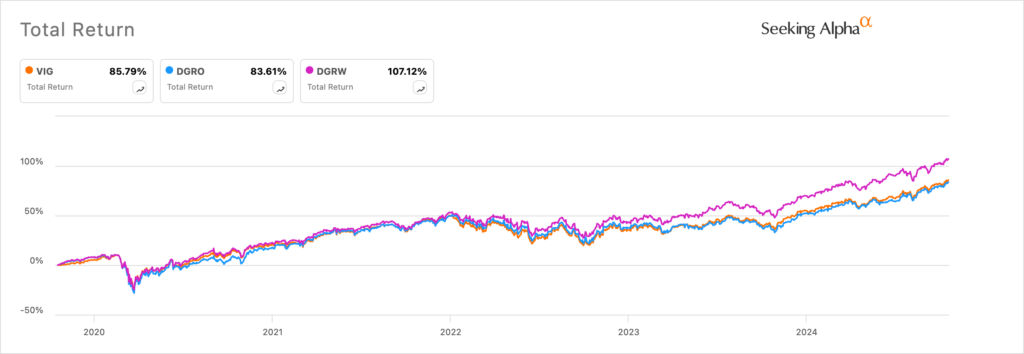

These funds have a long track record of doing well. As shown below, the DGRW ETF has had a total return of 107% in the past five years. Similarly, the DGRO and VIG funds have returned 83% and 85% in the same period. The same performance is replicated across other timeframes.

These funds have performed well because they are made up of blue-chip companies that have rallied over time. For example, top constituents in the funds like Broadcom, Microsoft, and AbbVie have a long record of soaring.

Are they really dividend ETFs?

The challenge, however, is whether these funds qualify as dividend ETFs. In other words, should one invest in them to receive their regular payouts?

The VIG ETF has a dividend yield of 1.7% and a four-year average of 1.78%. Similarly, the DGRW fund has a yield of 1.47% and a four-year yield of 1.88%. The DGRW fund pays 2.16% and a four-year average of 2.25%.

Therefore, in this case, the VIG ETF would pay about $170 in dividends for a $10,000 investment, while the other two would pay $148 and $225, respectively.

However, one needs to include the expense ratio and taxes in the dividend return calculation. VIG and DGRO have an expense ratio of 0.08%, while DGRW charges 0.28%. As such, we see that the total dividend return offered by these funds is almost negligible.

There are two things to consider when determining whether they are good dividend funds. First, it is the risk-free return, which in most cases, is investing in US government bonds. With the ten-year yielding 4.2%, it means that a $10,000 investment will bring in $420, or more than double what the three funds pay.

Still, these bonds don’t have growth, and there is usually a risk that the yield will fall as the Fed slashes rates.

Second, the other thing to look is investing in a low-cost index tracking fund like the Vanguard S&P 500 ETF (VOO). VOO has an expense ratio of 0.03% and a dividend yield of 1.26%. It has a four-year average of 1.46%.

The ETF has never marketed itself as a dividend fund, and most of its investors don’t invest it for its dividend. It is simply a fund that tracks the five hundred biggest companies in the fund.

Read more: Love the SCHD ETF? CLM and CRF are better yielding alternatives

Focusing on the total return

Therefore, we have concluded that the VIG, DGRO, and DGRW ETFs are not good dividend ETFs because of their low yields.

At the same time, data shows that an ETF that tracks the S&P 500 index generates better total returns over time. For example, as shown above, the VOO ETF has had a total return of 112% in the last five years.

The DGRW fund has returned 107%, while the DGRO and VIG have returned 83% and 85%, respectively. This means that an investor who allocated funds in the VOO ETF generated better returns than those who invested in the other funds.

The same trend is happening this year as the VOO ETF has returned 24.24%, while the other three have returned less than 21%.

As such, if you are considering investing for the long term, odds are that you will do better by focusing on the S&P 500 index. Instead, if you are focused on dividends, there are many assets to consider like the BNY Mellon High Yield Strategies Fund and Guggenheim Taxable Municipal Bond & Investment Grade Debt Trust, which pay over 8%.

Read more: Love the utilities XLU ETF? Boost it with some UTG

The post VIG, DGRW, DGRO are popular; but are they really dividend ETFs? appeared first on Invezz